Top UK Stocks | AB Foods Shares | Rolls Royce Shares | Babcock Shares | Firstgroup Shares | BAT Shares | M&S Shares

Top News: AB Foods raises expectations after strong finish

Associated British Foods said it generated more profit in the final quarter of its financial year than expected, driven by Primark and its Sugar business, which will allow it to report annual growth in earnings.

The company said Primark’s adjusted operating profit margin was better than anticipated in the final quarter of the year to September 18, helping counter lower than expected sales. Meanwhile, Sugar is anticipated delivering a ‘much-improved profit’ from last year following a strong performance from Illovo.

‘For the full year, we now expect AB Sugar to deliver an even greater improvement in adjusted operating profit over last year than previously expected and Primark's adjusted operating profit, stated before repayment of job retention scheme monies, to be ahead of last year,’ said AB Foods.

‘Our outlook for the group's adjusted operating profit, stated before repayment of job retention monies, is now expected to be above last year excluding the benefit of the 53rd week this year,’ the company added.

Adjusted earnings per share for the full year will be ahead of previous guidance and ‘marginally ahead’ of the 81.1p delivered in the last financial year, which in turn had plunged 41% as the pandemic hit.

AB Foods said it expects to end the year with net cash before lease liabilities of around £1.9 billion, up from £1.6 billion a year ago.

‘This outturn reflects the strong cash generating capability of the group and good working capital management. The improvement in net cash since our last trading update is driven by the group's higher operating profit and lower than expected Primark inventory,’ AB Foods said.

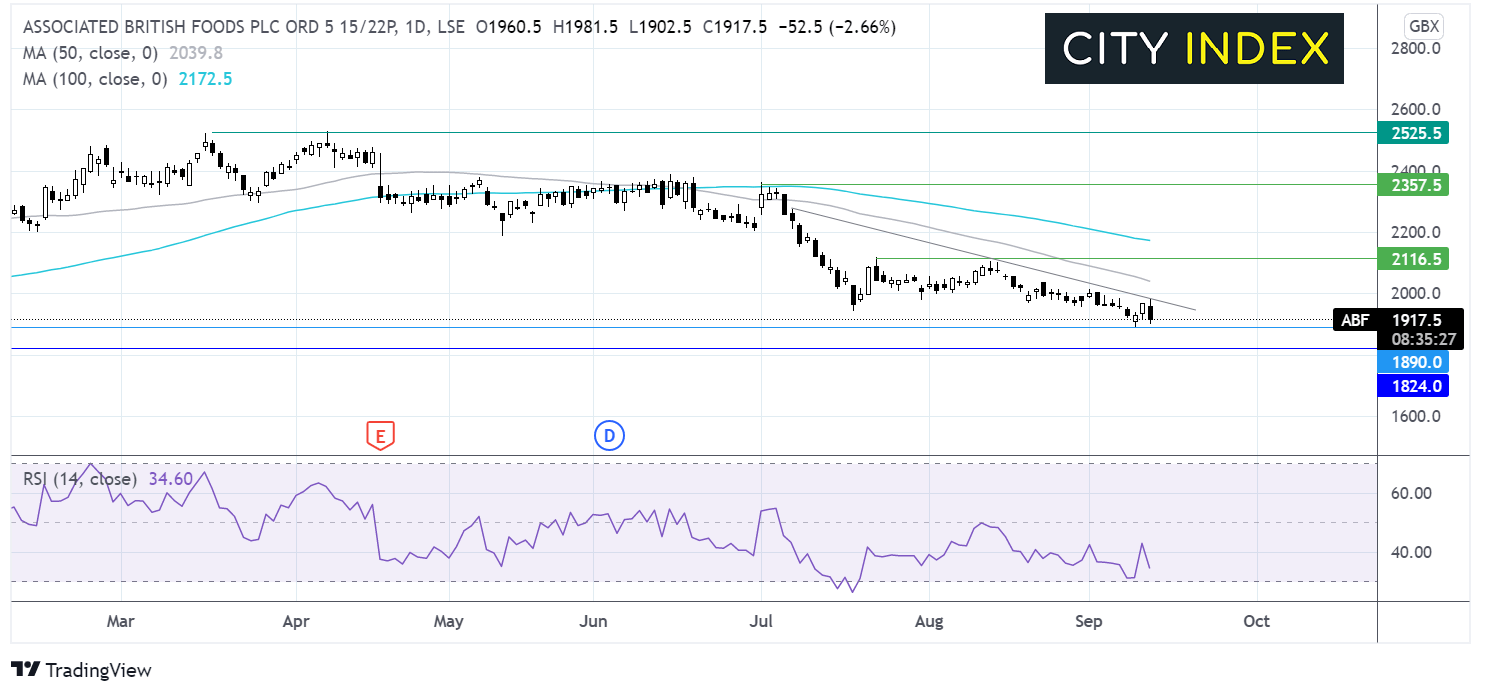

Where next for the AB Foods share price?

Associated British Foods share price reached a post pandemic high of 2525 in April. Since then, the price has been trending lower. The share price trades below its 50 & 100 sma on the daily chart and below its falling trendline dating back to early July.

The RSI is in bearish territory, pointing lower and supportive of further losses whilst it remains out of oversold territory.

Immediate resistance can be seen at 1890 last week’s low a level last seen in November 2020. A break below here could see 1815 come into target the September 2020 low.

Any recovery faces an uphill struggle with resistance seen at 1975 the falling trend line resistance, ahead of 2035 the 50 sma and 2120 the August high, a move above this level would change the bias to a bullish bias.

Rolls Royce and Babcock sell stakes in AirTanker Holdings

Rolls Royce and Babcock International have both struck agreements to sell their individual stakes in AirTanker Holdings to Equitix Investment Management.

AirTanker Holdings is a joint venture between Rolls Royce, Babcock, Airbus and Thales. The venture owns 14 A330-200 Voyager aircraft powered by Rolls Royce’s Trent 772B engines that are used to support air-to-air refuelling, transport and other ancillary services for the UK Ministry of Defence.

Rolls Royce said it has agreed to sell its 23.1% stake in AirTanker Holdings for £189 million in cash, which includes around £47 million worth of shareholder loans and interest. Rolls Royce said it plans to use the proceeds to reduce debt.

Babcock said it is selling its 15.4% stake in AirTanker Holdings to the same buyer for £126 million in cash, also including around £31.1 million in shareholder loans.

Notably, Rolls Royce said it is retaining a 23.5% stake in AirTanker Services, which operates the fleet of aircraft owned by AirTanker Holdings. It will also continue providing servicing and maintenance work for the engines used in the aircraft. Babcock is also retaining a 23.5% stake in AirTanker Services.

Rolls Royce said the sale was part of its plans to raise at least £2 billion from asset disposals as it recovers from the pandemic, while Babcock is also trying to raise £400 million by offloading non-core assets to help reduce debt.

Rolls Royce said its deal should close by the end of March 2022, while Babcock is confident it can get the deal done before the end of this year.

Rolls Royce shares were trading 1% higher in early trade this morning at 110.3p, while Babcock shares were trading 1.6% higher at 343.4p.

Firstgroup trading on-track as investors brace for £500 million return

Firstgroup said trading has remained in-line with expectations as bus and rail passengers rebound after being hard hit by the pandemic, and said it is working on signing renewals to its rail contracts and returning £500 million to shareholders.

Firstgroup shares were up 3% this morning at 89.4p.

The company said First Bus passenger volumes reached 65% of pre-pandemic levels over recent weeks and that this should improve in the near term as the autumn term for schools and universities takes off. A Covid-19 bus support grant that was helping prop up the industry came to an end at the start of this month, although it is now being supported by a bus recovery funding package that will run until April 2022.

As for its rail services, Firstgroup said the Department for Transport has approved the management and performance-based fees to First Rail's contracted rail operations for the year to March 31, 2021. It also said existing contracts for both Great Western Rail and West Coast Partnership have been extended by six months to June and October 2022, respectively.

Firstgroup said it is working on new contracts after the DfT issued notices that the next West Coast Partnership’s national rail contract could last up to 10 years when the existing one ends, running to October 2032. Meanwhile, Great Western Rail’s next contract could last up to six years to June 2028.

‘The group continues to work with the DfT toward signing these contracts, which will be more customer-centric and with an appropriate balance of risk and reward for all parties, including no passenger volume risk for operators,’ said Firstgroup.

Meanwhile, Firstgroup said the £500 million that will be returned to shareholders will be done so via a tender offer, allowing investors to tender some or all of their shares at a pre-determined price that will be announced when it is launched. If not enough shareholders tender their shares, then the surplus will be returned through a special dividend. The funds being returned were raised through the sale of First Student and First Transit back in July.

Firstgroup is holding its annual general meeting today that will see chief executive Matthew Gregory and two non-executives stand down. Chairman David Martin will become interim executive chairman until a new CEO is found.

PRESS: BAT negotiated bribes for former Zimbabwean leader Mugabe

A BBC Panorama investigation alleges it has uncovered new evidence that suggests British American Tobacco paid a bribe to the former leader of Zimbabwe, Robert Mugabe, and was also paying off officials in South Africa.

Documents show that BAT was involved in negotiations to pay between $300,000 to $500,000 to Mugabe’s Zanu-PF party back in 2013. They also suggest BAT was paying bribes in South Africa and operating a network of almost 200 secret informants in the country, as it used illegal surveillance to damage rivals.

The investigation was jointly taken on by Panorama, the Bureau of Investigative Journalism and the University of Bath. Together, they obtained thousands of leaked documents.

BBC Panorama has accused BAT of bribery before. Back in 2015, the UK Serious Fraud Office launched a five-year investigation after allegations of bribery were made, although these concluded earlier this year and said there was not enough evidence to prosecute.

BAT shares were trading 0.4% lower this morning at 2642.5p.

PRESS: Marks & Spencer Group reviewing future of French stores

Marks & Spencer Group is reviewing the future of its 20 stores in France after struggling to manage the problems with border delays and customs arrangements following Brexit, according to reports in the Mail on Sunday.

M&S currently runs a franchise model in France said it is reviewing its model with its two partners in the market, Lagardere and SFH Invest. It follows reports that stores have suffered from empty shelves after the transition period between the UK and the EU ended, sparking stricter customs rules.

‘In light of the new customs arrangements we are taking decisive steps to reconfigure our European operations and have already made changes to food export into [the] Czech Republic,’ M&S said.

In the Czech Republic, M&S has already replaced fresh and chilled foods with frozen food and other items with a longer shelf life in order to mitigate problems with deliveries of fresh produce.

M&S may now have to either close down its larger French stores or stop selling fresh produce and chilled foods, according to the report.

M&S shares were trading 1.3% lower in early trade this morning at 185.0p.

How to trade top UK stocks

You can trade a wide variety of UK stocks with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade