Tokyo State of Emergency due to Covid: Where does Yen go from here? USD/JPY, EUR/JPY

Japan has declared a second State of Emergency for Tokyo and 10 surrounding areas, which will last 1 month, amid a surge in coronavirus cases in the nation’s capital. Although Tokyo isn’t heading into full lockdown mode, the capital city has set curfews at restaurants and bars and will limit capacity at large events to 5,000 people. As a result, the Ministry of Finance, Bank of Japan, and Japan’s Financial Services Agency met to ensure the stability of the Yen and remind everyone that they are “vigilant” of exchange rates. This meeting helped cause a selloff in Yen pairs.

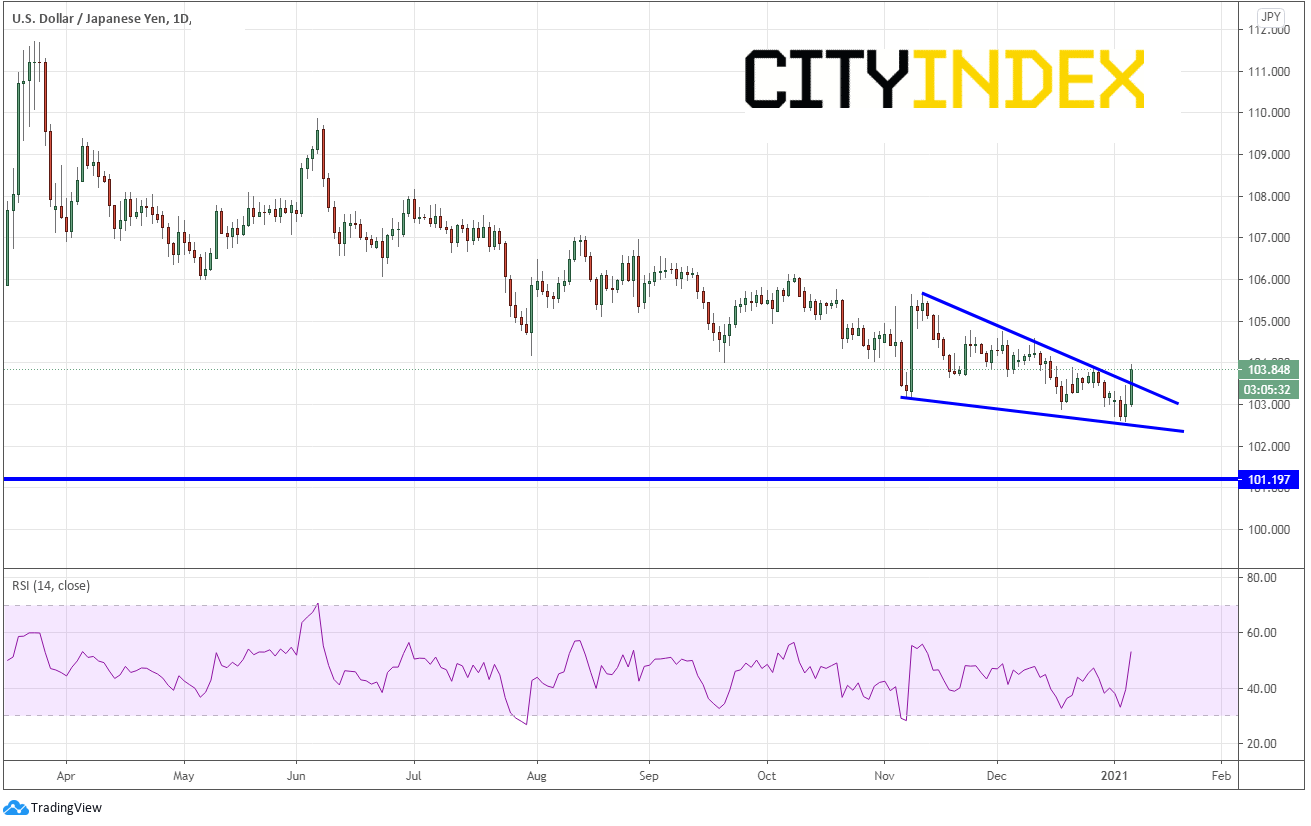

USD/JPY has been moving lower (Yen strengthening) since the pandemic highs in mid-March when it traded as high as 111.71. More recently, the pair has been trading in a descending wedge and traded as low as 102.59 yesterday. Today, USD/JPY broke higher through the downward sloping top trendline of the descending wedge.

Source: Tradingview, City Index

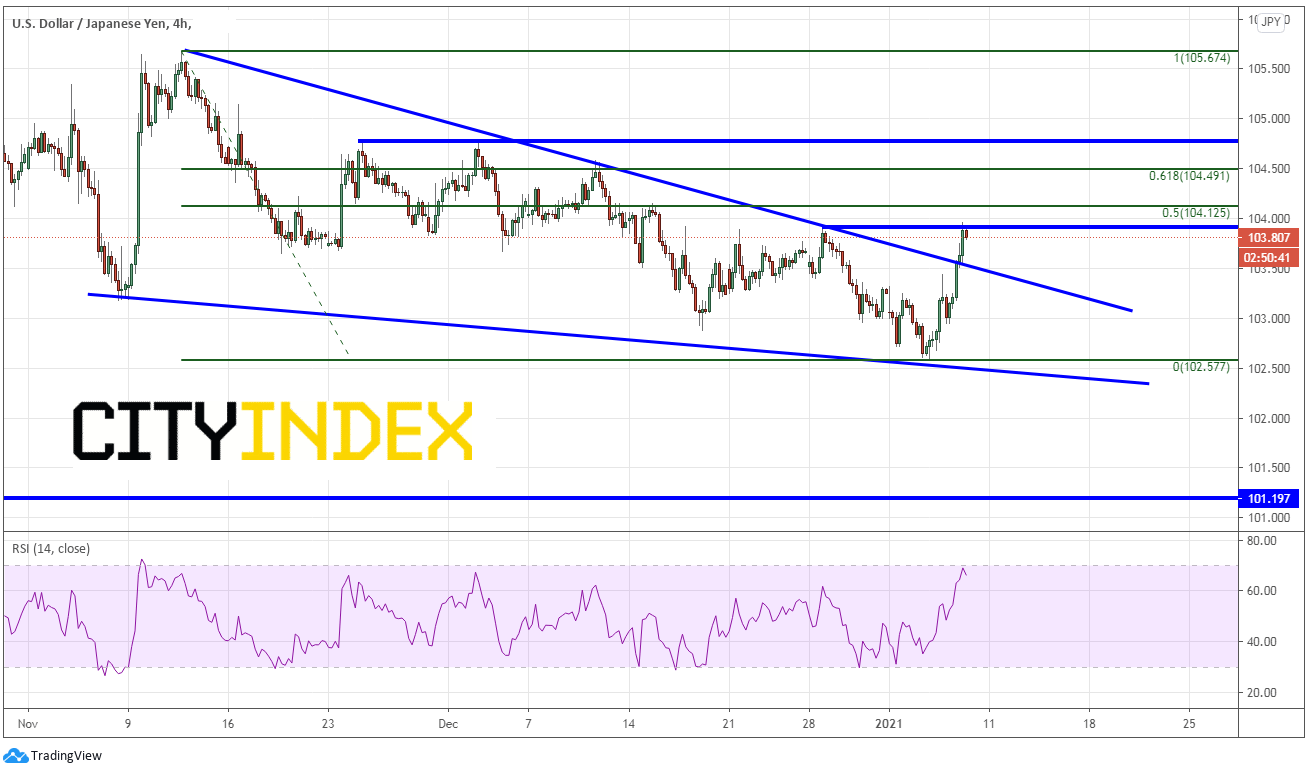

The target level on the breakout of a descending wedge is a 100% retracement of the wedge, or near 105.67. But USD/JPY has plenty of work to do to get back to that level. On a 240-minute timeframe, USD/JPY is banging up against horizontal resistance and prior highs from December 20th, 2020, near 103.85. Above there, resistance is at the 50% retracement level and the 61.8% Fibonacci retracement level from the March 24th, 2020 highs to the January 6th lows at 104.12 and 104.50, respectively. Watch for sellers to come in and try and push the pair lower near these levels. If higher prices can not be sustained, support is at the top trendline of the wedge near 103.50. Below there, price can fall back to January 6th lows near 102.59.

Source: Tradingview, City Index

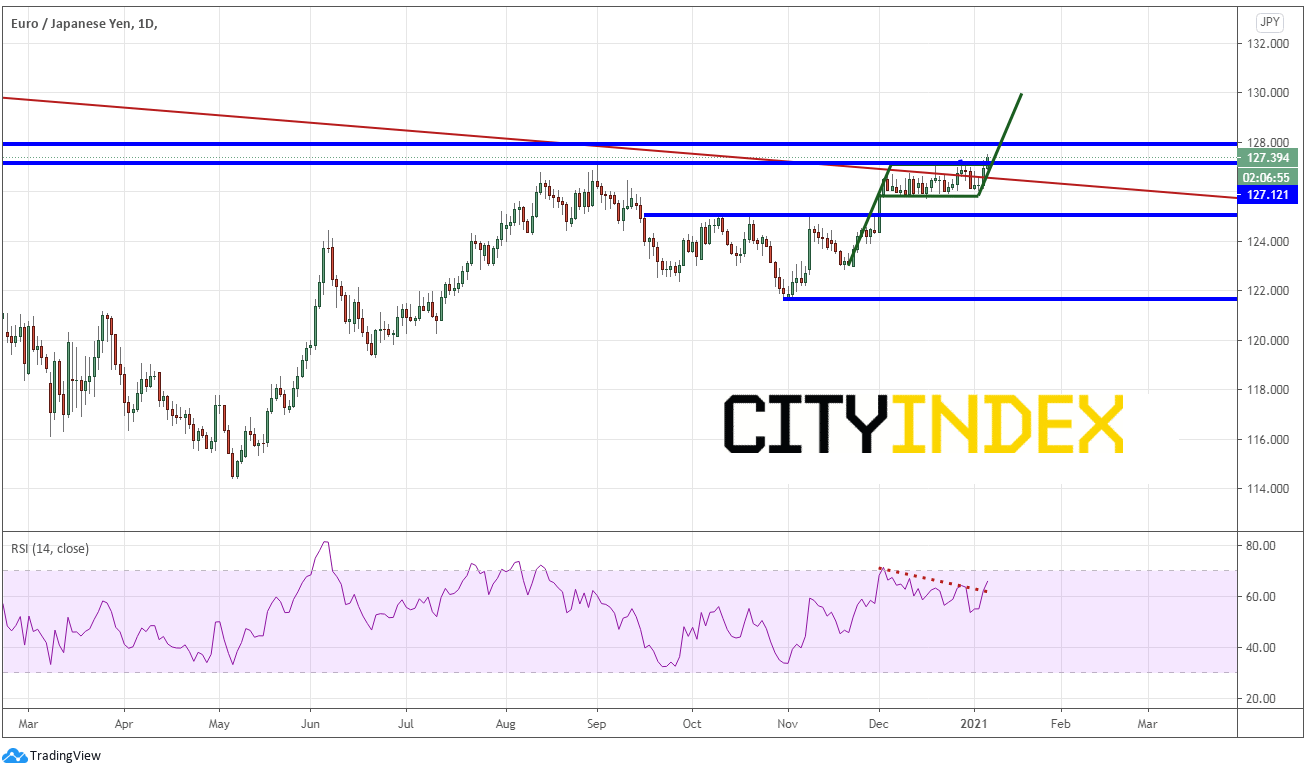

Contrary to USD/JPY, EUR/JPY has been moving higher off its lows since early May 2020, near 114.39. More recently, the pair has been forming a flag pattern and today, broke higher out of the flag and above long-term horizontal resistance at 127.25.

Source: Tradingview, City Index

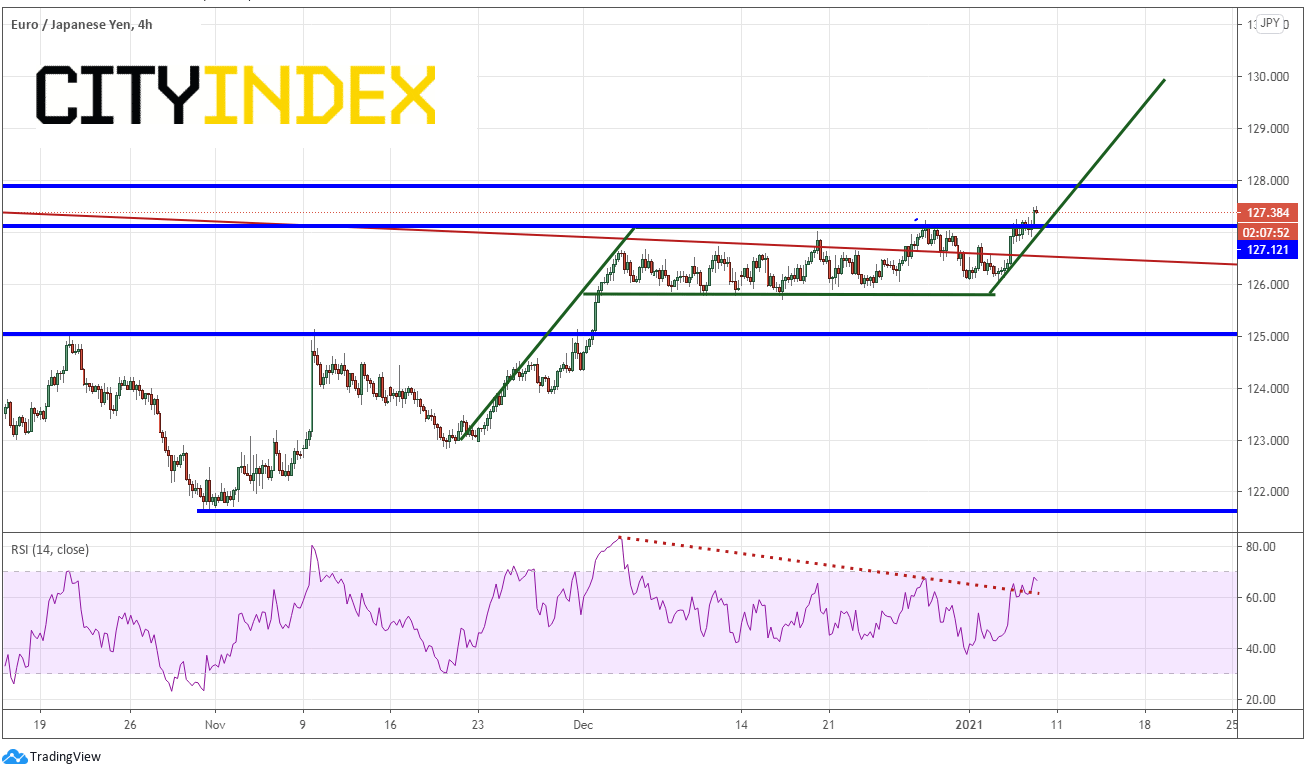

The target for the breakout of a flag is the length of the “pole” and add it to the breakout point of the flag. (The more conservative approach for a target is to measure the breakout point from the bottom trendline of the flag, as shown here.) In this case, the target is near 130.00. Horizontal resistance sits just above at 127.86. Support is at the breakout level near 127.25, then the bottom of the flag near 125.75. Below there is horizontal support near 125.12. Watch for buyers to enter on dips near any of these levels to add to long positions.

Source: Tradingview, City Index

If the coronavirus continues to spread in Japan, there will undoubtedly be additional measures taken by the government. If that is the case, watch for additional rhetoric by the BOJ, MOF, and government officials trying to talk down the value of the Yen!

Learn more about forex trading opportunities.