The speed and the depth of the impact on the aviation industry is breath taking. British Airways axed 75% of its flights as EasyJet and Ryanair grounded aircrafts, with the latter saying it could ground its entire fleet; TUI has suspended most of its operations as the industry struggles to survive the impact of the flight restrictions and waning demand.

Unions are warning that thousands of jobs could be wiped out as global airline alliances call on governments for intervention to shore up an industry that staring down the barrel to collapse.

A rebound coming?

We all know not to try to catch a falling knife. A rebound in aviation stocks depend largely on the duration of the outbreak.

Most airlines should survive if the travel restriction and low booking levels are for just one or two quarters.

Some carriers, such as Cathy Pacific are already showing early signs of life. Hong Kong arrivals were heavily affected by the coronavirus outbreak with 80% of the fleet grounded on travel restrictions and waning demand. However quick smart action has seen the spread of the virus and the fatality rate come quickly under control. The number of flights is cautiously increasing. Using past outbreaks as a guide tourism and leisure travel return fast after a virus outbreak, potentially as soon as the summer, easily stimulated by fare sales

Business travel, however, could see more permanent changes as companies cut right back and focus on teleconferencing over business travel.

Time for bargain hunting?

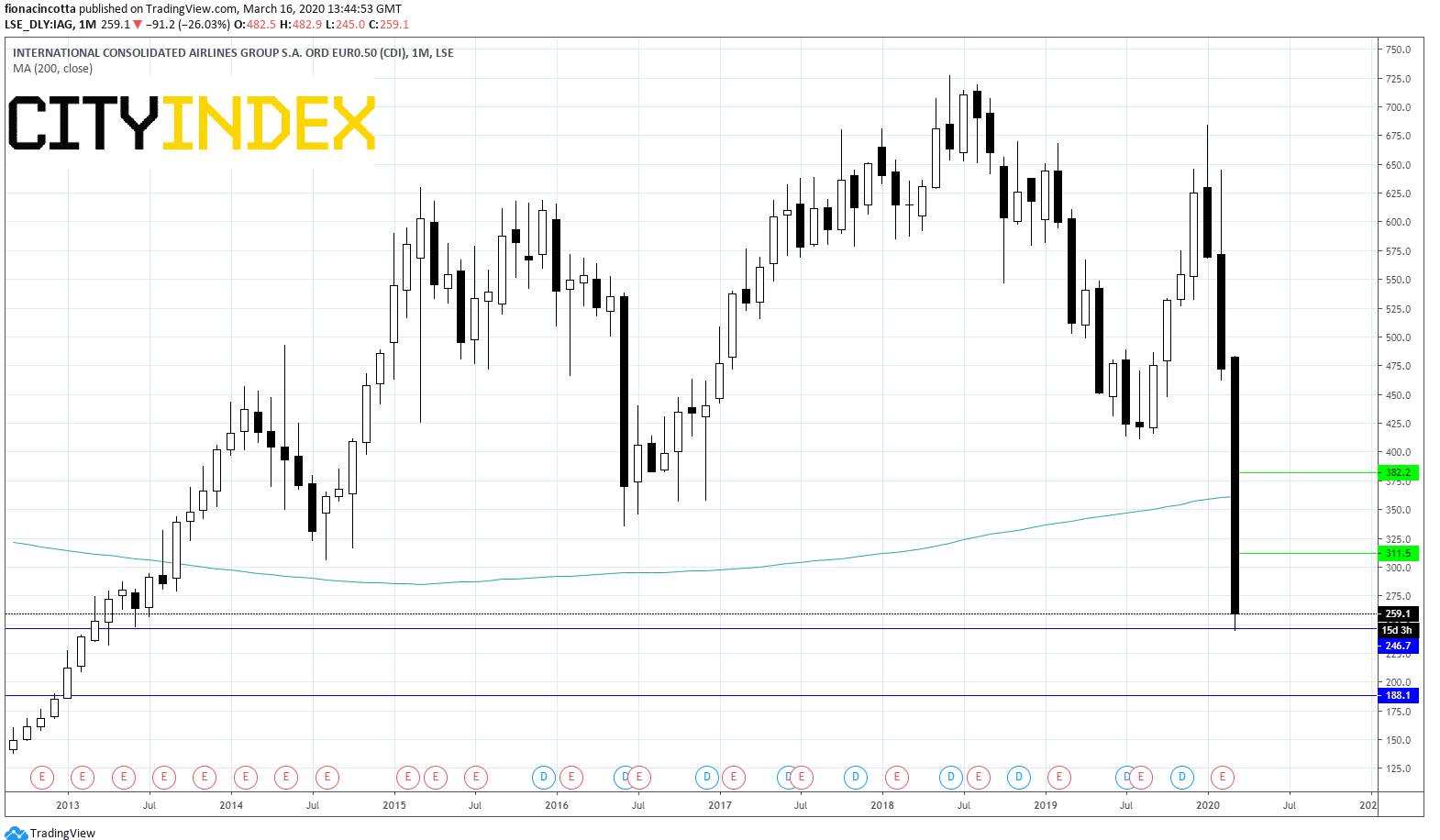

It is still too early to call the bottom on airline stocks. This could well get worse before it gets better. The IAG has dropped 70% but the outlook is not 70% worse today than at the start of the year. Let's not forget IAG made £2.89 billion operating profit last year. The share price drop is a drop driven by sentiment rather than financials. There will be a time for hunting Airline bargains. But it is not quite yet.

Norwegian Air is considered to be particularly at risk, potentially only surviving the next few weeks.

US airline Delta is considered to be in a strong position as a highly profitable airline.