With markets already in a fragile mindset following a decision by the World Health Organization to finally label the coronavirus a Pandemic overnight, an announcement today by U.S. President Trump that travel from Europe to the U.S. would be restricted for the next 30 days, has seen risk assets ratchet lower again during the Asian time zone.

Apart from the impact the coronavirus is having on economies worldwide, it seems that no person is immune from its reach. American actor Tom Hanks and his wife Rita Wilson today confirmed they tested positive to the virus while on the Gold Coast of Australia to shoot a movie about Elvis Presley. Elsewhere, the NBA announced it has suspended its season indefinitely after a player from the Utah Jazz tested positive to the virus.

I know many fellow traders have been focused on the threat of the virus both in a real and an economic sense for many weeks now. If there is one positive from today’s developments it potentially raises general awareness on the subject to help containment efforts.

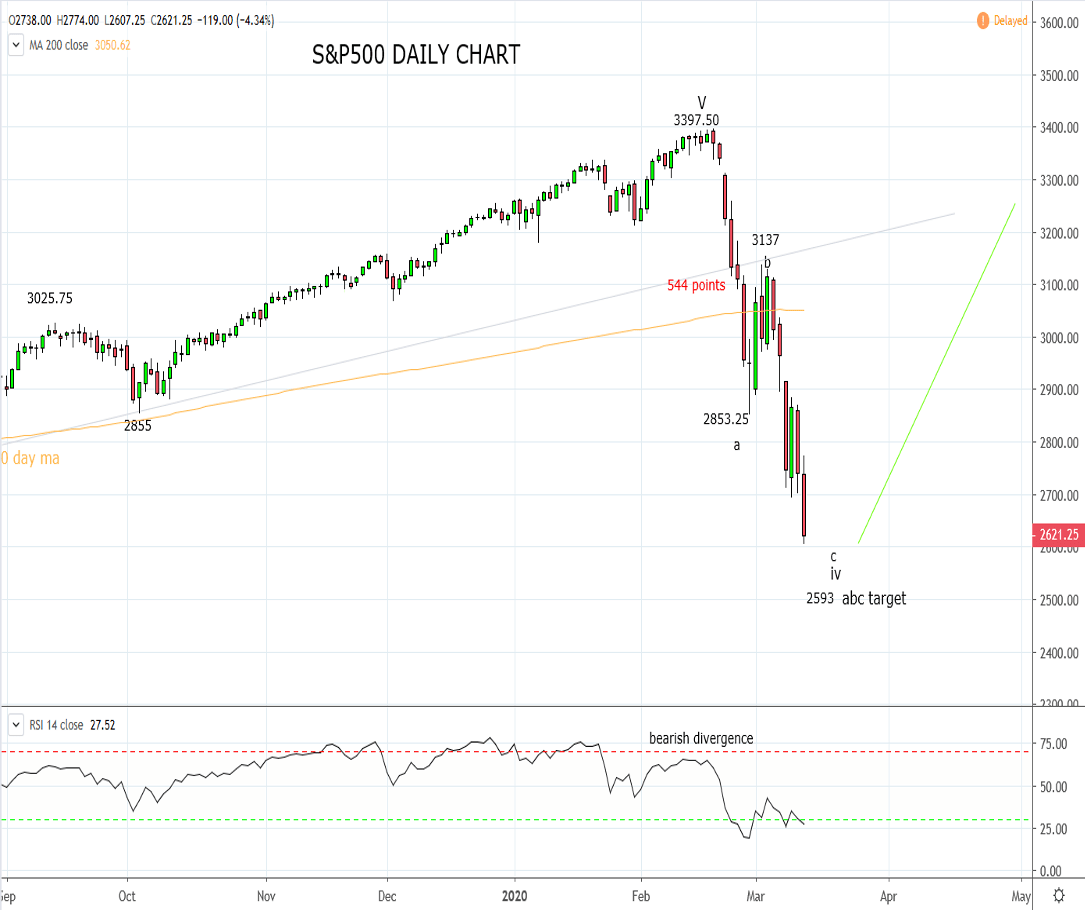

Returning to risk assets, the S&P 500 after today’s fall is approaching three significant downside support regions. The first is the “abc” wave equality target at 2593 which is calculated by subtracting the length of “Wave a” (3397.5 -2853.25) from the “Wave b high” of 3137.

Not far below here, resides weekly uptrend support at 2525 which comes from the March 2009, GFC 666 low and then a “line in the sand” of sorts, the 2316.75 low of Boxing Day 2018.

Longer term investors might like to “dip their toe” into the water and buy dips leaning against this broader support region in expectation of a medium term recovery.

For shorter term trading accounts, the high level of intraday volatility makes this idea a risky proposition. However a good starting point would be the formation of a bullish daily reversal candle, ideally from the 2600/2500 support area or from the 2316.75 December 2018 low.

- After completing a Wave v high at the February 20, 3397.50 high we are looking for the S&P500 to trade towards and hold the support in the 2600/2500 region which encapsulates the weekly uptrend support from the 2009 GFC low at 666 as well as the “abc” wave equality target (2593).

- We suggest investors might like to consider “dipping their toe” in the water and buy dips into this area in expectation of a recovery.

- For trading accounts, the high level of intraday volatility makes this a trickly proposition. We will attempt to narrow down some more specific short term levels in coming session. A key requirement would be the formation of a bullish daily reversal ideally in the 2600/2500 support area.

- Short Term Summary: Our bias has gone from selling bounces to buying dips into the 2600/2500 support area.

Source Tradingview. The figures stated areas of the 10th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation