Three Key Themes to Watch When Google Reports Earnings Tonight

In a clash of two storied NFL franchises, the Kansas City Chiefs celebrated an exciting come-from-behind victory over the San Francisco 49ers in Super Bowl 54 last night. For traders, a similarly titanic struggle has shaped over past week: coronavirus fears vs. tech stock earnings optimism.

As my colleague Fiona Cincotta noted late last week, US technology stocks have generally reported impressive earnings figures so far this month (with the big exception of Facebook), driving already massive firms like Apple (AAPL) and Amazon (AMZN) to fresh record highs and keeping broader indices afloat despite the rapid spread of coronavirus. With that high bar set, the stakes are elevated heading into this evening’s earnings report from Alphabet, Google’s $1T parent company and the last of the FAANGs to report.

Key figures to know ahead of GOOG’s earnings report:

- Consensus EPS estimate = $12.76 (-0.1% y/y).

- Consensus revenue estimate = $46.87B (+19.3% y/y).

- GOOG has beaten earnings estimates on 7 of its last 8 reports.

- GOOG has beaten revenue estimates in 6 of its last 8 reports.

- 42 of 47 analysts covering google have buy/overweight ratings on the company; the remaining 5 analysts have hold ratings on the stock.

- These analysts’ average price target for GOOG is $1542, according to FactSet.

Three Key Themes

- In recent months, Google’s most successful tech rivals have thrived by diversifying away from their core businesses and into fast-growing new business streams (see Apple Services + Wearables, Amazon web services, and Microsoft Azure). While GOOG has no shortage of alternative business lines, including YouTube and its self-driving subsidiary Waymo, traditional search advertising still provides the vast majority of GOOG’s revenue and profits. One way or another, bulls will be watching closely for signs of growth in Alphabet’s alternative businesses.

- Another major theme will be the impact Google’s C-Suite turnover. In recent months, Google’s co-founders Larry Page and Sergey Brin stepped away from their active roles in the company, adding new responsibilities to CEO Sundar Pichai’s plate. In addition, Google’s Chief Legal officer David Drummond left the company last week amidst an investigation into his relationships with women who worked at the company. Neither of these personnel changes is necessarily cause for alarm, but investors tend to be wary of leadership transitions, so comments on that front will be closely scrutinized.

- The final theme to watch will be the ongoing legal proceedings against Google business practices. The Federal government is probing whether Google’s dominance in online search or its Android platform violate antitrust regulations. Investors have thus far shrugged off similar investigations into megacap tech rivals including Facebook, Amazon, and Apple, so we wouldn’t expect much movement on the legal front this afternoon.

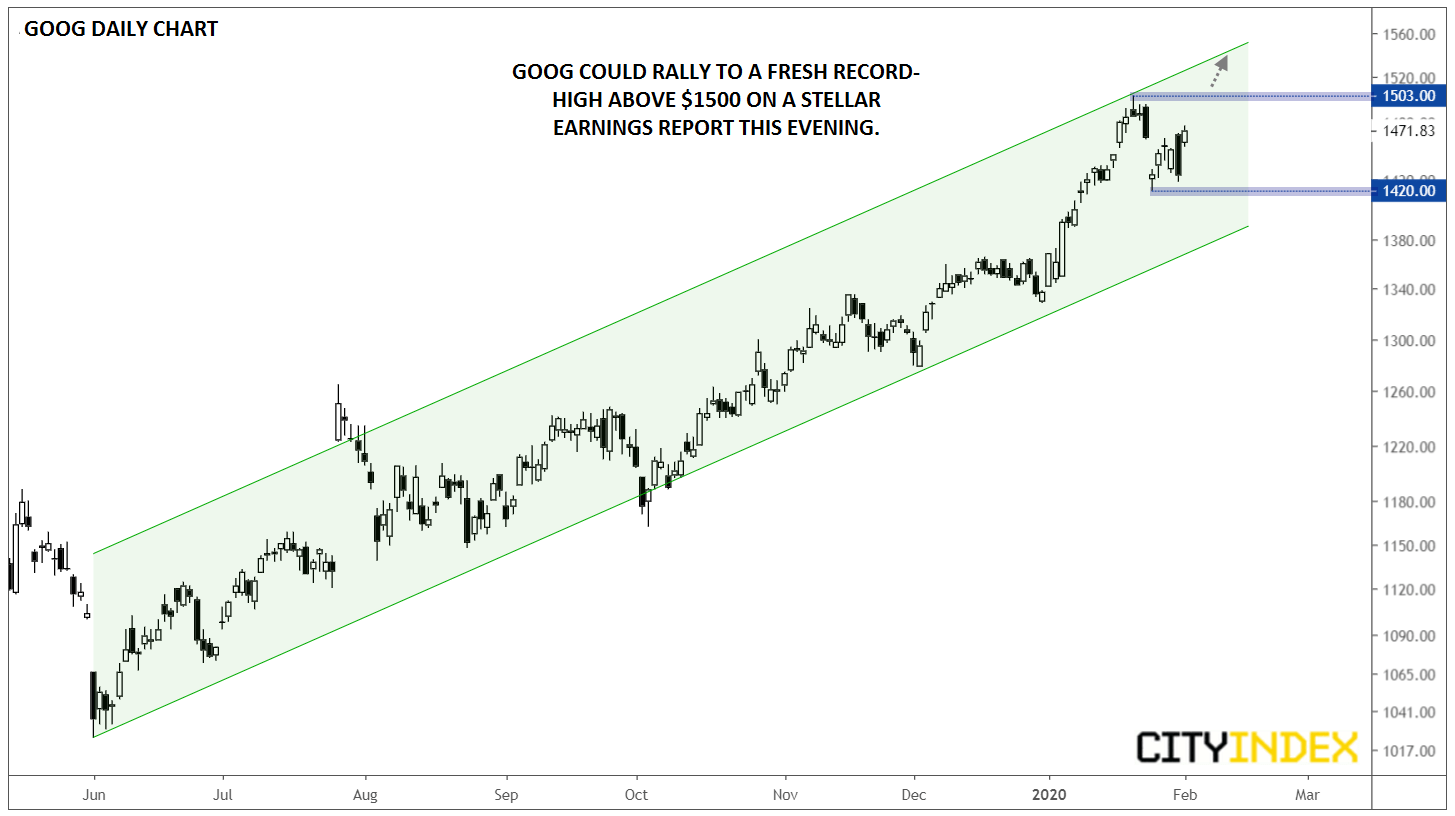

Chart Thoughts

After setting a fresh record high above $1500 late last month, GOOG has pulled back to consolidate in the mid-$1400s over the last week. Technically speaking, the short-term levels to watch will the record intraday high at $1503 and last week’s intraday low near $1420. Given investors’ current demand for growth at all costs, we lean toward a bullish reaction to GOOG’s earnings, with a truly stellar report opening the door for a move into the lower- or mid-$1500s. That said, a disappointing reading could still break $1420 support and expose the lower end of the recent bullish channel near $1375.

Source: TradingView, GAIN Capital.