Below are another three Aussie stocks that, in our opinion, are worth a look at:

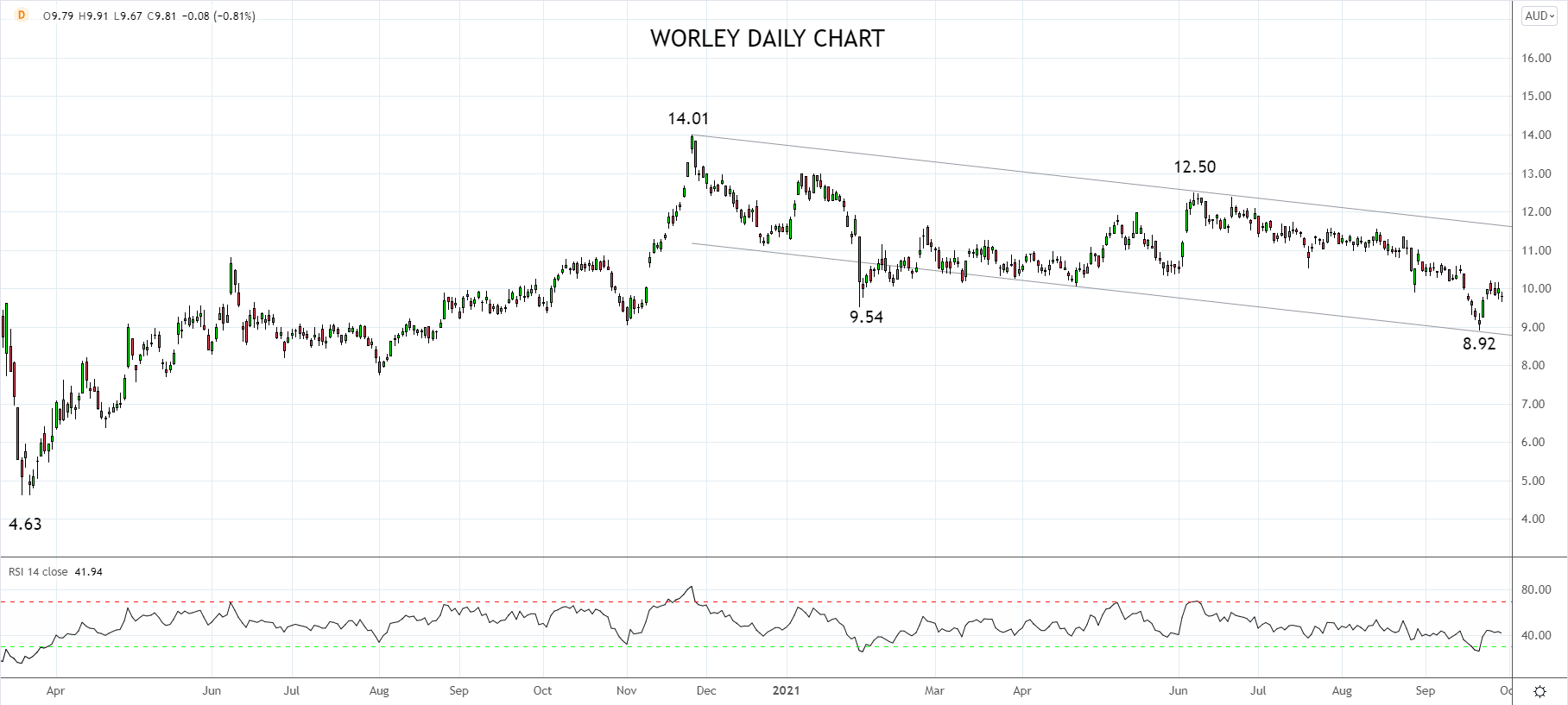

1. Worley (ASX: WOR)

Worley is a global engineering company that operates in the energy, chemical, and resource sectors. The share price of Worley has fallen over 30% since November 2020, from $14.01 to the current price of $9.79.

Last week Jacobs Engineering Group sold its ~10% shareholding of Worley, with Citigroup left underwriting the stock at around the $9.70 price level. What followed was a bit of an ugly sell down as the stock traded to its $8.92 low.

Worley is a significant player in the building of green projects in the move towards a decarbonized world. After testing and holding the trend channel base, we think Worley is worth a look at the current price of $9.73, expecting a move towards trend channel resistance at $11.50.

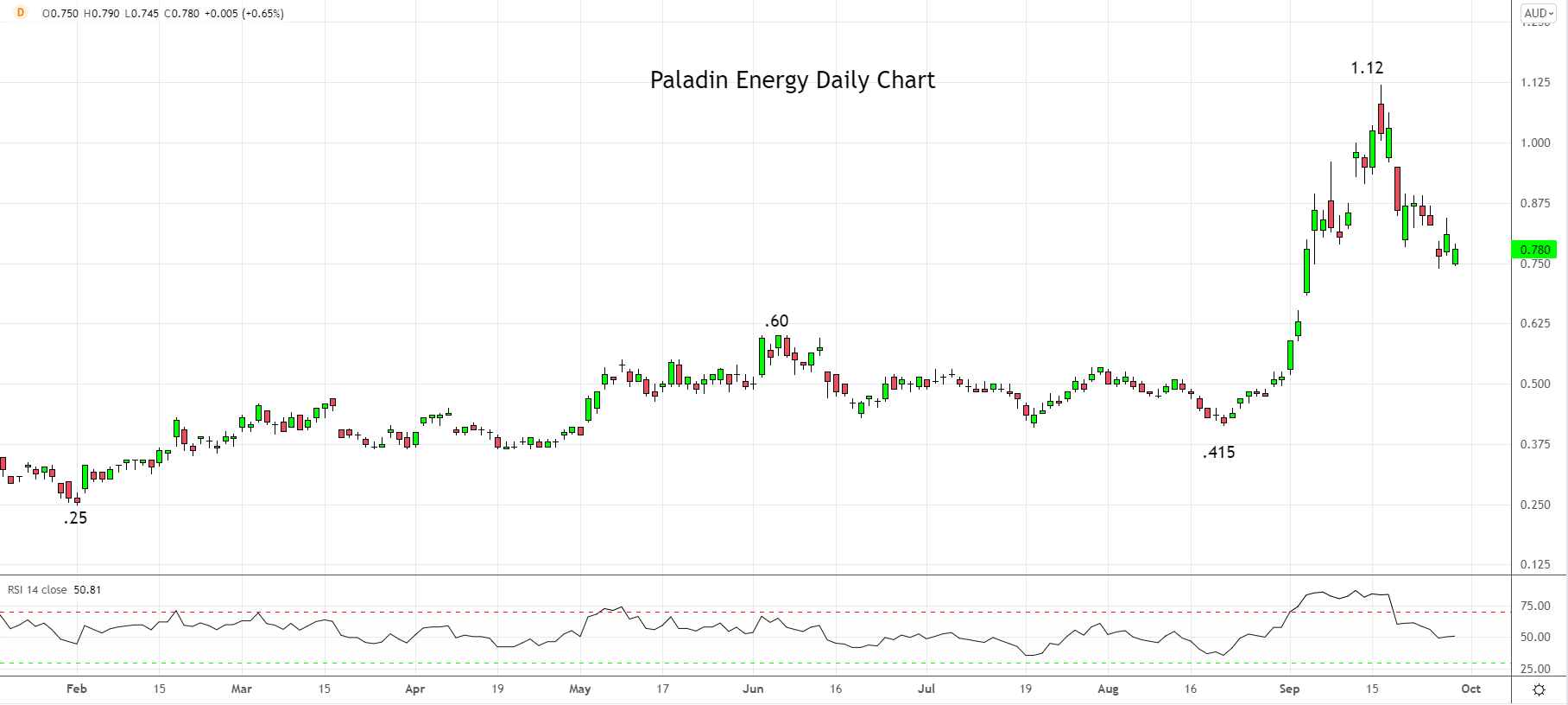

2. Paladin Energy (ASX: PDN)

Uranium stocks enjoyed substantial gains during the first half of September following the emergence of Sprott's Physical Uranium Trust as a buyer of uranium, which pushed the price of uranium from below US$30lb to above US$50lb.

Sprott's has not bought any additional uranium since September 17, and the price of uranium has eased back to $43lb dragging lower the shares of ASX listed uranium miners, including Paladin Energy.

Due to the continued trend towards decarbonization and with an energy crisis currently gripping many parts of the world, we think uranium, and, by extension, Paladin is worth a look here at .78c, in expectation of a retest of the recent $1.12 high.

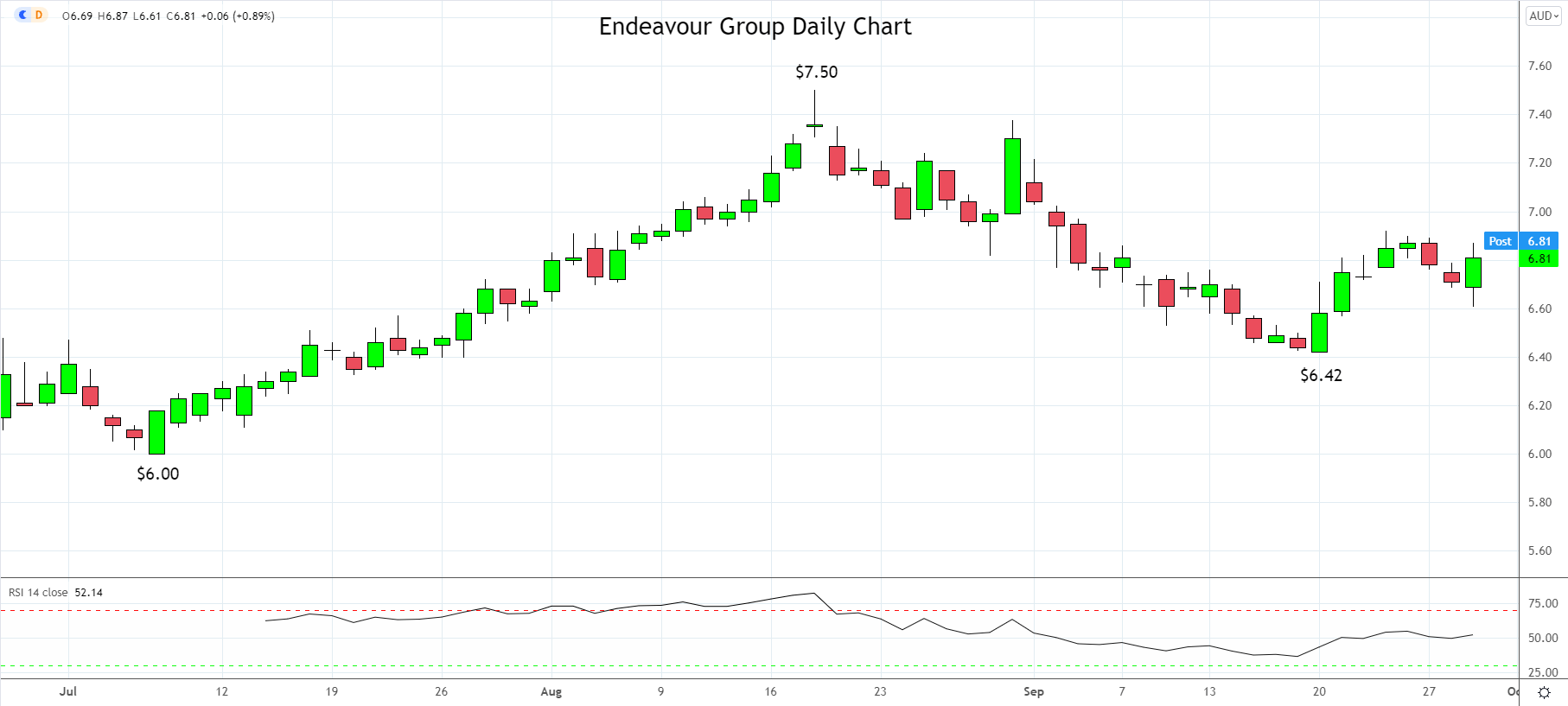

3. Endeavour Group (ASX: EDV)

The Endeavour Group, which includes Dan Murphy's, BWS, and the largest hotel network in Australia, was spun out of Woolworth's days before NSW entered lockdown fourteen weeks ago.

With a roadmap to a full re-opening in NSW and VIC now in place and the first stage of the re-opening just weeks away, the Endeavour Group is well positioning to benefit from cashed-up consumers eager to enjoy a meal and drink with friends.

With this in mind, we think the share price of the Endeavour Group is worth a look at the current price of $6.82 in expectation of a retest and break of its $7.50 high.

Source Tradingview. The figures stated areas of September 29, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation