This Weeks Market Forecast and Earnings to Look Out for in the Second Week of 2Q Earnings Season

On Tuesday, Coca-Cola (KO) is awaited to post 2Q EPS of $0.41 vs. $0.63 the prior year on revenue of $7.3B compared to $10.0B last year. Coca-Cola is the largest non-alcoholic beverage company in the world and on July 2nd, The Wall Street Journal reported that the Co made the decision to discontinue its Odwalla juice business and a refrigerated trucking network that delivered fresh drinks to stores. Technically speaking, the RSI is above 50. The MACD is above its signal line and positive. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $45.22 and $45.64). We are looking at the final target of $50.90 with a stop-loss set at $44.30.

On Wednesday, Microsoft (MSFT) is anticipated to release 4Q EPS of $1.38 vs. $1.37 the prior year on revenue of $36.5B compared to $33.7B last year. The Co develops software and on July 16th, Take-Two Interactive Software (TTWO), a leading global video game publisher, entered into a deal with the Co for the right to develop games and products for the upcoming Xbox One and Xbox Series X platforms, according to Bloomberg. From a chartist's point of view, the RSI is mixed to bearish. We are looking at the final target of $231.00 with a stop-loss set at $202.00.

On Thursday, Freeport-McMoRan (FCX) is expected to announce 2Q LPS of $0.02 vs. an LPS of $0.04 the prior year on revenue of $3.1B compared to $3.5B in the year before. Freeport-McMoRan is a diversified mining company focused on copper and on July 6th, the Co released a second quarter business update which stated that Gold sales exceeded expectations by roughly 10% and Copper sales also exceeded expectations by approximately 8%. On a different note, the Co's current analyst consensus rating is 15 buys, 5 holds and 0 sells, according to Bloomberg. From a technical point of view, the RSI is above 70. It could mean either that the stock is in a lasting uptrend or just overbought and therefore bound to correct (look for bearish divergence in this case). The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $12.08 and $10.51). We are looking at the final target of $16.10 with a stop-loss set at $12.40.

On Friday, Schlumberger (SLB) is likely to unveil 2Q LPS of $0.03 vs. an EPS of $0.35 the prior year on revenue of $5.4B compared to $8.3B last year. The Co is the world's largest supplier of oil products and services, and on June 29th, Bloomberg reported that Energy Recovery (ERII), a developer of energy recovery devices, exited a 15-year licensing agreement that was signed in October 2015 with the Co for it to have exclusive use of Energy Recovery's VorTeq hydraulic pumping system. Looking at a daily chart, the RSI is above 50. The MACD is above its signal line and negative. The MACD must break above its zero level to call for further upside. Moreover, the stock is above its 20 and 50 day MA (respectively at $18.35 and $18.56). We are looking at the final target of $23.40 with a stop-loss set at $16.80.

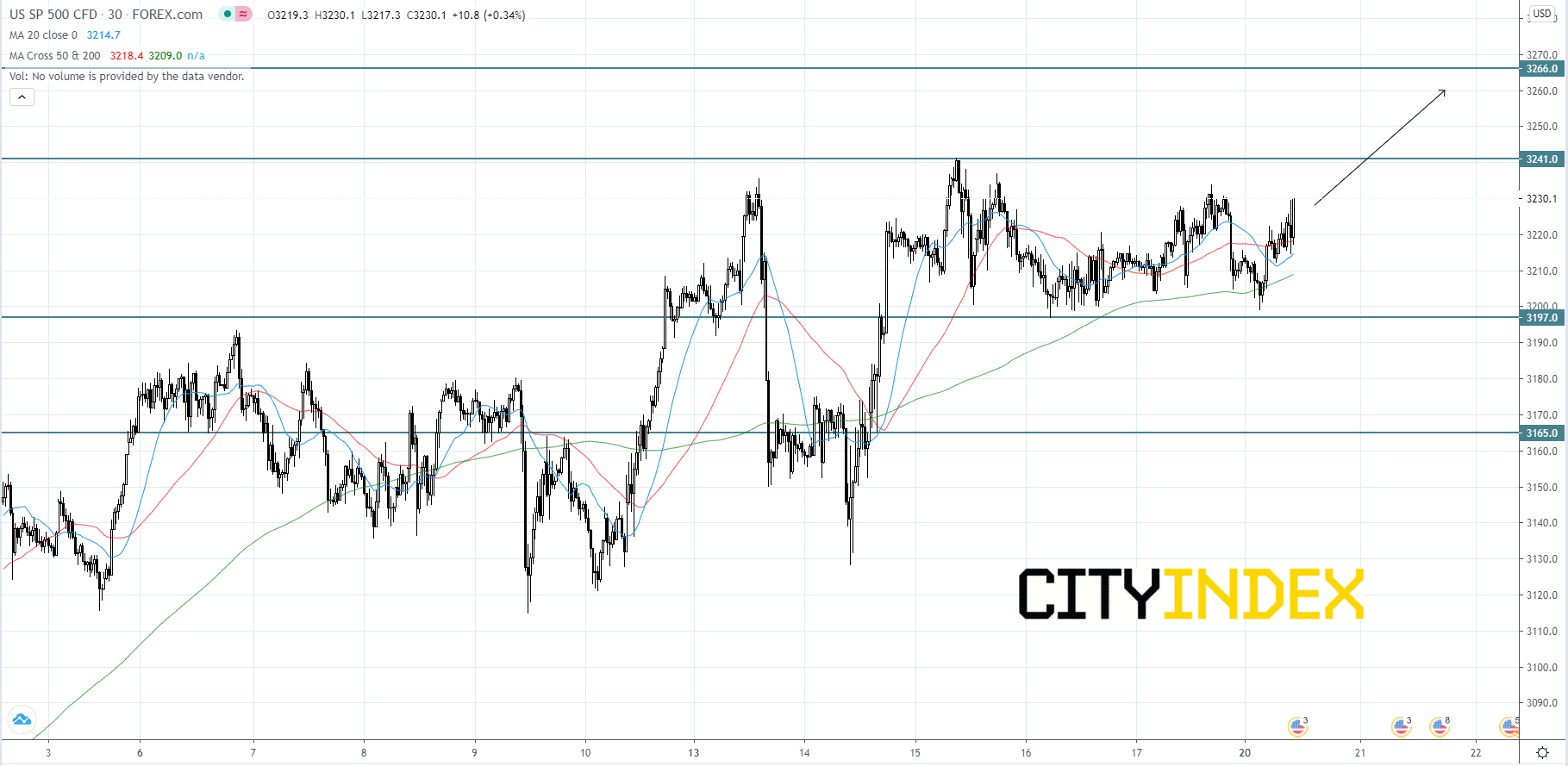

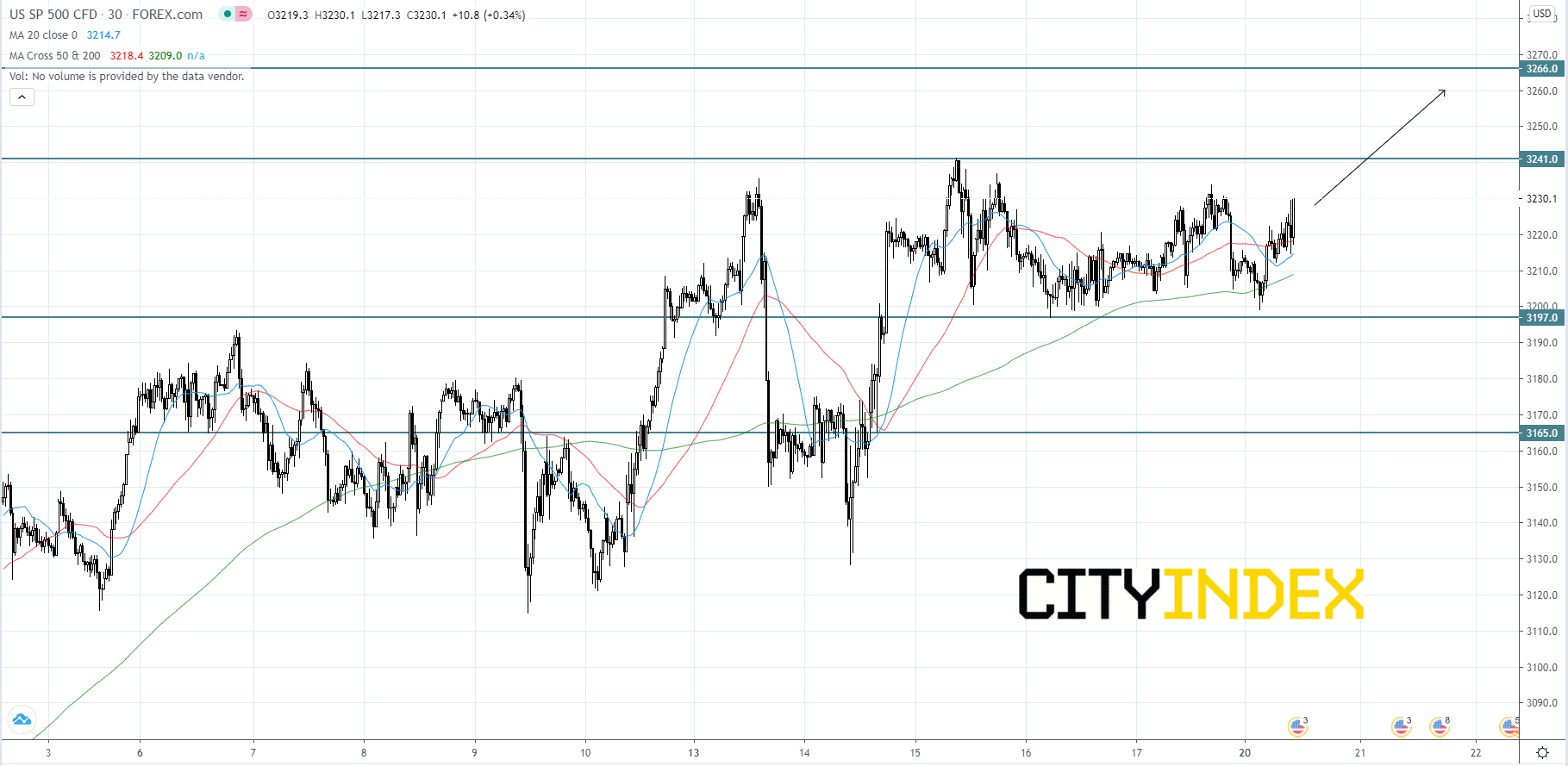

Looking at the S&P 500 CFD on a 30 minute chart, the index has been holding in a range between 3,197 and 3,241 since Wednesday last week, after price made a new peak at 3,241, a bullish signal. Market conditions are still bullish and we are entering the second week of the second quarter earnings season, therefore we should still expect volatile price swings as we saw at the beginning of last week. Price will likely continue to advance and break out above the 3,241 resistance level. If price breaks 3,241 we will probably see price grind towards the 3,266 resistance level. If price falls below the 3,197 support level, then price could drop back down to 3,165 before the index finds its footing again.

Source: GAIN Capital, TradingView

On Wednesday, Microsoft (MSFT) is anticipated to release 4Q EPS of $1.38 vs. $1.37 the prior year on revenue of $36.5B compared to $33.7B last year. The Co develops software and on July 16th, Take-Two Interactive Software (TTWO), a leading global video game publisher, entered into a deal with the Co for the right to develop games and products for the upcoming Xbox One and Xbox Series X platforms, according to Bloomberg. From a chartist's point of view, the RSI is mixed to bearish. We are looking at the final target of $231.00 with a stop-loss set at $202.00.

On Thursday, Freeport-McMoRan (FCX) is expected to announce 2Q LPS of $0.02 vs. an LPS of $0.04 the prior year on revenue of $3.1B compared to $3.5B in the year before. Freeport-McMoRan is a diversified mining company focused on copper and on July 6th, the Co released a second quarter business update which stated that Gold sales exceeded expectations by roughly 10% and Copper sales also exceeded expectations by approximately 8%. On a different note, the Co's current analyst consensus rating is 15 buys, 5 holds and 0 sells, according to Bloomberg. From a technical point of view, the RSI is above 70. It could mean either that the stock is in a lasting uptrend or just overbought and therefore bound to correct (look for bearish divergence in this case). The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $12.08 and $10.51). We are looking at the final target of $16.10 with a stop-loss set at $12.40.

On Friday, Schlumberger (SLB) is likely to unveil 2Q LPS of $0.03 vs. an EPS of $0.35 the prior year on revenue of $5.4B compared to $8.3B last year. The Co is the world's largest supplier of oil products and services, and on June 29th, Bloomberg reported that Energy Recovery (ERII), a developer of energy recovery devices, exited a 15-year licensing agreement that was signed in October 2015 with the Co for it to have exclusive use of Energy Recovery's VorTeq hydraulic pumping system. Looking at a daily chart, the RSI is above 50. The MACD is above its signal line and negative. The MACD must break above its zero level to call for further upside. Moreover, the stock is above its 20 and 50 day MA (respectively at $18.35 and $18.56). We are looking at the final target of $23.40 with a stop-loss set at $16.80.

Looking at the S&P 500 CFD on a 30 minute chart, the index has been holding in a range between 3,197 and 3,241 since Wednesday last week, after price made a new peak at 3,241, a bullish signal. Market conditions are still bullish and we are entering the second week of the second quarter earnings season, therefore we should still expect volatile price swings as we saw at the beginning of last week. Price will likely continue to advance and break out above the 3,241 resistance level. If price breaks 3,241 we will probably see price grind towards the 3,266 resistance level. If price falls below the 3,197 support level, then price could drop back down to 3,165 before the index finds its footing again.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM