What Next?

The next prime minister is likely to be pro-Brexit, with hard line Brexiter Boris Johnson the bookies favourite to take the reins. Theresa May’s resignation was not unexpected, and the fact that we didn’t see a sharp selloff in the pound confirms that. The pound spiked higher piercing $1.27 before paring some gains this afternoon. However, a positive close still looks possible, meaning the pound could end its record-breaking losing run.

Pound traders have been bracing themselves for a pro-Brexit leader over the past few weeks, sending the pound tumbling. With a pro- Brexit leader in power, the chances of a hard, no deal Brexit will increase significantly.

The FTSE

The FTSE’s reaction has been minimal to Theresa May’s resignation. With around 70% of the FTSE made up by international firms the US – Sino trade dispute developments have had more of an impact driving the index higher.

Within the FTSE there are certain sectors which are more vulnerable to Brexit and domestic political changes. Stocks exposed to the UK economy, such as housebuilders, UK domestic banks RBS and Lloyds, retailers and airlines which could be grounded in the case of a no deal Brexit, are keeping their head above water today. These are stocks which could tumble should Boris Johnson come to power and reposition the UK towards the hardest of Brexits. The more domestically focused FTSE 250 is also up 0.6%.

The pound and the FTSE

The FTSE has an inverse relationship with the FTSE. Generally speaking, when the pound falls the FTSE moves higher as the multinationals benefit from the more favourable exchange rate. Should the pound continue to fall the FTSE could find itself supported. However, developments in the US - Sino trade war will also impact on the FTSE, potentially more so than Brexit and the pound.

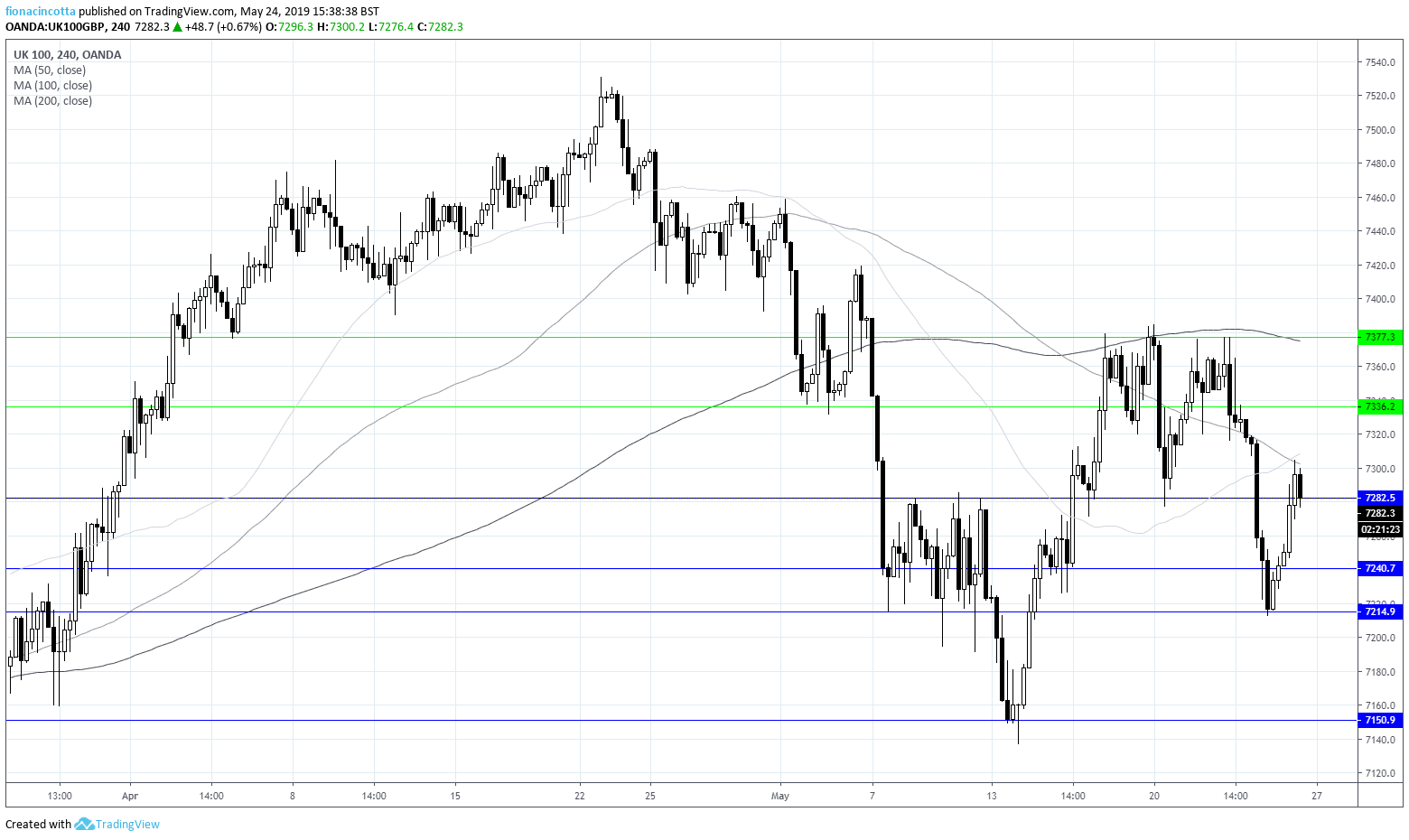

The chart

The FTSE is trading 0.6% higher on the day. It tried and failed to break resistance at 7300, falling back to test support at 7280. A breakthrough here could see the index lose ground towards 7240 as it heads towards 7150. On the upside resistance can be seen at 7336 before 7377.