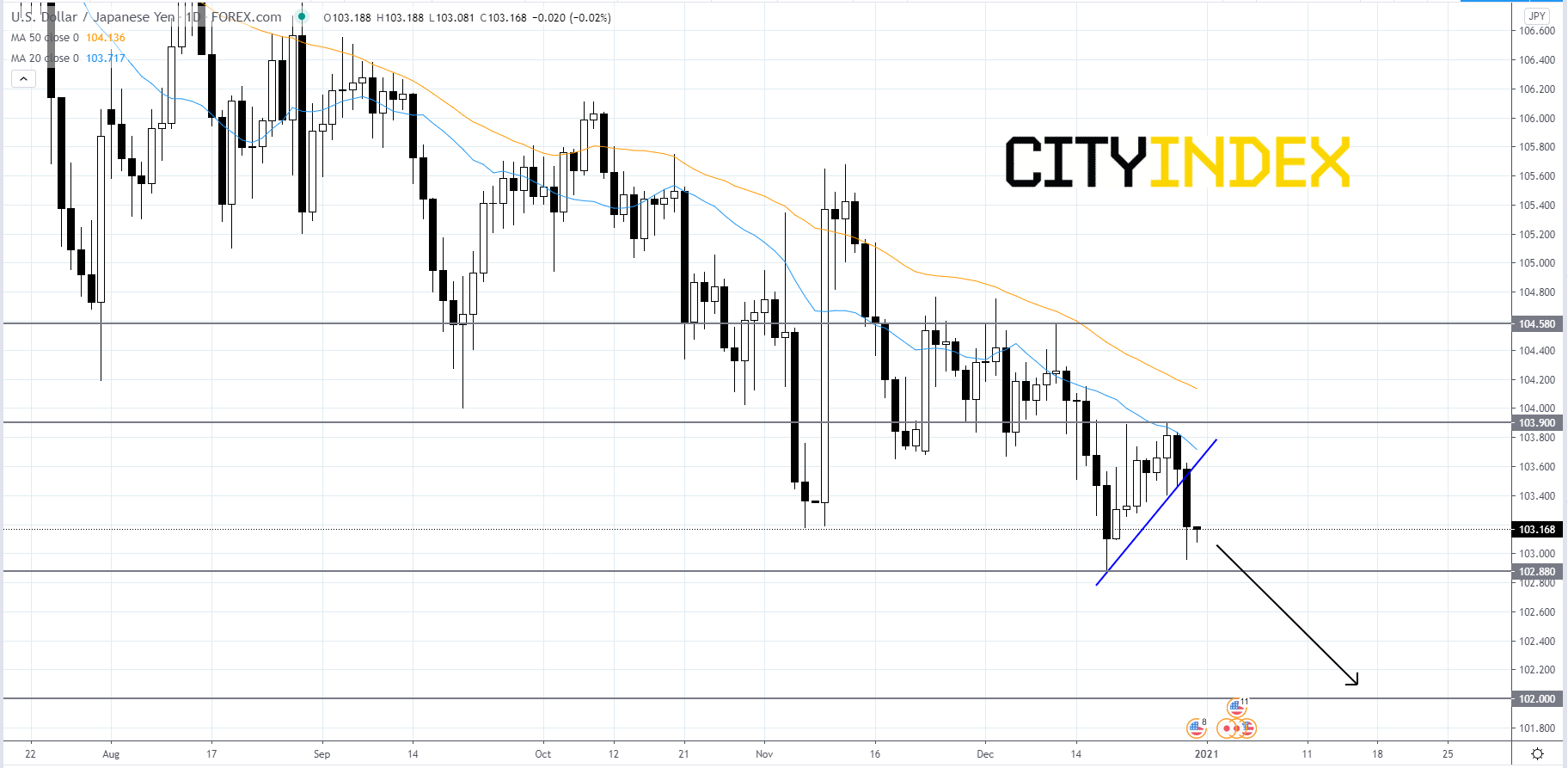

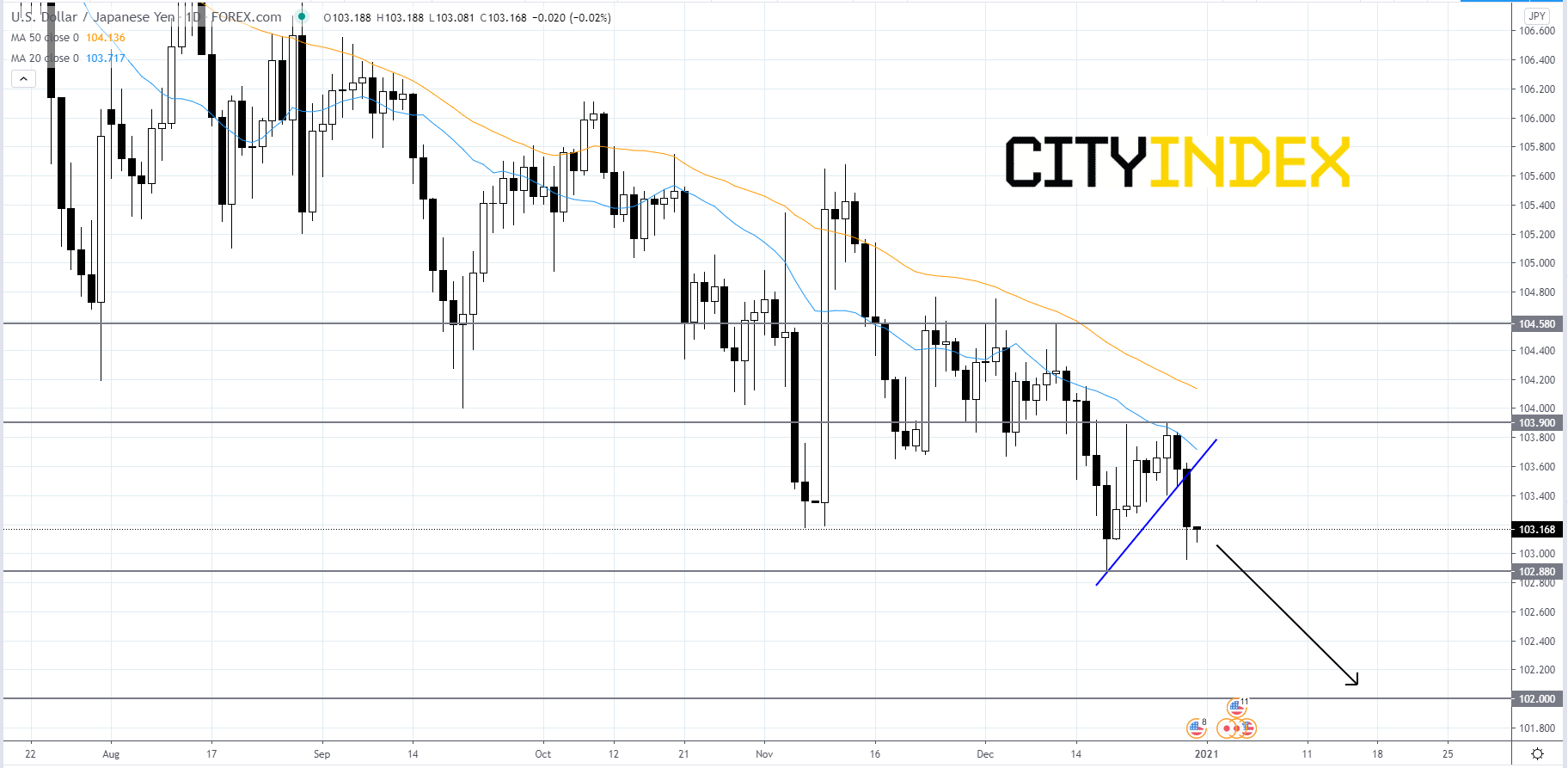

The USD/JPY appears to be headed for 102.00

The US Dollar was bearish against all of its major pairs on Wednesday. On the US economic data front, Wholesale Inventories fell 0.1% on month in the November preliminary reading (+0.6% expected), compared to a revised +1.2% in the October final reading. Market News International's Chicago Business Barometer unexpectedly rose to 59.5 on month in December (56.3 expected), from 58.2 in November. Finally, Pending Home Sales declined 2.6% on month in November (0% expected), compared to a revised -0.9% in October.

On Thursday, Initial Jobless Claims for the week ending December 26th are expected to rise to 833K, from 803K in the previous week. Finally, Continuing Claims for the week ending December 19th are expected to increase to 5,390K, from 5,337K in the week before.

The Euro was bearish against most of its major pairs with the exception of the CHF and USD. In the U.K., the Nationwide Building Society has posted its house price index for December +0.8% (vs +0.4% over one month expected).

The Australian dollar was bullish against all of its major pairs.

Technically speaking, on a daily chart, the USD/JPY currency pair just broke out to the downside of a short-term bullish trendline that began to form on December 17th. The simple moving averages (SMAs) are arranged in a bearish manner, as the 20-day SMA is below the 50-day SMA. If the pair continues to fall then its next support levels would be 102.88 and 102.00. If the pair rallies traders should look for resistance at 103.90. If price gets above 103.90, then the pair could advance towards 104.58 before it hits resistance.

Source: GAIN Capital, TradingView

On Thursday, Initial Jobless Claims for the week ending December 26th are expected to rise to 833K, from 803K in the previous week. Finally, Continuing Claims for the week ending December 19th are expected to increase to 5,390K, from 5,337K in the week before.

The Euro was bearish against most of its major pairs with the exception of the CHF and USD. In the U.K., the Nationwide Building Society has posted its house price index for December +0.8% (vs +0.4% over one month expected).

The Australian dollar was bullish against all of its major pairs.

Technically speaking, on a daily chart, the USD/JPY currency pair just broke out to the downside of a short-term bullish trendline that began to form on December 17th. The simple moving averages (SMAs) are arranged in a bearish manner, as the 20-day SMA is below the 50-day SMA. If the pair continues to fall then its next support levels would be 102.88 and 102.00. If the pair rallies traders should look for resistance at 103.90. If price gets above 103.90, then the pair could advance towards 104.58 before it hits resistance.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM