On the economic data front, Markit's U.S. Manufacturing Purchasing Managers' Index rose to 51.3 on month in the July preliminary reading (52.0 expected), from 49.8 in the June final reading.

New Homes Sales jumped to 776K on month in June (700K expected), from a revised 682K in May, a high last reached in 2007.

Initial Jobless Claims rose to 1,416K for the week ending July 18th (1,300K expected), from a revised 1,307K in the week before.

Continuing Claims unexpectedly fell to 16,197K for the week ending July 11th (17,100K expected), from a revised 17,304K in the prior week.

The Leading Index increased 2.0% on month in June (+2.1% expected), compared to a revised +3.2% in May.

The Mortgage Bankers Association's Mortgage Applications rose 4.1% for the week ending July 17th, compared to +5.1% in the week before.

Existing Home Sales increased to 4.72 million homes on month in June (4.75 million homes expected), from 3.91 million homes in May.

Finally, The Federal Reserve Bank of Chicago's National Activity Index spiked to 4.11 on month in June (4.00 expected), from a revised 3.50 in May, marking a record high.

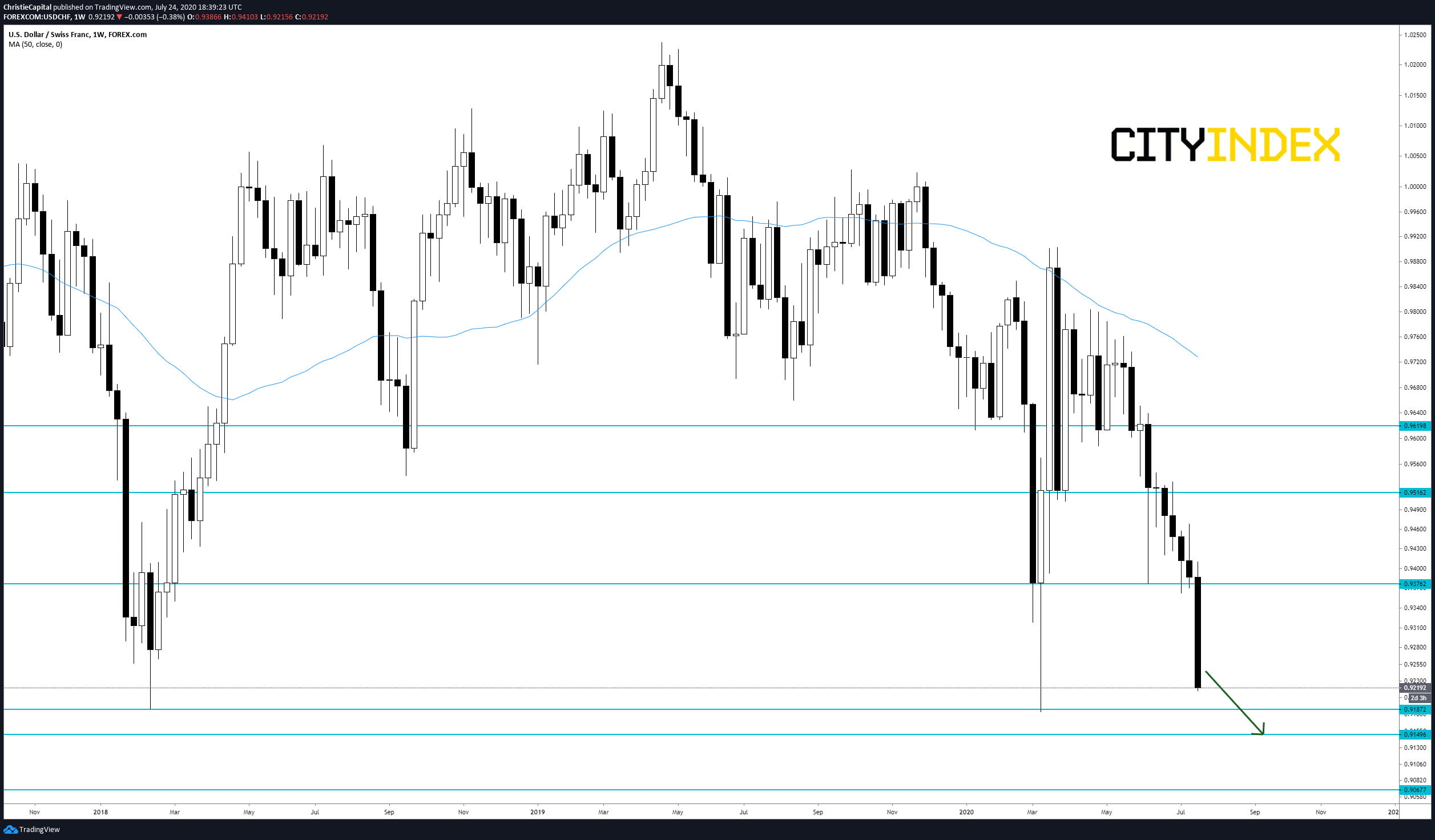

Looking at forex major pairs, the biggest movers of the week were the EUR/USD (+1.80%) and the USD/CHF (-1.77%). Here is a look at the charts from a technical perspective.

The EUR/USD continues its uptrend towards 1.182 resistance.

Source: GAIN Capital, TradingView

The USD/CHF remains under pressure to test 2018 lows.

Source: GAIN Capital, TradingView

Have a great weekend.