The business end of the week is upon us. Even after this morning’s release of Australian Q3 CPI data, there remains no fewer than five tier one economic releases still to go including advanced GDP, FOMC, PCE, NFP, and ISM. That’s without considering month-end rebalancing flows capable of causing unpredictable moves.

Trying to successfully negotiate and hold trades through a data calendar like the one ahead is a lot like playing the market's version of Frogger, a video game whereby players direct frogs across roads and rivers full of hazards to their homes. It takes nerves, hard work and a bit of luck.

For me, the standout event is tomorrow' mornings FOMC meeting so without any further ado, let us look at what is expected from the FOMC.

The market is almost fully priced for a 25bp cut from 1.75-2.00% to 1.50-1.75%. As the next quarterly forecast update (“dot plots”) is not until December, traders will look for possible guidance from the Fed that it is done cutting for now.

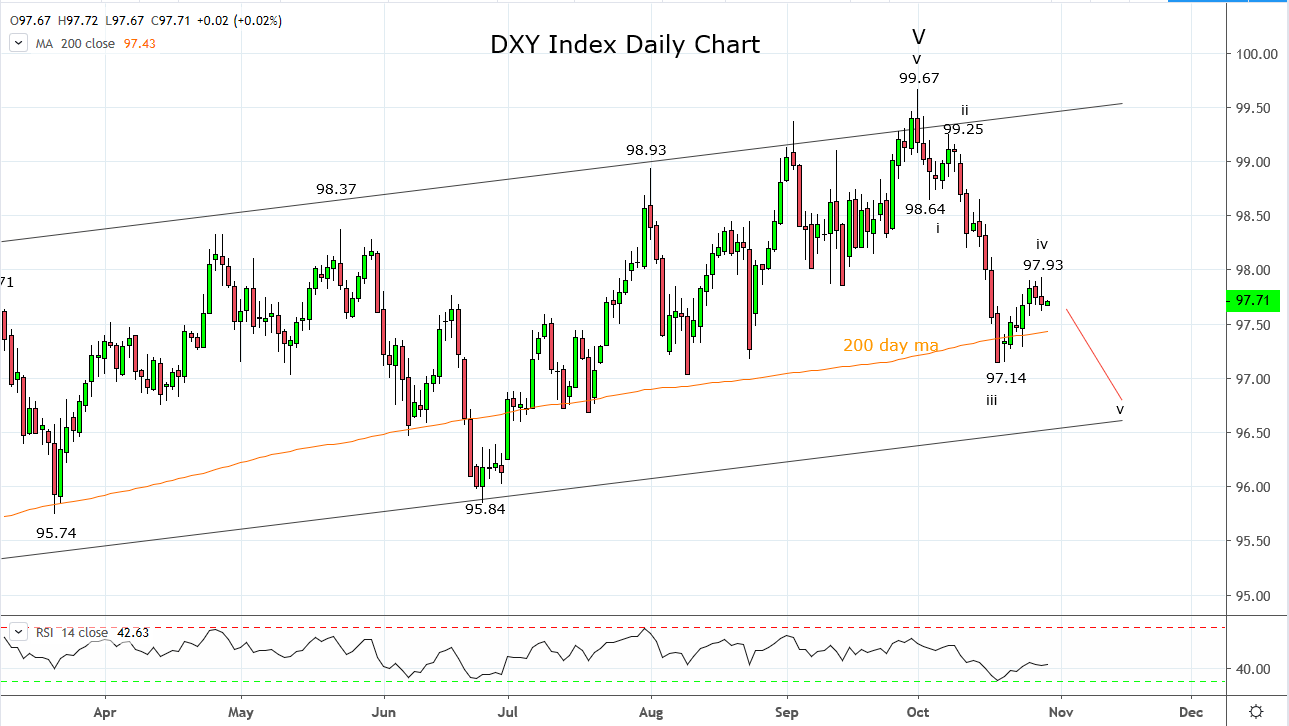

A Fed pause is already partially priced into the interest rate market. The probability of another Fed cut sits at just 20% after being at 50% a few weeks ago. Hence a Fed pause is also partially priced into the U.S. dollar index, the DXY. Of course, should the Fed maintain a dovish bias it would see the DXY index come quickly under pressure.

Technically the feeling is the DXY index is in a good position to stall and fall from after trading into the middle of the resistance zone mentioned in this note last week https://www.cityindex.com.au/market-analysis/brexit-delay-stalls-us-dollar-decline/

“the target for the current U.S. dollar bounce is towards the 97.80/98.00 resistance area. Providing the structure of the bounce displays corrective characteristics it should be viewed as a minor Wave iv, and a selling opportunity in expectation of another bout of U.S. dollar weakness towards trendline support 96.60/50 area for a minor Wave v.”

In summary, the macro and technical picture imply downside risks for the U.S. dollar index, the DXY remain. Given the events mentioned it would advisable to keep positions smaller than usual and be prepared for some twist and turns, before the next downside target of 96.60 is reached.

Source Tradingview. The figures stated areas of the 30th of October 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.