The spending review will only cover 2021 -22 given the clouded outlook from the covid pandemic, rather than the usual 4 years. Whilst the covid crisis has seen Chancellor Rishi Sunak present at least 5 mini statements since March, the spending review will be the most significant

Recent spending reviews haven’t had much impact on the markets. The most significant part of the review for the Pound is expected to be the new OBR growth forecasts.

OBR economic outlook

After taking into consideration Rishi Sunak’s announcements on Wednesday, the Office of Budget Responsibility will provide an outlook for the economy. At the start of the crisis the OBR expected a -13% contraction in the UK economy this year. There is a possibility that this forecast will be upwardly revised. That said, with the UK now back in lockdown 2.0 a double-digit GDP contraction of -11% could well still be on the cards.

Any comments regarding long term scaring should be closely monitored. The OBR are likely to estimate the scale of the hangover from the covid pandemic. In the summer they predicted that the UK economy would still be 3% smaller in 2025.

The Chancellor is not expected to announce any fresh tax cuts or public finances targets but will instead highlight the size of the hole in public finances that will at some point need to be filled by improved economic performance, spending cuts or taxes hikes or a combination of all three. The sheer size of this could unnerve Pound traders.

Public sector pay. Saving rather than spending is expected to dominate on Wednesday. Rumours are swirling that public sector pay could be in the firing line with pay freezes for all except front line NHS staff. This is likely to meet a frosty reception.

Levelling up the North & South of the UK could be back on the agenda and infrastructure spending is key here. Stocks to watch Carillion, Kier, Morgan Sindall

A boost to defence spending to the tune of £16.5 billion has already been announced, defence stocks bounced accordingly so we aren’t expecting too much more movement there. Stocks BAE Systems, Rolls Royce & Meggitt.

Brexit related spending with the end of transition period just weeks away Brexit related spending decisions will be high up the agenda. The UK government has already spent £8 billion on Brexit preparations and with no trade deal yet agreed more spending here could be essential.

Let’s not forget that Bank of England Governor Andrew Bailey said this week that a no trade deal Brexit could be as economically damaging long term as the covid pandemic.

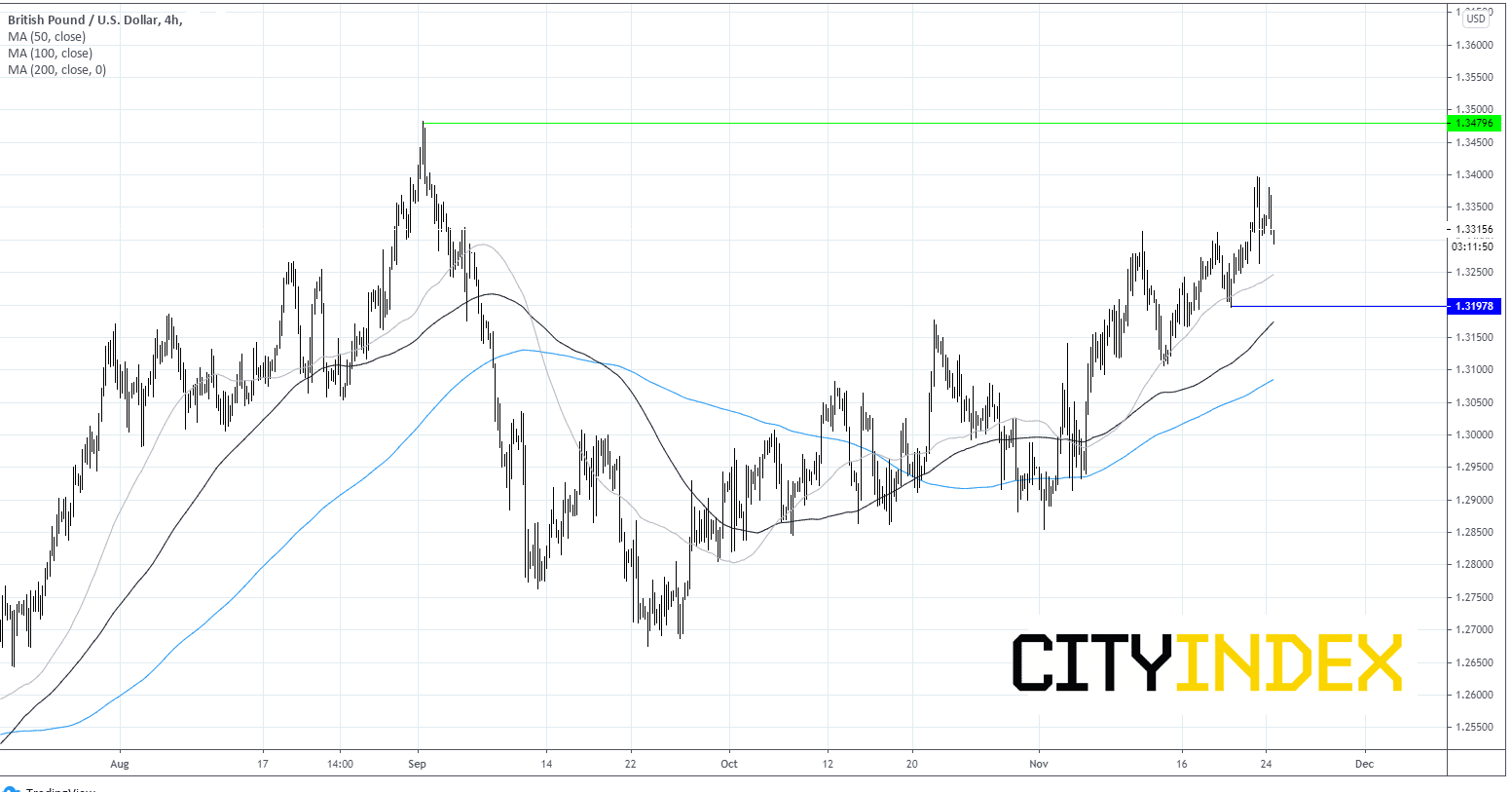

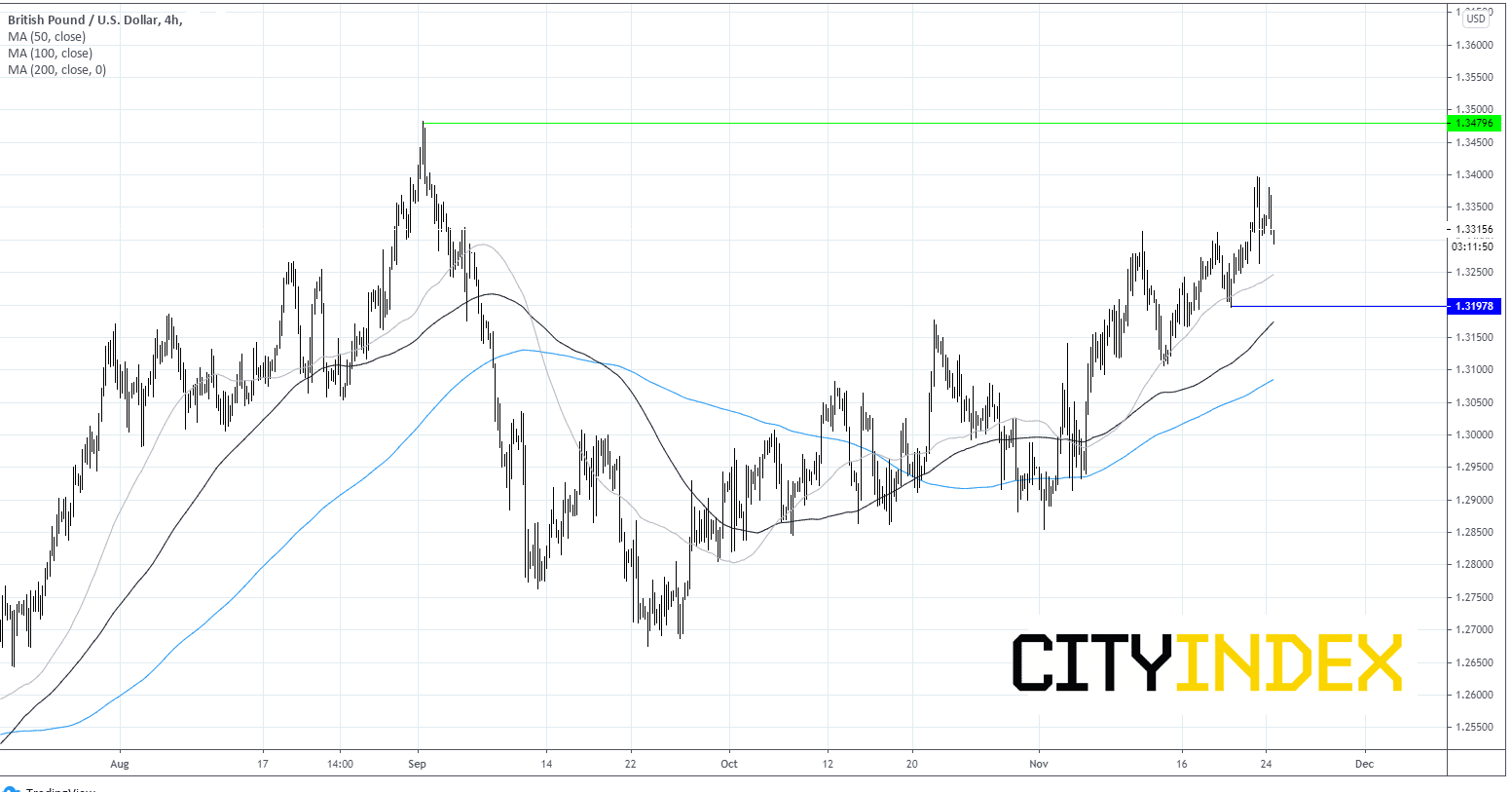

GBP/USD Chart

GBP/USD is advancing + 0.2% around 1.3350, having broken through resistance at 1.3310. The pair trades comfortably above 50, 100 & 200 sma on 4 hour chart, suggesting their could be more upside on the cards. Immediate resistance can be seen at 1.3480 (high early Sept). Immediate support can be see 1.3250 50 sma, prior to horizontal support at 1.32