The S&P 500 Continues Its Advance to New Record Highs

On Tuesday, Autozone (AZO) is expected to announce first quarter EPS of $17.02 compared to $14.30 a year ago on revenue of $3.1 billion vs $2.8 billion in the previous year. The Co is a leading retailer of aftermarket automotive parts, tools and accessories in the U.S., and on November 16th, the Co disclosed that Ron Griffin, Senior Vice President and Chief Information Officer, Customer Satisfaction, will retire in early 2021. Looking at a daily chart, the RSI is above 50. The MACD is above its signal line and negative. The MACD must break above its zero level to call for further upside. Moreover, the stock is above its 20 and 50 day MA (respectively at $1,144.79 and $1,153.22). We are looking at the final target of $1,235.00 with a stop-loss set at $1,121.00.

On Wednesday, Slack Technologies (WORK) is anticipated to release third quarter LPS of $0.04 vs an LPS of $0.02 last year on revenue of $224.6 million compared to $168.7 million a year earlier. The Co operates a software as a service platform and on December 1st, Salesforce.com (CRM), a developer of business software, reported that it entered into an agreement to acquire the Co in a cash and stock deal worth 27.7 billion dollars. From a technical point of view, the RSI is above 70. It could mean either that the stock is in a lasting uptrend or just overbought and therefore bound to correct (look for bearish divergence in this case). The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $32.28 and $30.13). We are looking at the final target of $56.40 with a stop-loss set at $36.90.

On Thursday, Adobe (ADBE) is likely to unveil fourth quarter EPS of $2.66 vs $2.29 last year on revenue of $3.4 billion compared to $3.0 billion in the prior year. The Co develops software products and on November 9th, Bloomberg revealed that the Co entered into an agreement to acquire Workfront, a developer of web-based work management and project management software, for 1.5 billion dollars. The deal is expected to close during the first quarter of Adobe's 2021 fiscal year. From a chartist's point of view, the RSI is above its neutrality area at 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $470.74 and $479.76). We are looking at the final target of $547.00 with a stop-loss set at $460.00.

Additionally on Thursday, Costco Wholesale (COST) is awaited to post first quarter EPS of $2.00 compared to $1.73 a year ago on revenue of $41.8 billion vs $37.0 billion last year. The Co operates a chain of warehouse stores and on November 16th, the Co announced that its Board of Directors declared a special dividend on Costco common stock of $10 per share to be paid on December 11th, 2020, to shareholders of record as of the close of December 2nd, 2020. Technically speaking, the RSI is above its neutrality area at 50. The MACD is below its signal line and positive. The stock could retrace in the short term. Moreover, the stock is above its 20 and 50 day MA (respectively at $372.52 and $363.68). We are looking at the final target of $403.00 with a stop-loss set at $360.00.

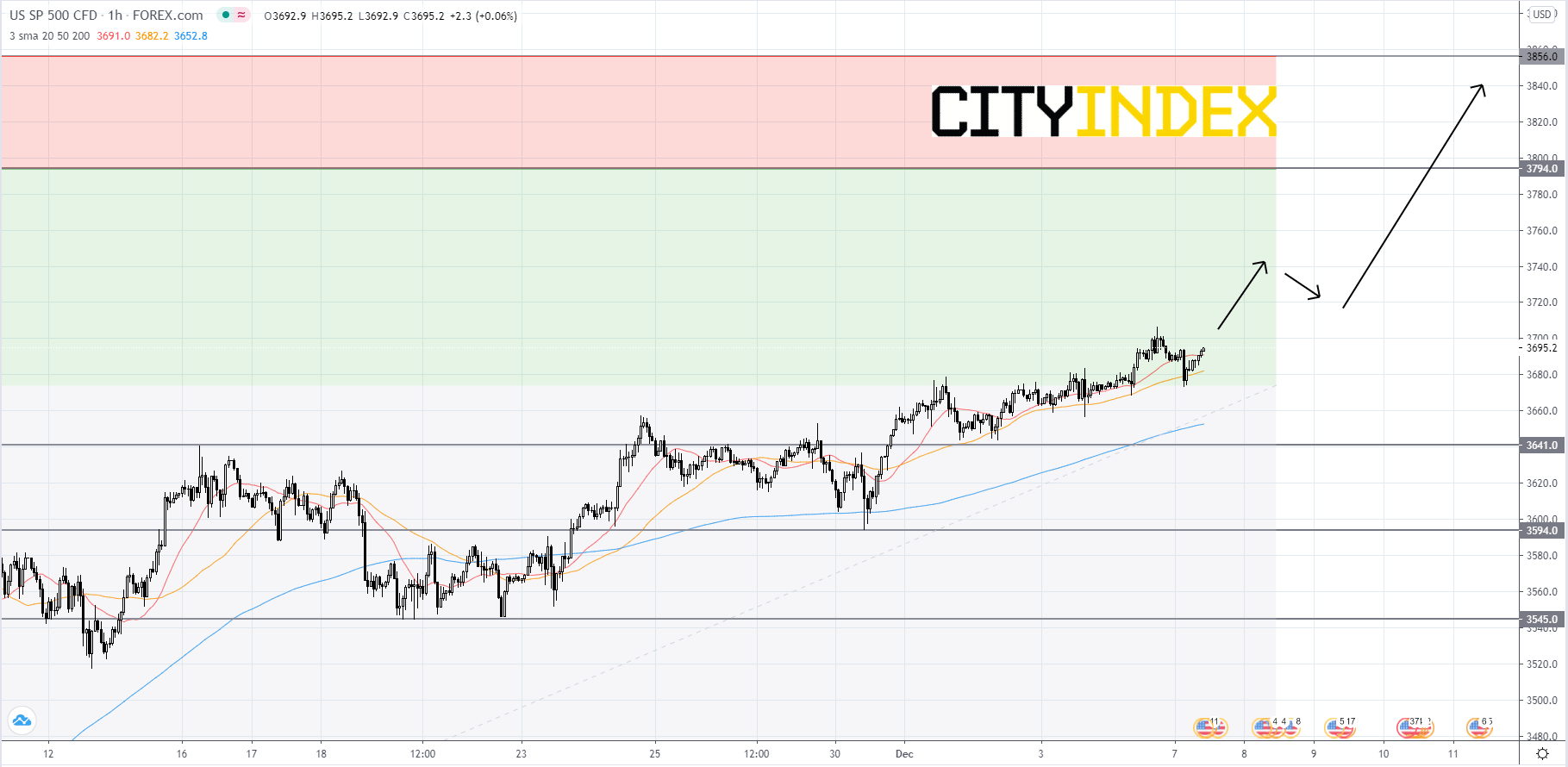

Looking at the S&P 500 CFD on a 1 hour chart, the index finally broke out to the upside of 3,674.00, a bullish signal. The index will most likely continue to grind towards the first Fibonacci target of 3,794.00. If price can breakout above 3,794.00, then price could rally towards its second Fibonacci target of 3,856.00. On the other hand, if price retreats then traders should look for a bounce off of 3,641.00. If 3641.00 fails to support price, then speculators should look to 3,594.00 for a rebound. If price falls below 3,594.00 it would be a bearish signal, as price would be under its 20-day simple moving average on a daily chart. If that occurs, price could slip to 3,545.00 and possibly lower.

Source: GAIN Capital, TradingView

On Wednesday, Slack Technologies (WORK) is anticipated to release third quarter LPS of $0.04 vs an LPS of $0.02 last year on revenue of $224.6 million compared to $168.7 million a year earlier. The Co operates a software as a service platform and on December 1st, Salesforce.com (CRM), a developer of business software, reported that it entered into an agreement to acquire the Co in a cash and stock deal worth 27.7 billion dollars. From a technical point of view, the RSI is above 70. It could mean either that the stock is in a lasting uptrend or just overbought and therefore bound to correct (look for bearish divergence in this case). The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $32.28 and $30.13). We are looking at the final target of $56.40 with a stop-loss set at $36.90.

On Thursday, Adobe (ADBE) is likely to unveil fourth quarter EPS of $2.66 vs $2.29 last year on revenue of $3.4 billion compared to $3.0 billion in the prior year. The Co develops software products and on November 9th, Bloomberg revealed that the Co entered into an agreement to acquire Workfront, a developer of web-based work management and project management software, for 1.5 billion dollars. The deal is expected to close during the first quarter of Adobe's 2021 fiscal year. From a chartist's point of view, the RSI is above its neutrality area at 50. The MACD is positive and above its signal line. The configuration is positive. Moreover, the stock is above its 20 and 50 day MA (respectively at $470.74 and $479.76). We are looking at the final target of $547.00 with a stop-loss set at $460.00.

Additionally on Thursday, Costco Wholesale (COST) is awaited to post first quarter EPS of $2.00 compared to $1.73 a year ago on revenue of $41.8 billion vs $37.0 billion last year. The Co operates a chain of warehouse stores and on November 16th, the Co announced that its Board of Directors declared a special dividend on Costco common stock of $10 per share to be paid on December 11th, 2020, to shareholders of record as of the close of December 2nd, 2020. Technically speaking, the RSI is above its neutrality area at 50. The MACD is below its signal line and positive. The stock could retrace in the short term. Moreover, the stock is above its 20 and 50 day MA (respectively at $372.52 and $363.68). We are looking at the final target of $403.00 with a stop-loss set at $360.00.

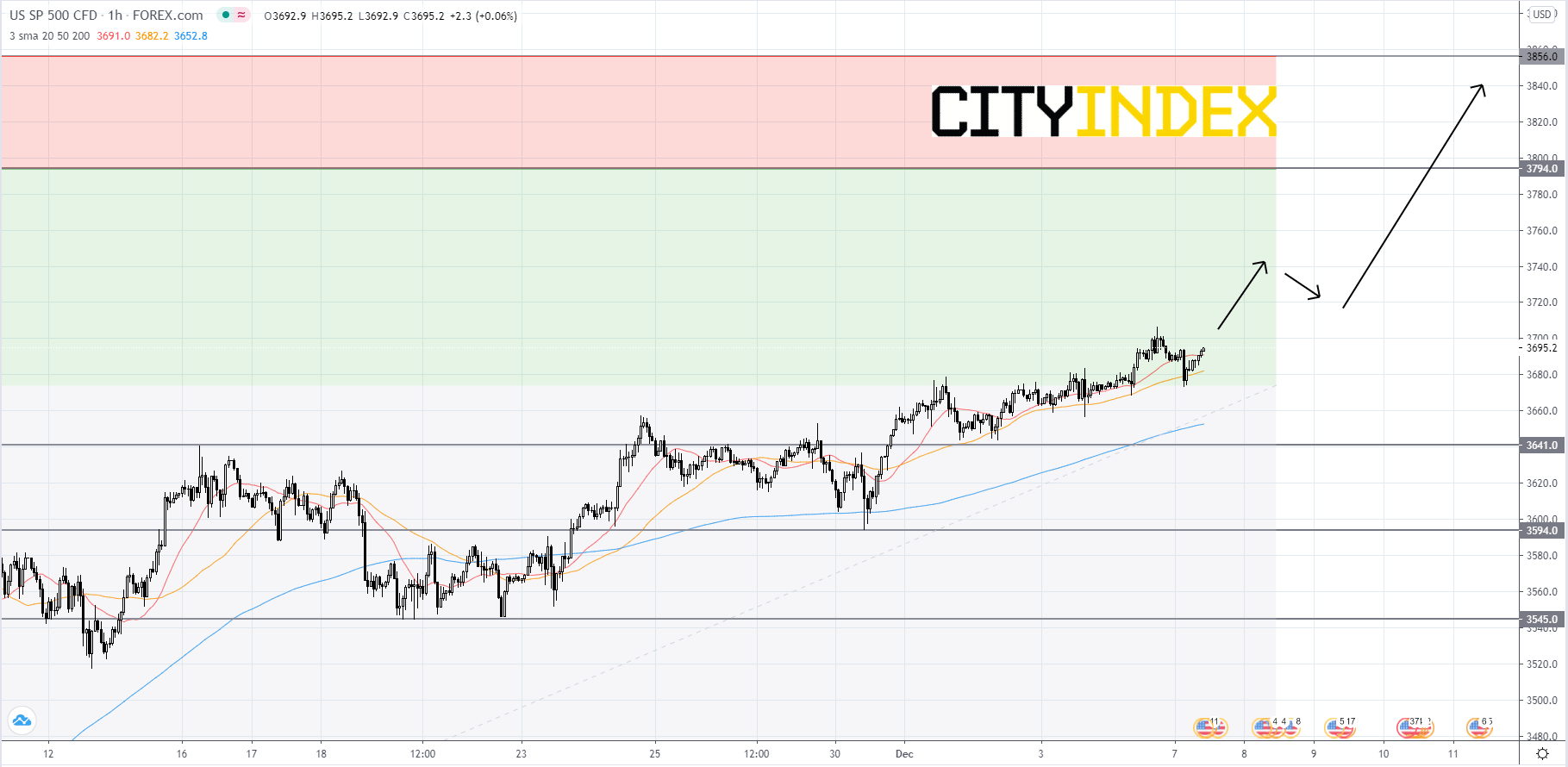

Looking at the S&P 500 CFD on a 1 hour chart, the index finally broke out to the upside of 3,674.00, a bullish signal. The index will most likely continue to grind towards the first Fibonacci target of 3,794.00. If price can breakout above 3,794.00, then price could rally towards its second Fibonacci target of 3,856.00. On the other hand, if price retreats then traders should look for a bounce off of 3,641.00. If 3641.00 fails to support price, then speculators should look to 3,594.00 for a rebound. If price falls below 3,594.00 it would be a bearish signal, as price would be under its 20-day simple moving average on a daily chart. If that occurs, price could slip to 3,545.00 and possibly lower.

Source: GAIN Capital, TradingView

Latest market news

April 28, 2024 02:00 PM

Yesterday 03:00 PM

Yesterday 01:12 PM