The S&P 500 Appears to Be Consolidating After Making a New Record High Last Week

On Tuesday, Walmart (WMT) is awaited to post third quarter EPS of $1.18 compared to $1.16 a year ago on revenue of $132.3 billion vs $128.0 billion last year. The Co is a retail giant and on November 12th, the Co announced the launch of Walmart Pet Care, a service that includes Walmart Pet Insurance and pet care services such as dog-walking and pet sitting. In other news, on November 6th, the Co revealed that it agreed to sell its business in Argentina to Grupo de Narvaez, a Latin group. Technically speaking, the RSI is above 50. The MACD is above its signal line and positive. The configuration is positive. Moreover, the stock is trading above both its 20 and 50 day MA (respectively at $143.64 and $141.3). We are looking at the final target of $158.40 with a stop-loss set at $144.30.

Additionally on Tuesday, Home Depot (HD) is likely to unveil third quarter EPS of $3.01 vs 2.53 last year on revenue of $31.7 billion compared to 27.2 billion a year ago. The Co is the world's largest home improvement specialty retailer and on November 11th, the Co introduced expanded resources and programs to further support its 35,000 veteran and military spouse employees, including guaranteed employment opportunities to associates who are spouses of relocating members of the military. From a chartist's point of view, the RSI is below its neutrality area at 50. The MACD is negative and below its signal line. The configuration is negative. Moreover, the share stands above its 20 day MA ($277.78) but below its 50 day MA ($278.01). We are looking at the final target of $254.40 with a stop-loss set at $289.20.

On Wednesday, Nvidia (NVDA) is expected to announce third quarter EPS of $2.57 compared to $1.78 a year ago on revenue of $4.4 billion vs 3.0 billion the year before. The Co is a leading designer of graphics processors and on October 21st, Bloomberg reported that Chinese companies including Huawei Technologies have been lobbying the State Administration for Market Regulation to either reject the Co's proposed 40 billion dollar acquisition of Arm Ltd. or to impose certain unfavorable conditions on the deal. From a technical point of view, the RSI is below its neutrality area at 50. The MACD is positive and below its signal line. The MACD must penetrate its zero line to expect further downside. Moreover, the stock is trading under its 20 day MA ($534.06) but above its 50 day MA ($528.04). We are looking at the final target of $445.00 with a stop-loss set at $583.00.

On Friday, Foot locker (FL) is anticipated to release third quarter EPS of $0.50 vs $1.13 last year on revenue of $1.9 billion, in line with the previous year. The Co is a global athletic footwear and apparel retailer, and its current analyst consensus rating is 13 buys, 11 holds and 0 sells, according to Bloomberg. Looking at a daily chart, the RSI is above its neutrality area at 50. The MACD is below its signal line and positive. The stock could retrace in the short term. Moreover, the stock is trading under its 20 day MA ($37.91) but above its 50 day MA ($36.27). We are looking at the final target of $42.60 with a stop-loss set at $34.60.

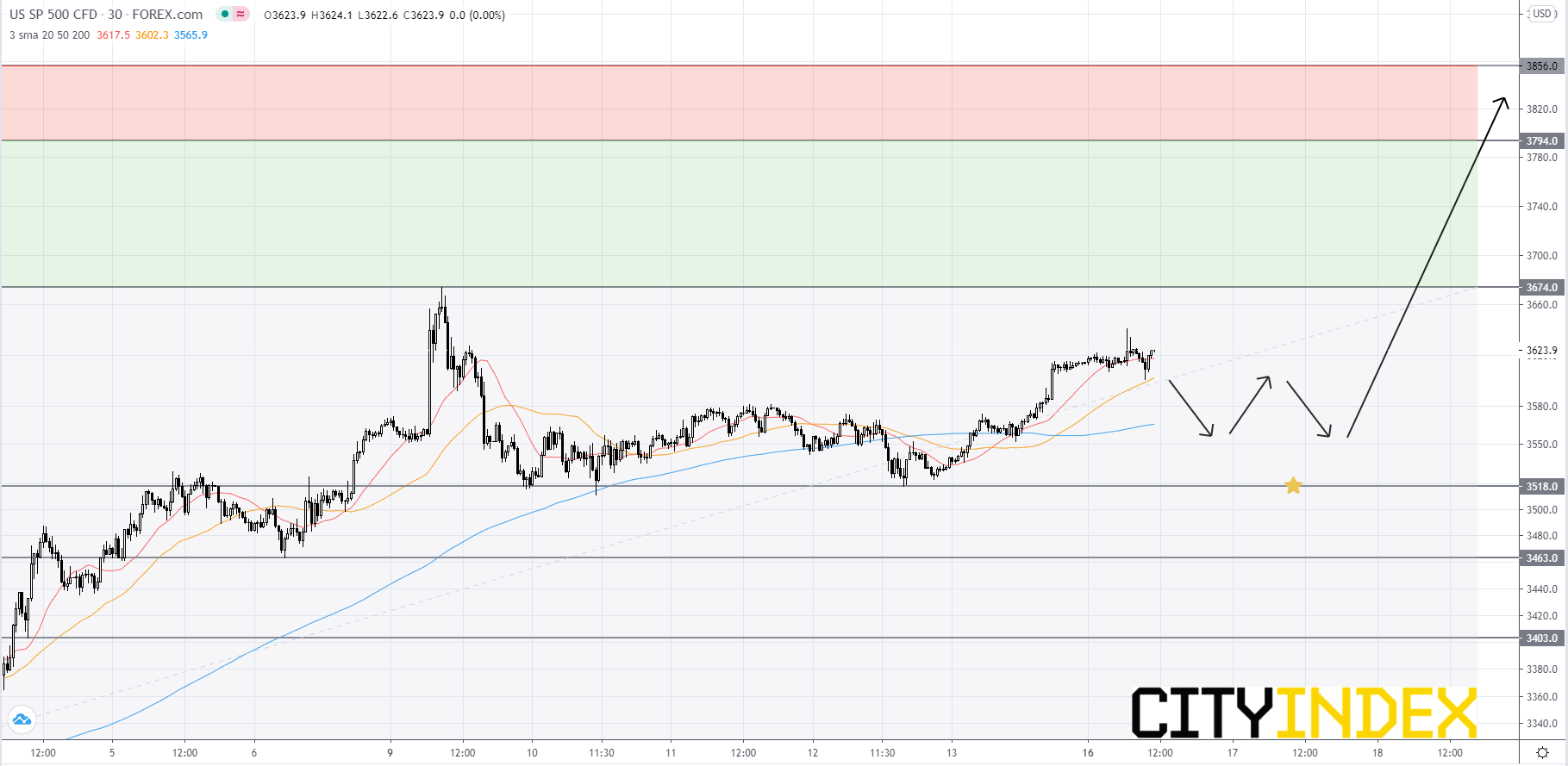

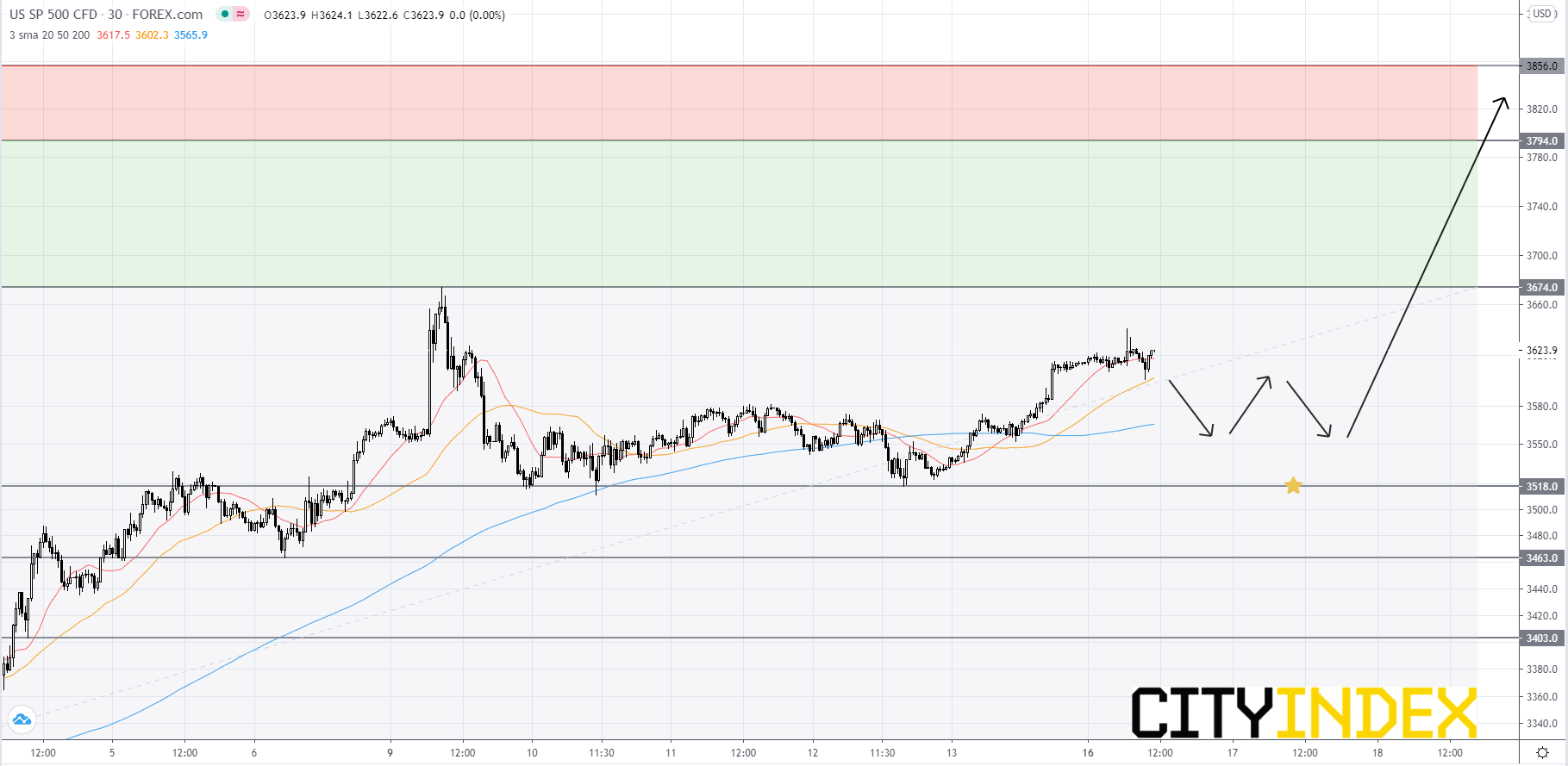

Looking at the S&P 500 CFD on a 30 minute chart, the index appears to be consolidating after making a record high of 3,673.90 last week. Price will likely bounce around in between 3,518.00 and 3,674.00 until a breakout occurs. The bias remains bullish, so traders should look for price to break above 3,674.00. If price can make a new high, then the next two Fibonacci targets are at 3,794.00 and 3,856.00. If the index falls below 3,518.00, it would be a negative signal and traders should look to 3,463.00 as possible support. If price fails to rebound off of 3,463.00, then price could drop further to 3,403.00. If the decline its not stopped at 3,403.00, then traders should be cautious as price could slip lower.

Source: GAIN Capital, TradingView

Additionally on Tuesday, Home Depot (HD) is likely to unveil third quarter EPS of $3.01 vs 2.53 last year on revenue of $31.7 billion compared to 27.2 billion a year ago. The Co is the world's largest home improvement specialty retailer and on November 11th, the Co introduced expanded resources and programs to further support its 35,000 veteran and military spouse employees, including guaranteed employment opportunities to associates who are spouses of relocating members of the military. From a chartist's point of view, the RSI is below its neutrality area at 50. The MACD is negative and below its signal line. The configuration is negative. Moreover, the share stands above its 20 day MA ($277.78) but below its 50 day MA ($278.01). We are looking at the final target of $254.40 with a stop-loss set at $289.20.

On Wednesday, Nvidia (NVDA) is expected to announce third quarter EPS of $2.57 compared to $1.78 a year ago on revenue of $4.4 billion vs 3.0 billion the year before. The Co is a leading designer of graphics processors and on October 21st, Bloomberg reported that Chinese companies including Huawei Technologies have been lobbying the State Administration for Market Regulation to either reject the Co's proposed 40 billion dollar acquisition of Arm Ltd. or to impose certain unfavorable conditions on the deal. From a technical point of view, the RSI is below its neutrality area at 50. The MACD is positive and below its signal line. The MACD must penetrate its zero line to expect further downside. Moreover, the stock is trading under its 20 day MA ($534.06) but above its 50 day MA ($528.04). We are looking at the final target of $445.00 with a stop-loss set at $583.00.

On Friday, Foot locker (FL) is anticipated to release third quarter EPS of $0.50 vs $1.13 last year on revenue of $1.9 billion, in line with the previous year. The Co is a global athletic footwear and apparel retailer, and its current analyst consensus rating is 13 buys, 11 holds and 0 sells, according to Bloomberg. Looking at a daily chart, the RSI is above its neutrality area at 50. The MACD is below its signal line and positive. The stock could retrace in the short term. Moreover, the stock is trading under its 20 day MA ($37.91) but above its 50 day MA ($36.27). We are looking at the final target of $42.60 with a stop-loss set at $34.60.

Looking at the S&P 500 CFD on a 30 minute chart, the index appears to be consolidating after making a record high of 3,673.90 last week. Price will likely bounce around in between 3,518.00 and 3,674.00 until a breakout occurs. The bias remains bullish, so traders should look for price to break above 3,674.00. If price can make a new high, then the next two Fibonacci targets are at 3,794.00 and 3,856.00. If the index falls below 3,518.00, it would be a negative signal and traders should look to 3,463.00 as possible support. If price fails to rebound off of 3,463.00, then price could drop further to 3,403.00. If the decline its not stopped at 3,403.00, then traders should be cautious as price could slip lower.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM