The Sentiment of Industrial Metals are Positive on Stimulus Packages

The market sentiment of industrial metals is positive on the stimulus package from different countries. Recently, European Union leaders reached an agreement on a EUR750 billion stimulus package. Besides, the U.S. president Donald Trump also said the second stimulus package would come.

The industrial metals sharply rebounded from March low. Let's take a look on copper, palladium and platinum.

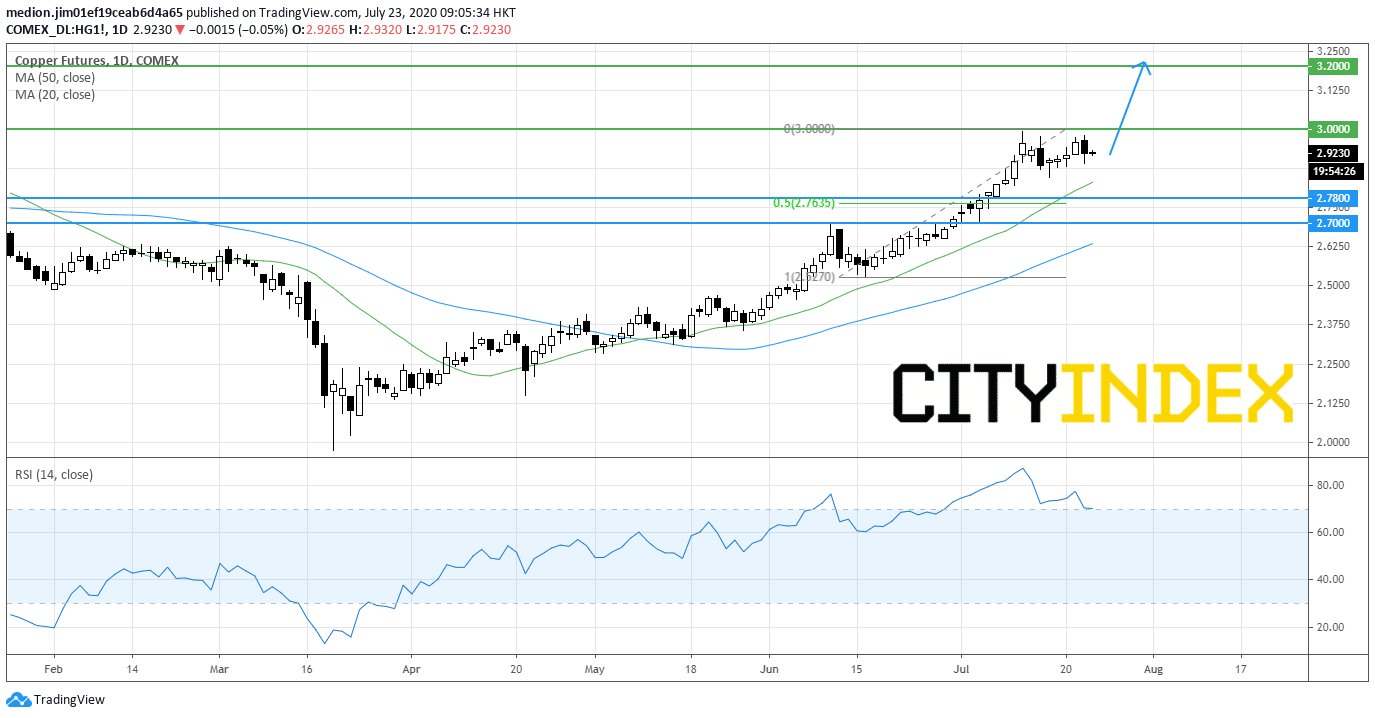

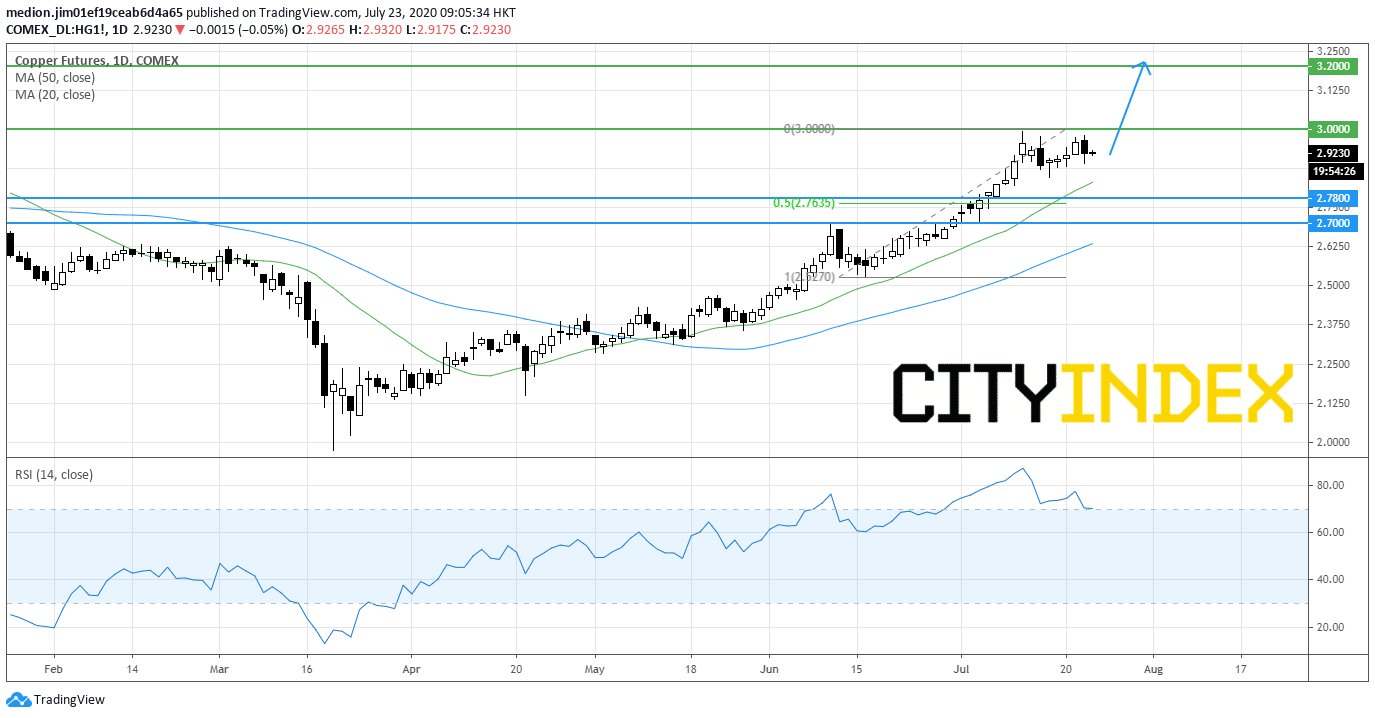

Copper Futures: Bullish bias remains

The Copper futures, as shown on the daily chart, remains holding on the upside after soaring around 38% from March low.

Currently, the prices stay above the rising 20-day moving average. It would suggest the bullish outlook for the prices.

However, the relative strength index breaks down the overbought level at 70, which would indicate that the prices may enter a phase of consolidation.

As long as the support level at $2.78 (the 50% retracement of recent upmove) is not broken, the technical outlook of copper futures remains bullish. The resistance levels would be located at $3.00 and $3.20.

In an alternative scenario, a break below $2.78 would trigger a deeper pullback to $2.70 (the high of June 10).

Source: GAIN Capital, TradingView

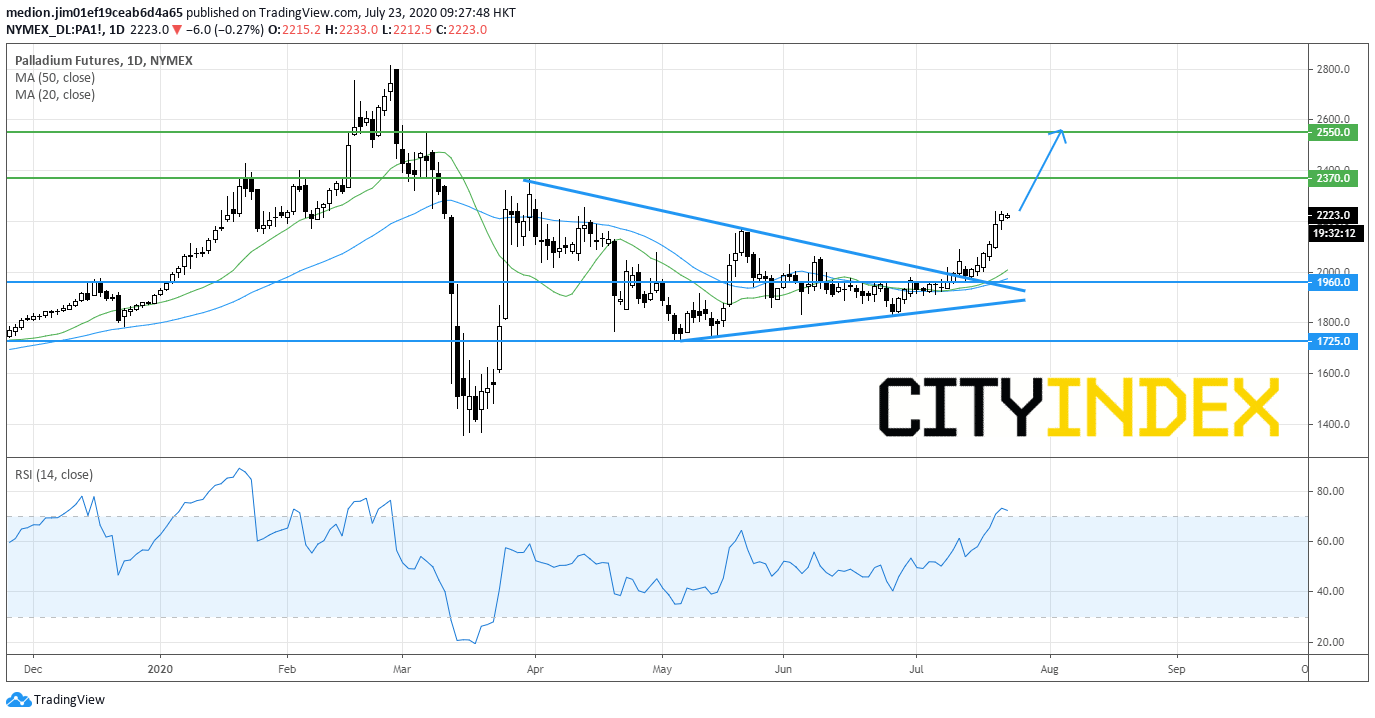

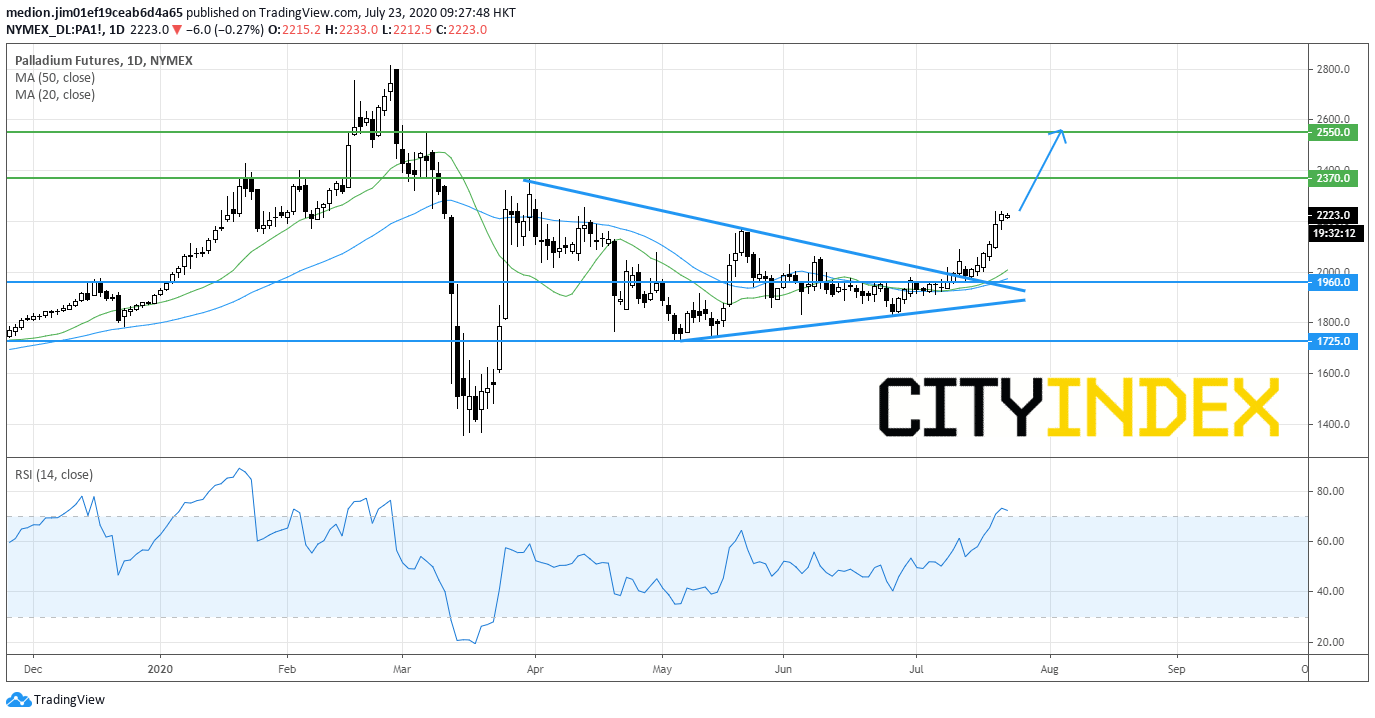

Palladium Futures: Upside breakout

The technical outlook of Palladium futures would be bullish on the daily chart as the prices broke above the symmetric triangle pattern.

Both 20-day and 50-day moving averages are turning upward. Besides, the relative strength index is above its overbought level at 70, but has not displayed any reversal signal.

Bullish readers could set the nearest support level at $1960 (the low of July 14), while the resistance levels would be located at $2370 (the high of March 31) and $2550 (the high of March 6) respectively.

Source: GAIN Capital, TradingView

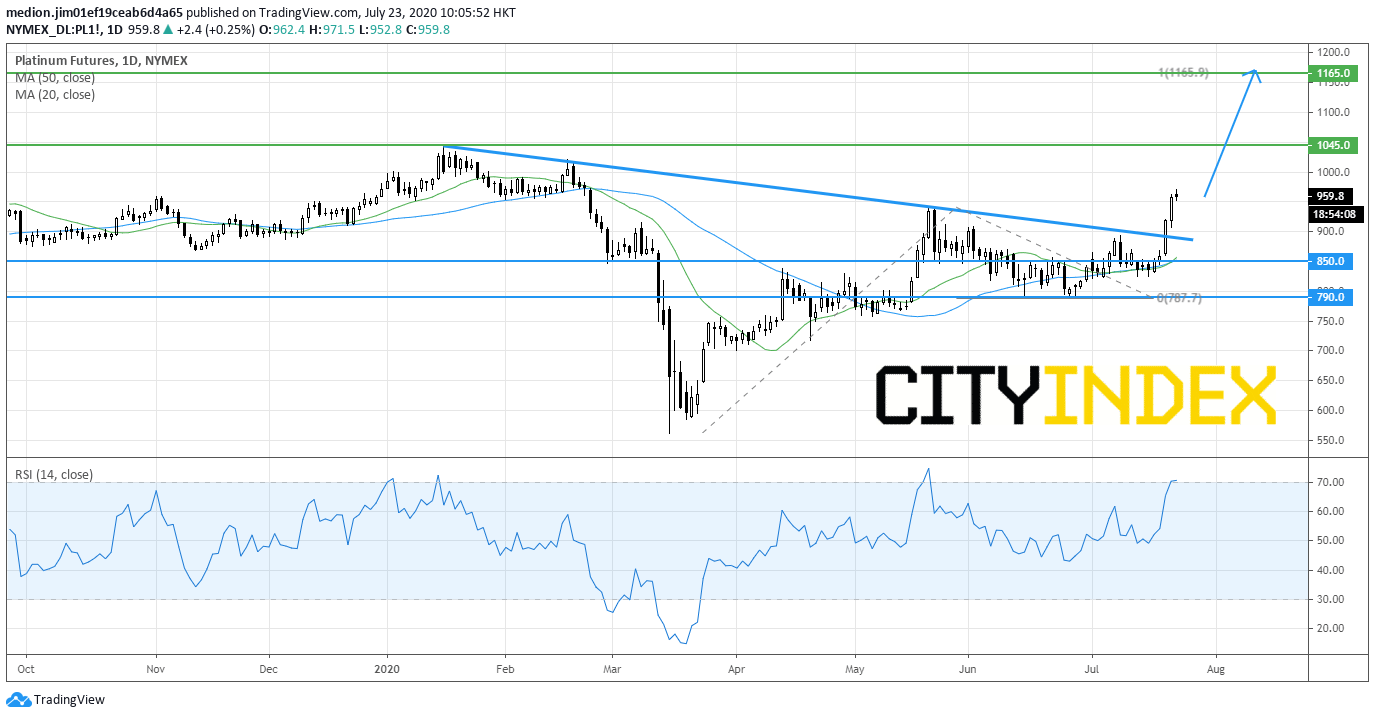

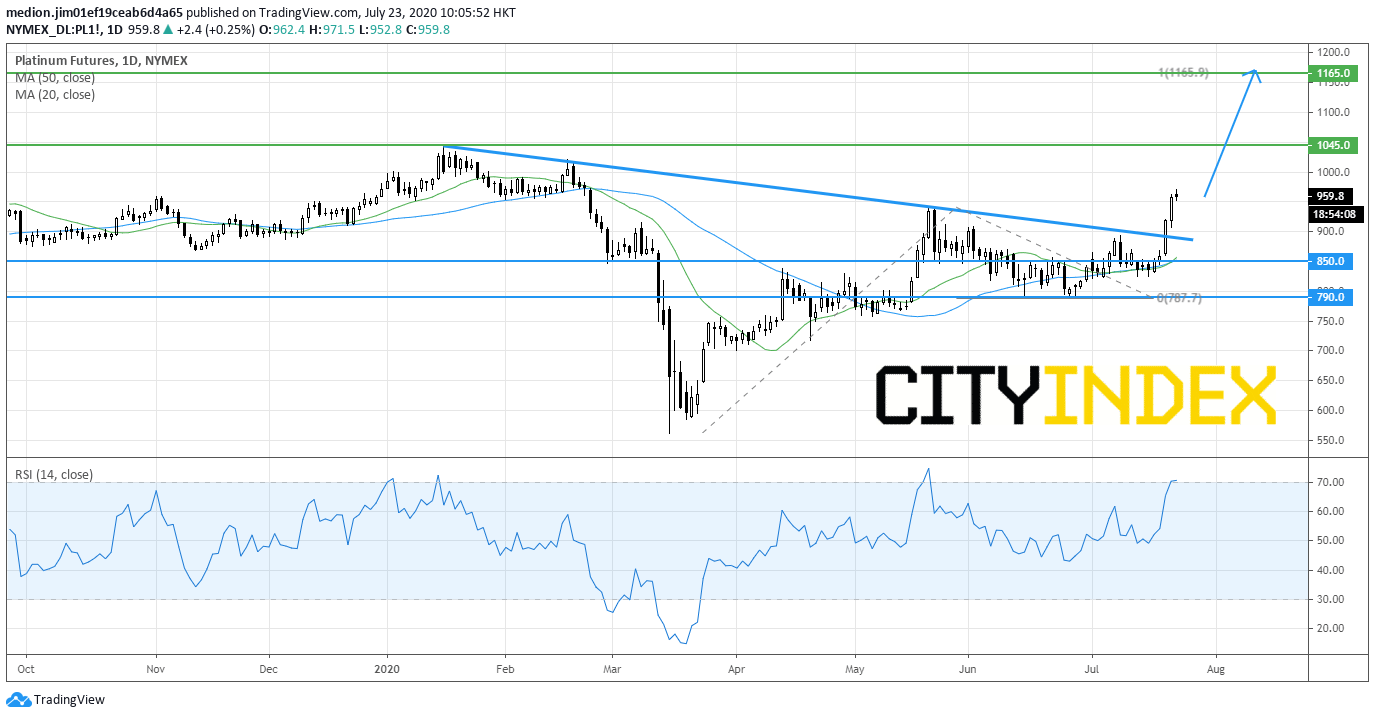

Platinum Futures: Further advance

On a daily chart, platinum futures have broken above the declining trend line drawn from January top. In addition, the prices have recorded a series of higher tops and higher bottoms. Both technical configuration would favor the bullish outlook.

Readers would set the resistance levels at $1045 (the high of January) and $1165 (100% measured move). The support level is located at $850 (around both 20-day and 50-day moving averages).

Source: GAIN Capital, TradingView

The industrial metals sharply rebounded from March low. Let's take a look on copper, palladium and platinum.

Copper Futures: Bullish bias remains

The Copper futures, as shown on the daily chart, remains holding on the upside after soaring around 38% from March low.

Currently, the prices stay above the rising 20-day moving average. It would suggest the bullish outlook for the prices.

However, the relative strength index breaks down the overbought level at 70, which would indicate that the prices may enter a phase of consolidation.

As long as the support level at $2.78 (the 50% retracement of recent upmove) is not broken, the technical outlook of copper futures remains bullish. The resistance levels would be located at $3.00 and $3.20.

In an alternative scenario, a break below $2.78 would trigger a deeper pullback to $2.70 (the high of June 10).

Source: GAIN Capital, TradingView

Palladium Futures: Upside breakout

The technical outlook of Palladium futures would be bullish on the daily chart as the prices broke above the symmetric triangle pattern.

Both 20-day and 50-day moving averages are turning upward. Besides, the relative strength index is above its overbought level at 70, but has not displayed any reversal signal.

Bullish readers could set the nearest support level at $1960 (the low of July 14), while the resistance levels would be located at $2370 (the high of March 31) and $2550 (the high of March 6) respectively.

Source: GAIN Capital, TradingView

Platinum Futures: Further advance

On a daily chart, platinum futures have broken above the declining trend line drawn from January top. In addition, the prices have recorded a series of higher tops and higher bottoms. Both technical configuration would favor the bullish outlook.

Readers would set the resistance levels at $1045 (the high of January) and $1165 (100% measured move). The support level is located at $850 (around both 20-day and 50-day moving averages).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM