The rise of the US Dollar and Yields into month/quarter end

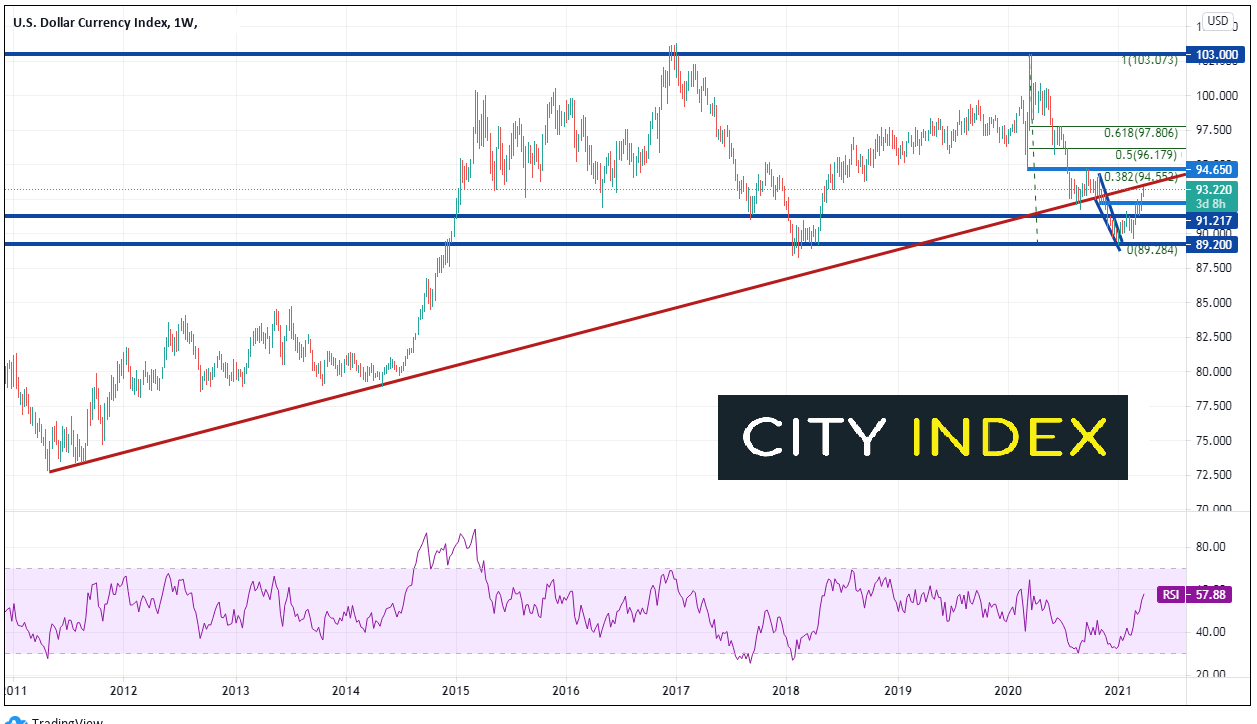

In our Week Ahead for last week, we highlighted the daily US Dollar Index (DXY) as the Chart of the Week. We noted that price had broken out of a flag pattern on the daily timeframe and was heading towards the target price from the flag breakout and a descending wedge, near 94.00. Indeed, price action over the last 2 days shows the DXY is on its way. However, the DXY is running into a major resistance trendline. If price is to move to target, it must first get through the upward sloping weekly trendline dating back to Spring 2011!

Source: Tradingview, City Index

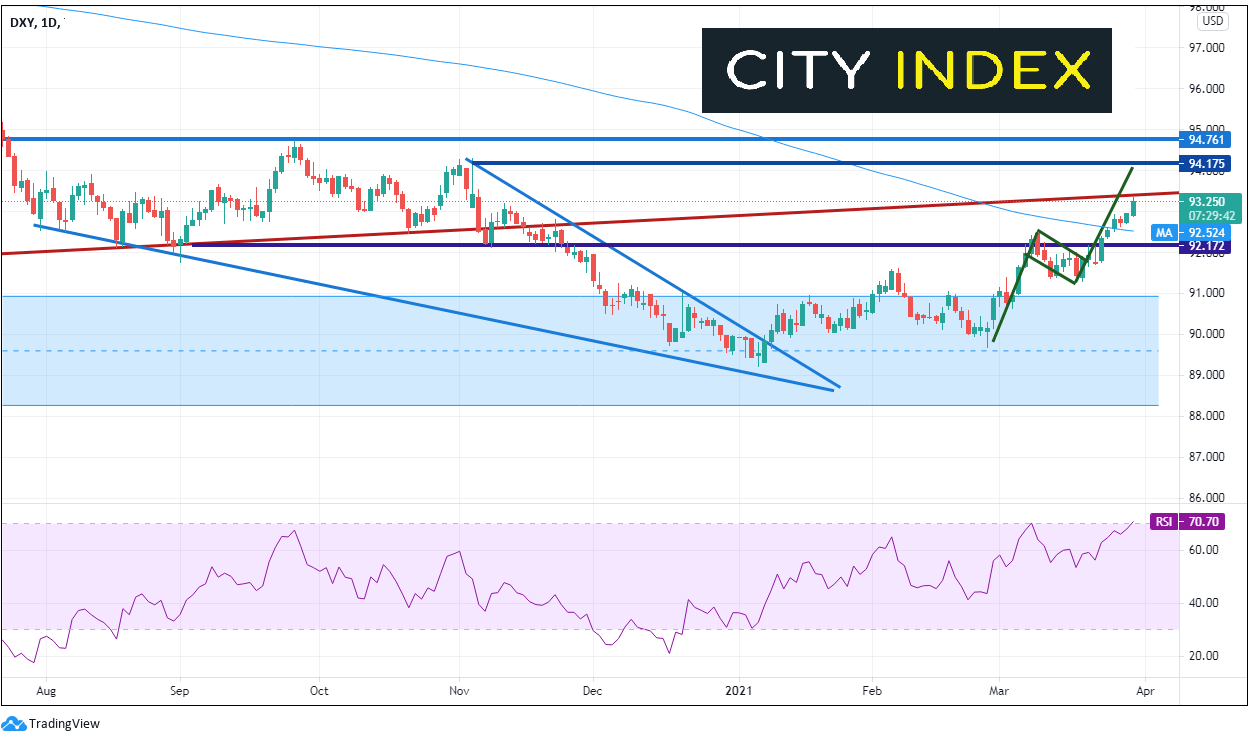

On a daily timeframe, price has easily cleared the 200 Day Moving Average at 92.52. The weekly trendline (red line) crosses at the current highs of the day, near 93.35. However, with Wednesday as month end AND quarter end, traders may be looking to thrust price higher above the trendline and accelerate the US Dollar Index towards the target. The flag target and the target for the descending wedge converge between 94.00 and 94.17. The RSI has barely moved into overbought territory, however if the current flows continue into month/quarter end, this may be irrelevant. Be wary of a pullback after month/quarter end flows have finished!

Source: Tradingview, City Index

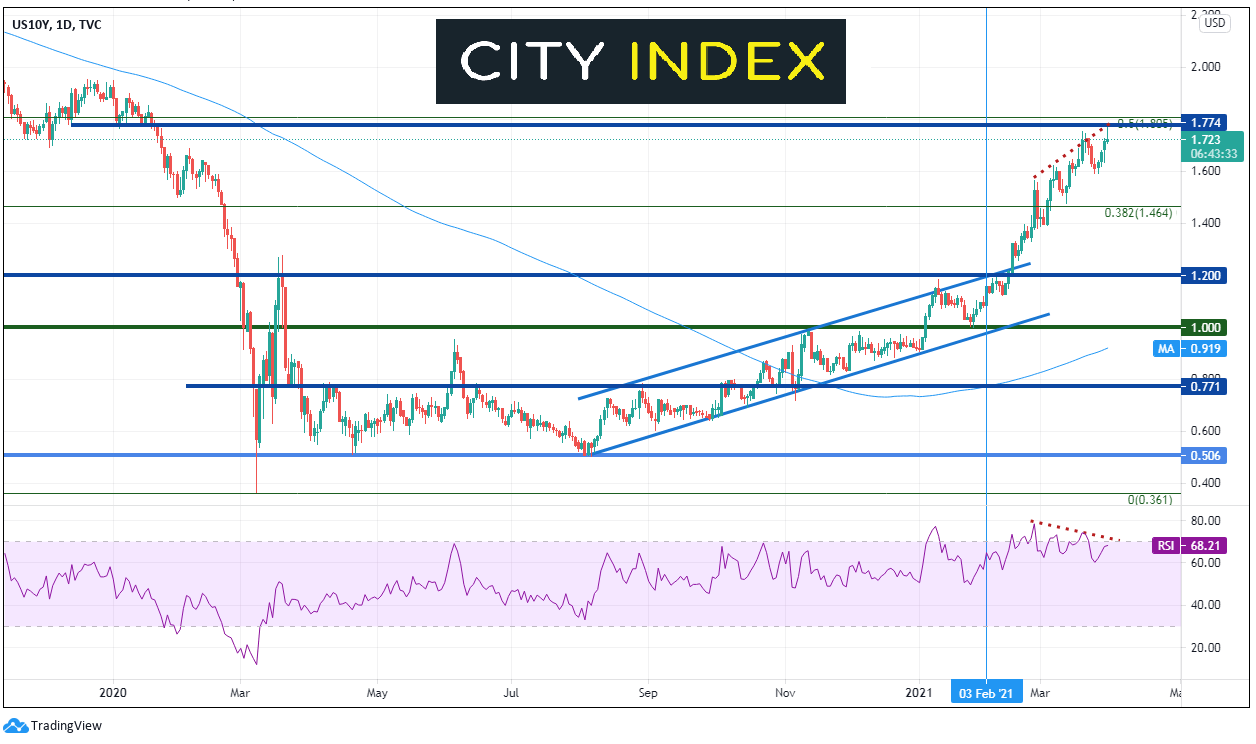

Interest rates have risen today as well to their highest level since January 2020, pre-pandemic. However, 10-year yields are pushing up against horizontal resistance, the 50% retracement level from the November 2018 highs to the March 9th, 2020 lows, near 1.77%/1.80%. The RSI is also diverging and may be considered a “3-driver” RSI, in which yields put in 3 higher highs and the RSI puts in 3 lower highs. This indicates a strong possibility of a reversal. In addition, although today isn’t over, today’s action is forming a shooting star, which is an indication of a possible reversal. The move higher in yields may continue higher into March 31st, however, traders should be aware that the month end selling (of bonds) may end shortly and yields could fall. If the happens, the US Dollar may pull back as well.

Source: Tradingview, City Index

The rise in the US Dollar Index and 10-year yields over the last week has been impressive! However, tomorrow is month end and quarter end. Be cautious of a possible pullback in the DXY and 10 year-yields as pension funds, mutual funds, and hedge funds try and position themselves for rebalancing and a bit of “window dressing”!

Learn more about forex trading opportunities