The Return of Gold as a Safe Haven

The US Federal Reserve took exhaustive measures today help provide more stimulus to a world economy which everyday seems to be on the brink of collapse. Today’s measures aim to pump US Dollars into the system, as firms around the world scramble to secure funds for simple everyday operations, among other things.

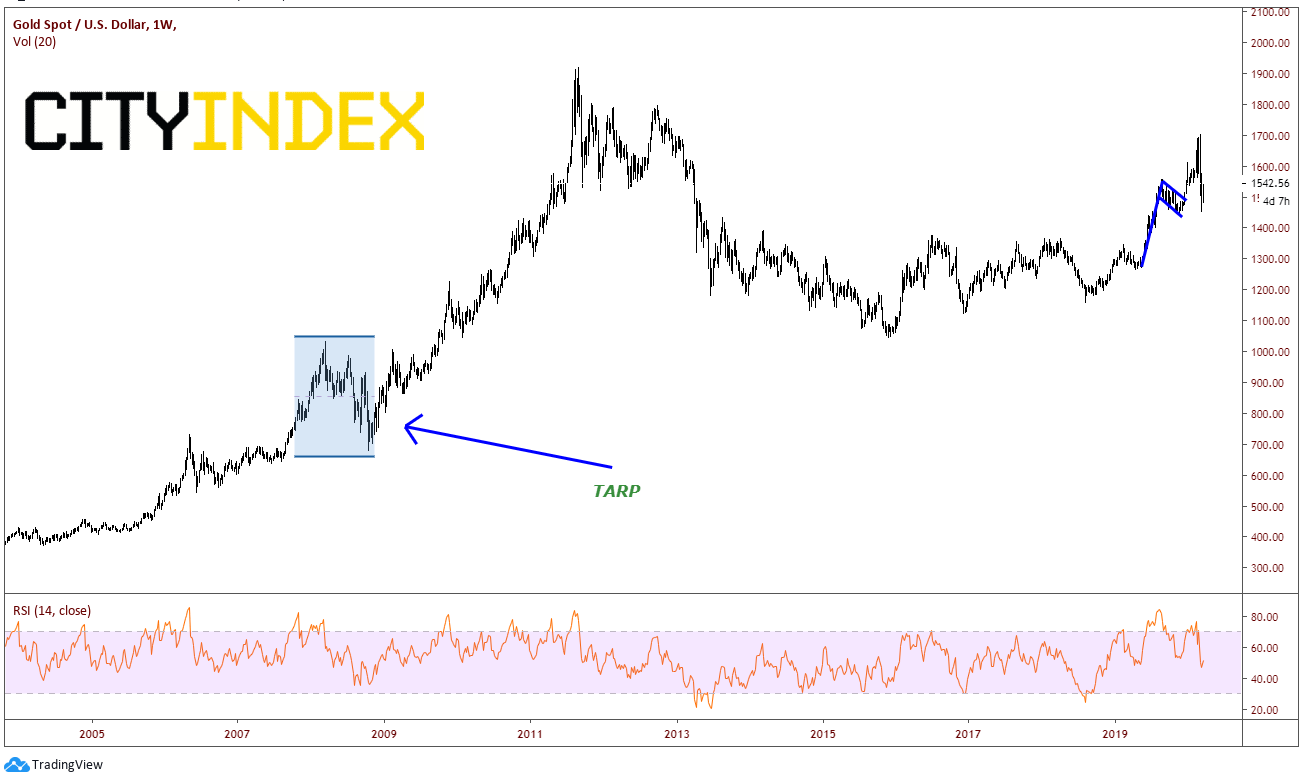

One of the beneficiaries of this massive supply of US Dollars from the Fed is Gold. In 2008, gold was selling off as the Fed began it Troubled Asset Relief Program (TARP). After the program was announced, gold moved higher. Investors realized that the Fed would have to unwind from the easing at some time in the future. Gold put in a high the first week of September 2011 after a 3-year rally from 681.75 to 1912.29, a gain of 180%. The still stands as the all-time high in gold.

Source: Tradingview, City Index

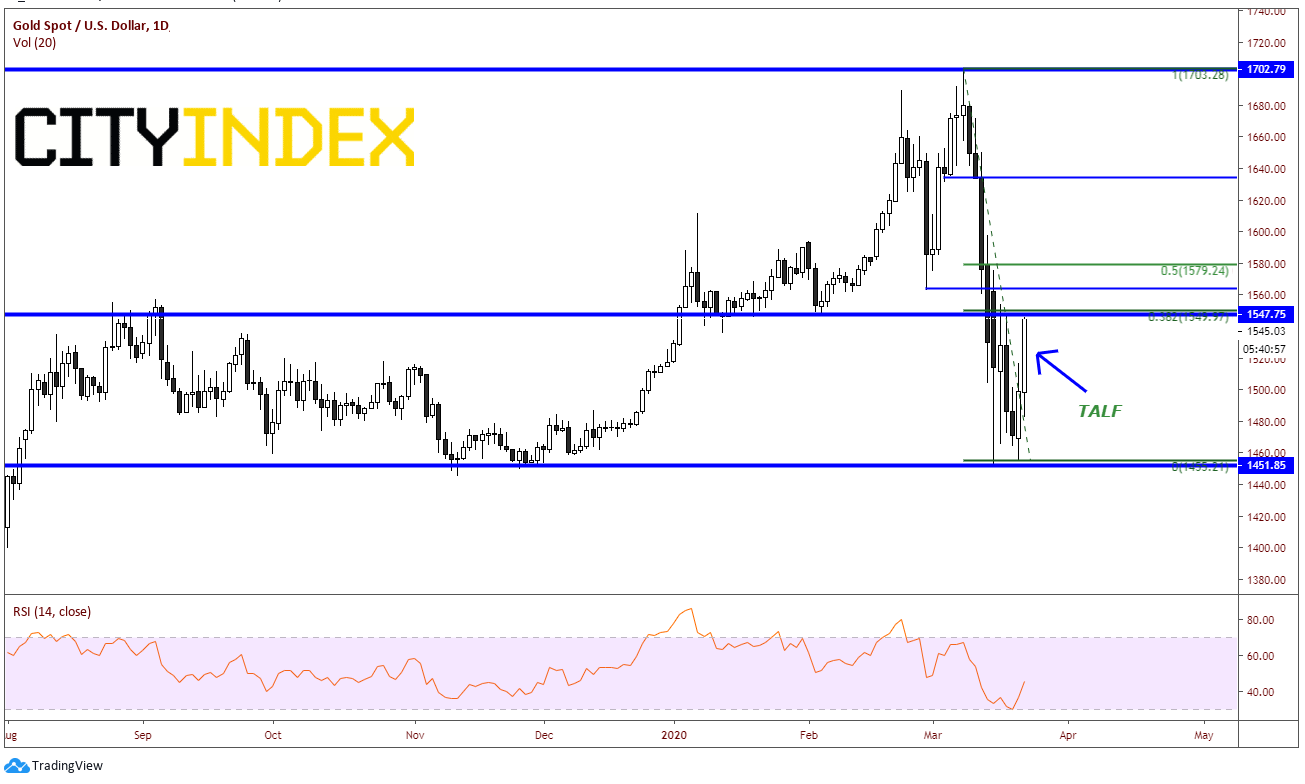

Fast forward to today. Although the time period has been condensed due to the rapid spread of the virus and the rapid nature of the selloff in equities, gold has been moving lower over the last few weeks. When the selloff in gold first began in mid-February, it was considered a flight to safety. However, as the selloff continued, gold needed to be sold in order to raise cash for margin accounts. Today, after the (Term Asset-Backed Securities Loan Facility (TALF) was announced, gold immediately shot higher.

Source: Tradingview, City Index

Can gold move higher as much as it did from 2008-2011? Anything is possible, and gold is off to a healthy start today, up over $45.00, or 3%. Near term resistance is 1547.75, which is also the 38.2% Fibonacci retracement from the highs in February to last week’s lows. Above that is horizontal resistance at 1563 and 1632. This year’s high at 1702 is the final resistance before the all-time highs. Support is $100 lower near 1450.

I’m not sure what else the Fed has left in their briefcase, but if they continue pumping money into the system, one of the ultimate beneficiaries should continue to be gold.