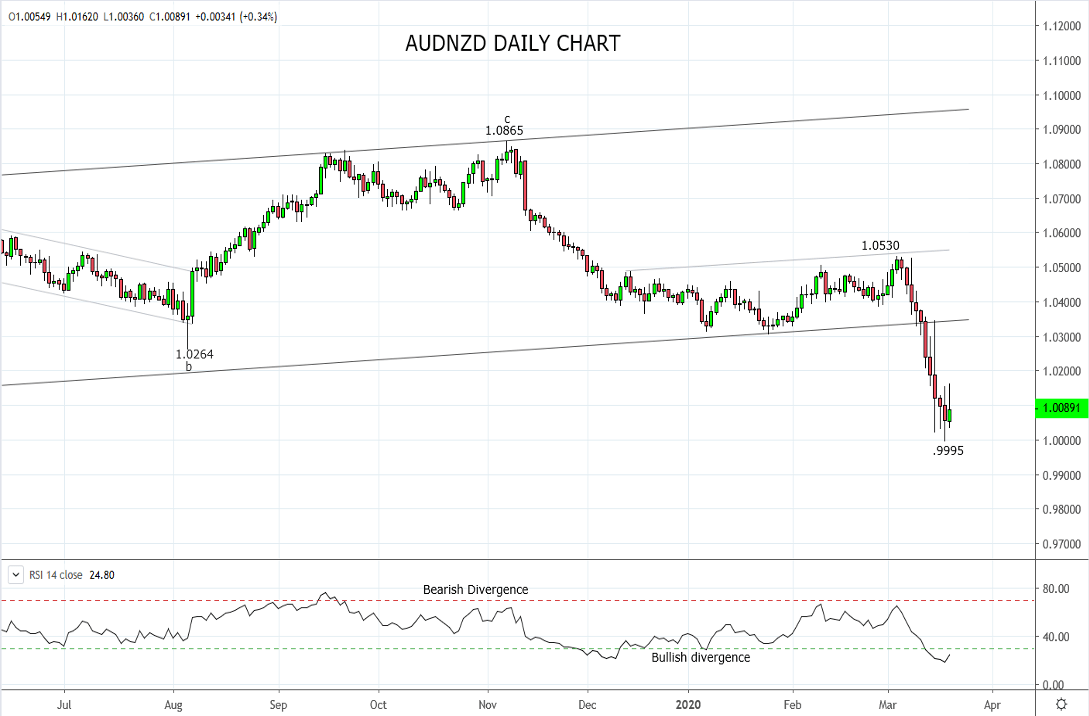

A dark day for proud Australian FX traders as the AUDNZD cross broke below parity for the very first time. Similar to their famous rugby team and because the FX market first opens in New Zealand each Monday to start the new trading week, New Zealanders punch well above their weight in the world of FX trading. I have no doubt the streamers and party hats that many Kiwi FX traders have been saving for this occasion, were broken out across trading rooms today.

Now onto the more serious business of the goings-on in markets today and the three key events to digest. The first of which was an announcement by the European Central Bank they would launch a 750bn euro asset purchase program to counter the Covid-19 outbreak. After a brief 80 pip rally, the EURUSD slipped back to its opening price near 1.0900, a reflection of the grave concerns the market has towards the economic and social risks Covid-19 presents.

At any other time, the release of Australian Labour figures that revealed a decline in the unemployment rate from 5.3% to 5.1% would have been warmly greeted. However, due to the emergence of Covid-19, todays jobs data for February is considered outdated and expectations are for a sharp lift in the unemployment rate. As a guide, Shane Oliver, Chief Economist at AMP predicts the unemployment rate will lift to 7.5% in 2020 before the virus is brought under control.

Which is one of the key reasons why the RBA at an emergency meeting this afternoon cut the cash rate by 25bp, to its lower bound of 0.25%. In another first, the RBA also announced the start of a Quantitative Easing (QE) program targeting a 3-year bond rate of around 0.25%, implemented via the purchase of both government and semi-government bonds in the secondary market. In terms of forward guidance, the RBA stated it is committed to keeping the cash rate on hold at 0.25% until progress is made towards both its employment and inflation objectives.

Whether today’s actions undertaken by the RBA are viewed as comprehensive enough to restore some confidence to the sagging AUDNZD cross rate, or whether AUDNZD continues to break new ground, time will tell.

Source Tradingview. The figures stated areas of the 19th of March 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation