The loonie soars after Canada maintains rates

The USD/CAD fell under pressure as Canada maintains overnight lending rate.

New BOC governor Tiff Macklem holds Canada's overnight rate at 0.25% and pledges to hold until a 2% inflation target is achieved. The Bank of Canada does not see inflation reaching the 2% target next year.

The US Dollar was bearish against most of its major pairs on Wednesday with the exception of the CHF.

On the economic data front, the Mortgage Bankers Association's Mortgage Applications increased 5.1% for the week ending July 10th, from +2.2% in the previous week. Empire Manufacturing spiked to 17.2 on month in July (10.0 expected), from -0.2 in June. Industrial Production rose 5.4% on month in June (4.3% expected), from +1.4% in May. The Federal Reserve's Beige Book stated that economic activity increased in most Districts, but remained far below where it was before the COVID-19 pandemic. Employment increased on net in most Districts as numerous businesses reopened and/or increased activity, however payrolls in all Districts were well below pre-COVID levels. Districts also noted a difficulty in bringing back workers due to health and safety concerns, childcare needs and generous unemployment insurance benefits.

On Thursday, Retail Sales Advance for June are expected to release +5.0% on month, from +17.7% in May. Initial Jobless Claims for the week ending July 11th are expected to decline to 1,250K, from 1,314K in the week before. Finally, Continuing Claims for the week ending July 4th are expected to fall to 17,500K, from 18,062K in the prior week.

The Euro was bearish against most of its major pairs with the exception of the CHF. In Europe, the U.K. Office for National Statistics has released June CPI at +0.6% (vs +0.4% on year expected).

The Australian dollar was bullish against most of its major pairs with the exception of the NZD and CAD.

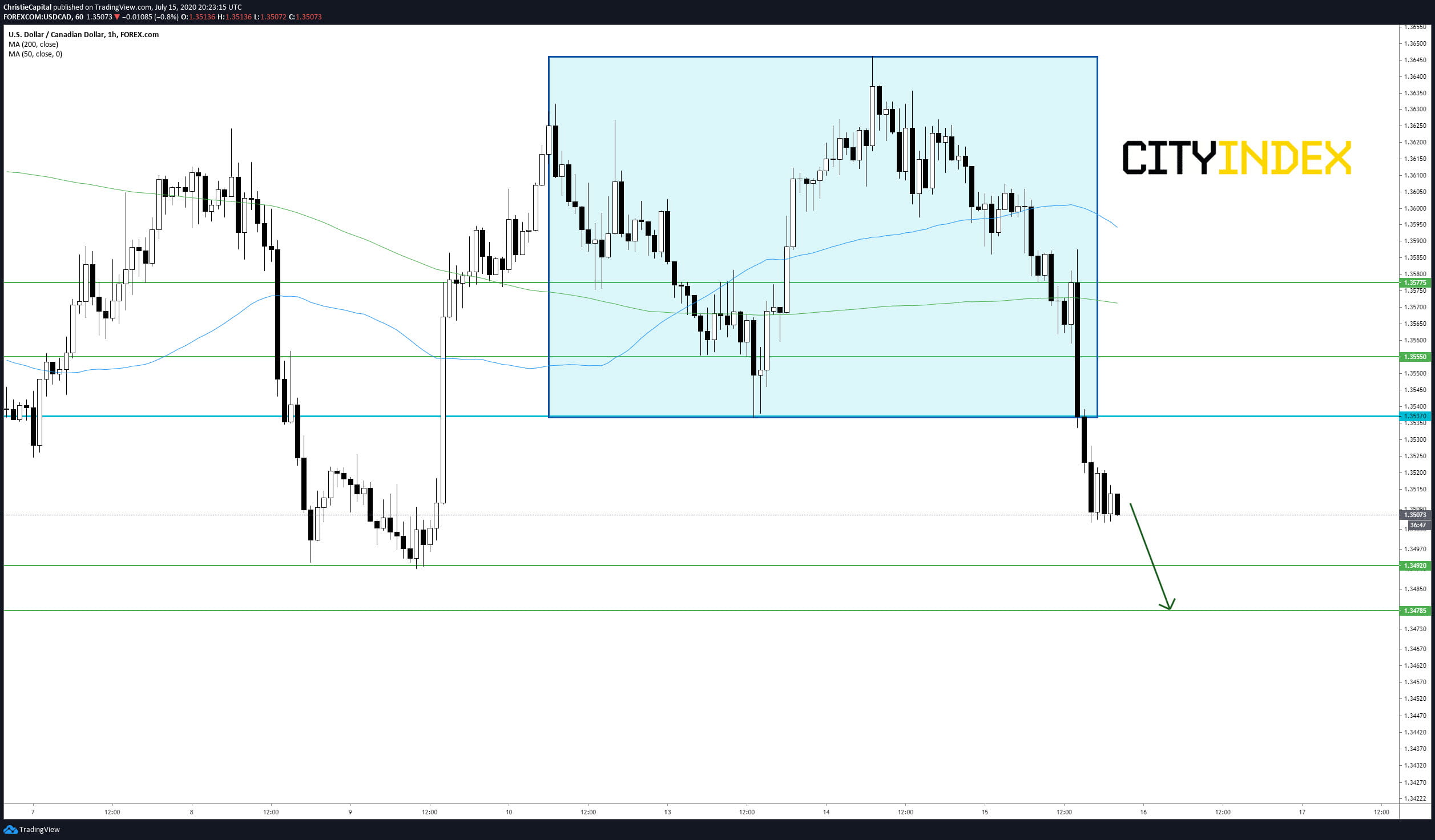

One of the largest currency pair decliners on Wednesday was the USD/CAD which dropped 104 pips to 1.3511. Prices broke below a consolidation range between 1.3537 and 1.3646. Look towards a test of 1.3492 support and 1.34785 in extension.

Source: GAIN Capital, TradingView

Happy Trading

New BOC governor Tiff Macklem holds Canada's overnight rate at 0.25% and pledges to hold until a 2% inflation target is achieved. The Bank of Canada does not see inflation reaching the 2% target next year.

The US Dollar was bearish against most of its major pairs on Wednesday with the exception of the CHF.

On the economic data front, the Mortgage Bankers Association's Mortgage Applications increased 5.1% for the week ending July 10th, from +2.2% in the previous week. Empire Manufacturing spiked to 17.2 on month in July (10.0 expected), from -0.2 in June. Industrial Production rose 5.4% on month in June (4.3% expected), from +1.4% in May. The Federal Reserve's Beige Book stated that economic activity increased in most Districts, but remained far below where it was before the COVID-19 pandemic. Employment increased on net in most Districts as numerous businesses reopened and/or increased activity, however payrolls in all Districts were well below pre-COVID levels. Districts also noted a difficulty in bringing back workers due to health and safety concerns, childcare needs and generous unemployment insurance benefits.

On Thursday, Retail Sales Advance for June are expected to release +5.0% on month, from +17.7% in May. Initial Jobless Claims for the week ending July 11th are expected to decline to 1,250K, from 1,314K in the week before. Finally, Continuing Claims for the week ending July 4th are expected to fall to 17,500K, from 18,062K in the prior week.

The Euro was bearish against most of its major pairs with the exception of the CHF. In Europe, the U.K. Office for National Statistics has released June CPI at +0.6% (vs +0.4% on year expected).

The Australian dollar was bullish against most of its major pairs with the exception of the NZD and CAD.

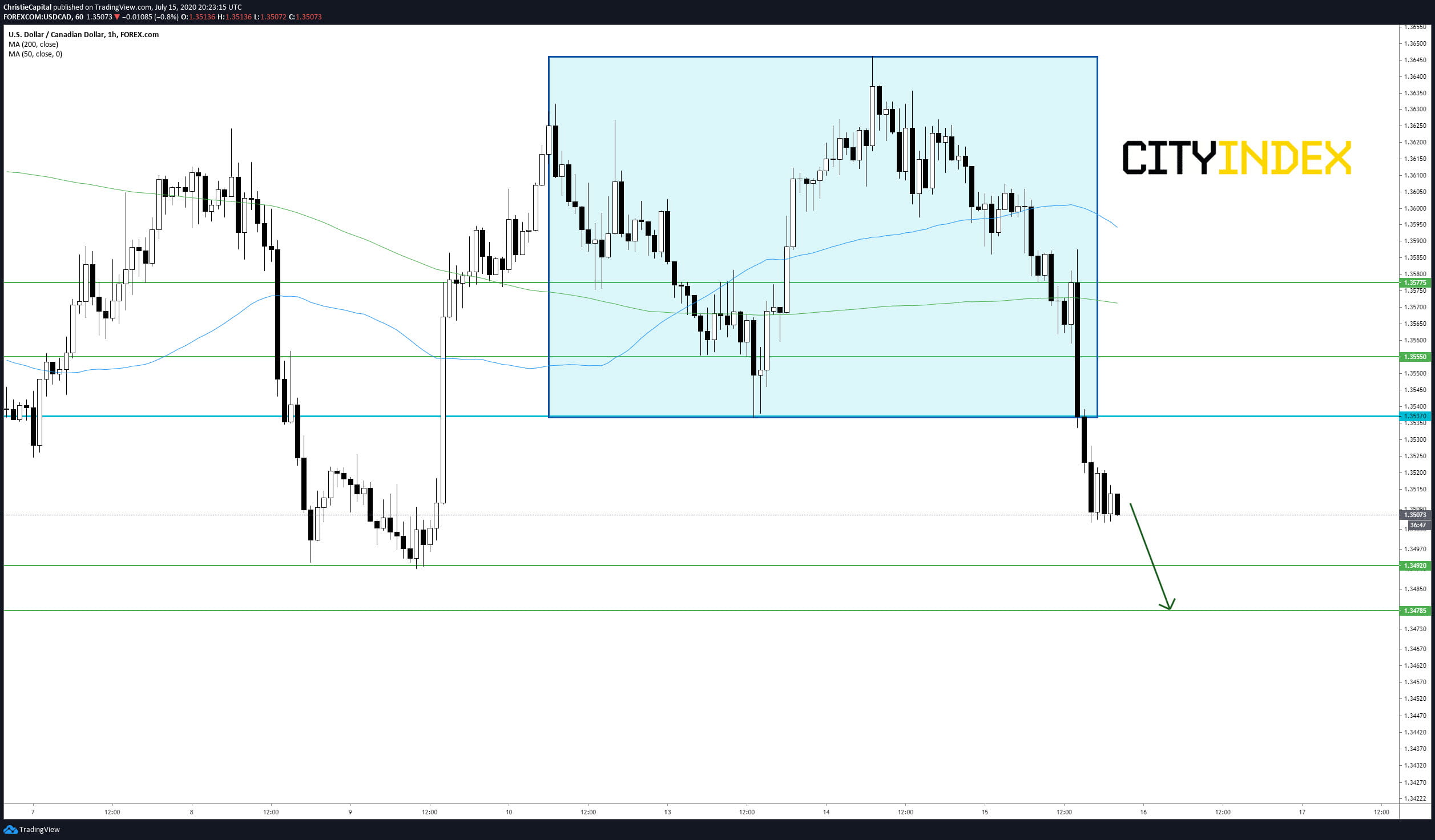

One of the largest currency pair decliners on Wednesday was the USD/CAD which dropped 104 pips to 1.3511. Prices broke below a consolidation range between 1.3537 and 1.3646. Look towards a test of 1.3492 support and 1.34785 in extension.

Source: GAIN Capital, TradingView

Happy Trading

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM