The sell-off, estimated to be on the equivalent of around 3000 Comex gold futures contracts took place at around 10.34 am Sydney time or at about 6.34 pm ET on a Sunday evening. Exacerbating thin volumes typical at this time of the day and week, the Martin Luther King public holiday in the US.

Although we will never know for sure, due to the unusual timing of the move, my guess is the sell-down was the result of an execution error, triggering stop-loss orders placed below last Friday's $1823 low. Adding to the impact, algorithms using correlation analysis, arbitrage, and linked orders then triggered stops in gold's high beta cousin, silver.

Exactly two weeks ago we wrote about the possibility of this type of move during January, in an article on Silver here. In the article, we highlighted a 500 pip sell-off in AUD/JPY that occurred on the 5th of January 2019, before an equally speedy recovery. Very similar to the type of price action viewed in gold this morning.

Typically a speedy recovery comes as the error is hastily covered in the market. If 3000 contracts have been sold by mistake, 3000 contracts will need to be covered and twice that number if the original order was meant to be a buy order!

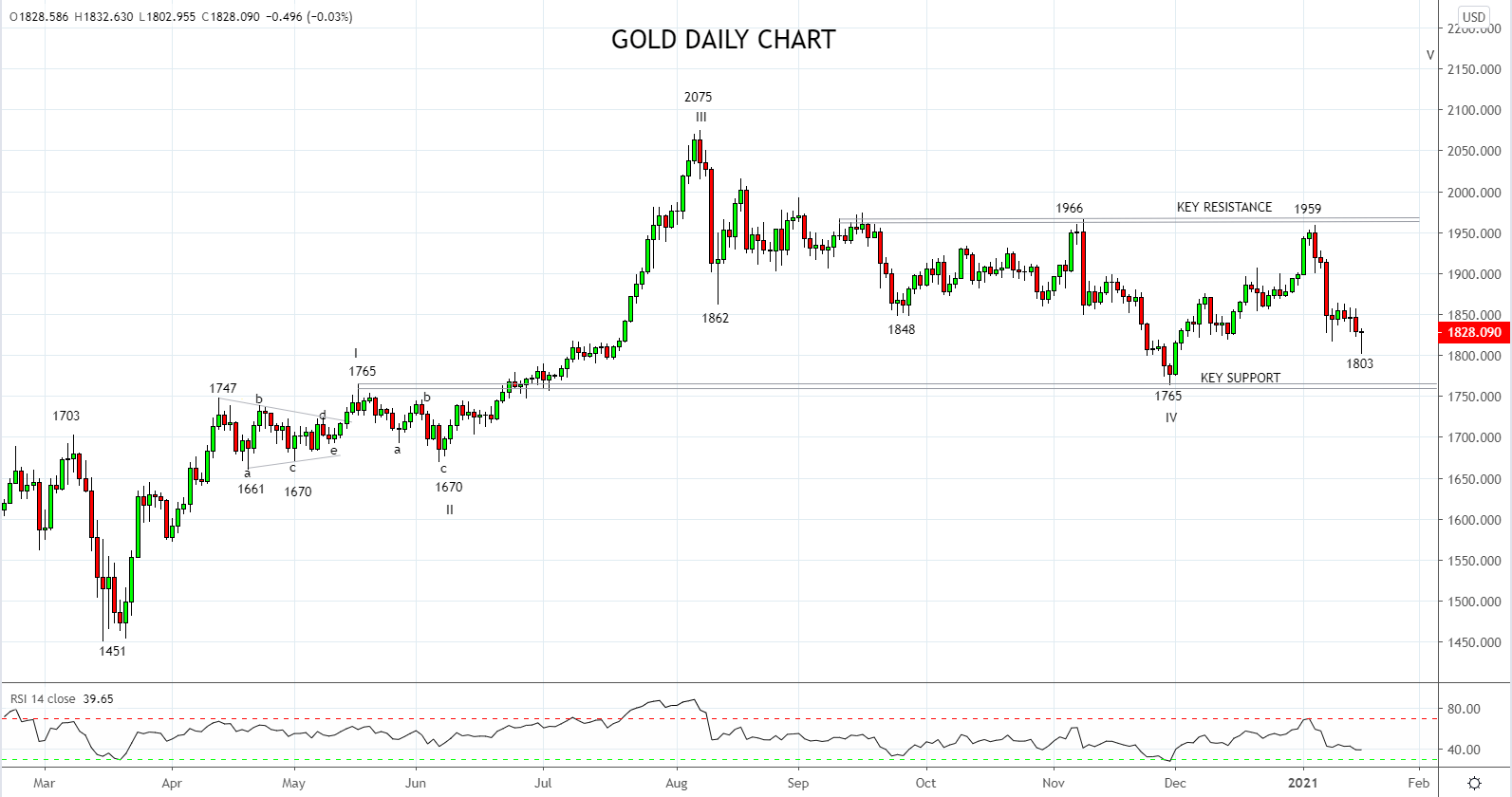

In terms of what these types of moves do to the outlook, I tend to look through them. As such following gold's rejection of the $1960/70 resistance zone in early January, gold needs to avoid falling back below this morning’s breakdown level $1820/15 area.

Otherwise, the risks are for a retest and break of the November $1765 low. Keeping in mind, a break and close above resistance $1960/70 area is required to confirm the uptrend has resumed and expectations of a retest of the August $2075 high.

Source Tradingview. The figures stated areas of the 18th of January 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation