In recent years, I have been a regular traveller to the twin towns of Albury and Wodonga which straddle the mighty Murray River on the NSW-Victorian border. Wonderful towns, renown for country hospitality, and for those townsfolk who are used to moving freely between the two towns for work reasons, it’s going to be a challenging period.

The situation here in Australia sums up succinctly the current predicament for global markets. The positive rebound following the re-opening is being threatened by regional Covid-19 flare-ups that raise questions about the economic outlook and how it might alter consumer behaviour. Who would want to be a central banker right now?

This brings me to tomorrow's RBA meeting and what all of this means for the AUDUSD.

The RBA is widely expected to keep interest rates on hold at 0.25% and the 3-year yield target will remain at 0.25%. The RBA will reiterate its dovish forward guidance and that its “accommodative approach will be maintained as long as it is required.” Of particular interest, if the virus flare-up in Melbourne is mentioned in the statement and how it might impact the recovery.

Turning to the AUDUSD, the market rewarded the AUDUSD during April and May for the apparent successful suppression of the virus here in Australia. Thus the situation in Victoria in theory represents a headwind to the currency.

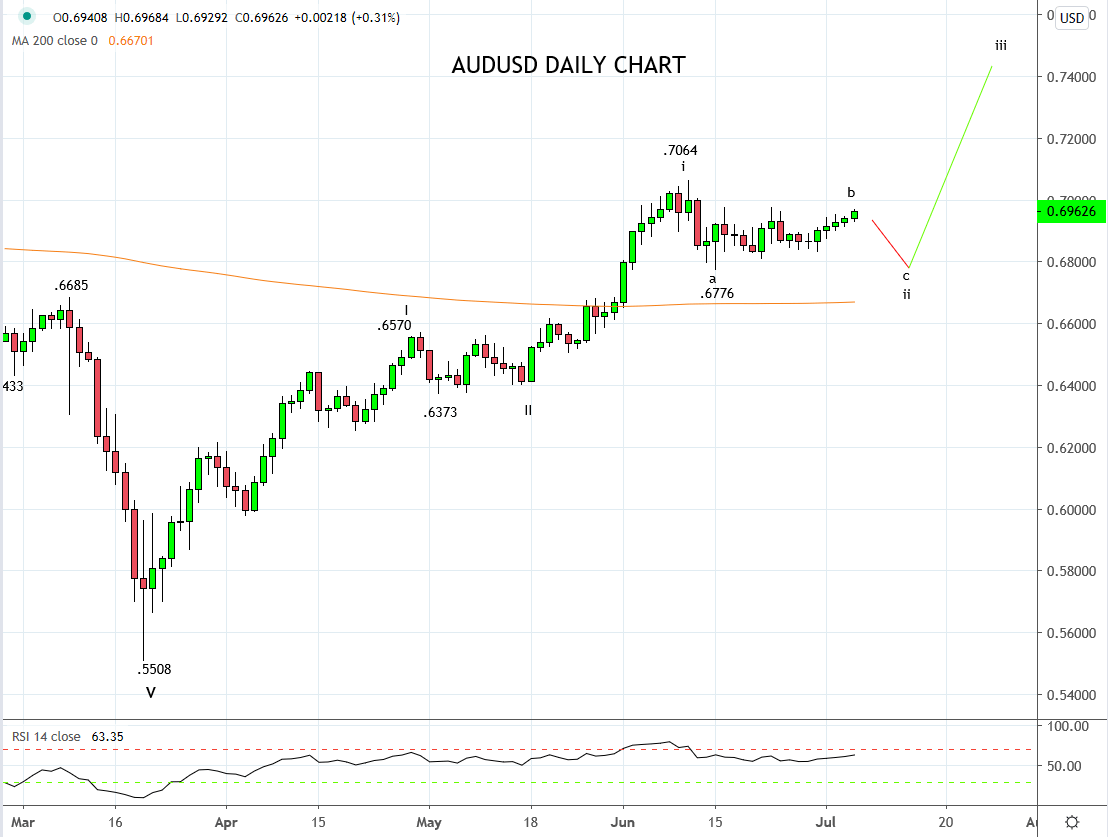

Technically, the price action for the past month following the .7064 high is viewed as corrective. Ideally, I would like to see another leg lower towards the .6680 support area to complete the correction and where I would look to be a buyer. However, should the final pullback fail to materialize, confirmation the correction is complete would be a break/close above the .7064 high which warns that a move towards .73/.75c is underway.

Source Tradingview. The figures stated areas of the 6th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation