The Fed says the banks are healthy

The Federal Reserve released the results of its stress tests, stating: "The banking system has been a source of strength during this crisis, and the results of our sensitivity analyses show that our banks can remain strong in the face of even the harshest shocks."

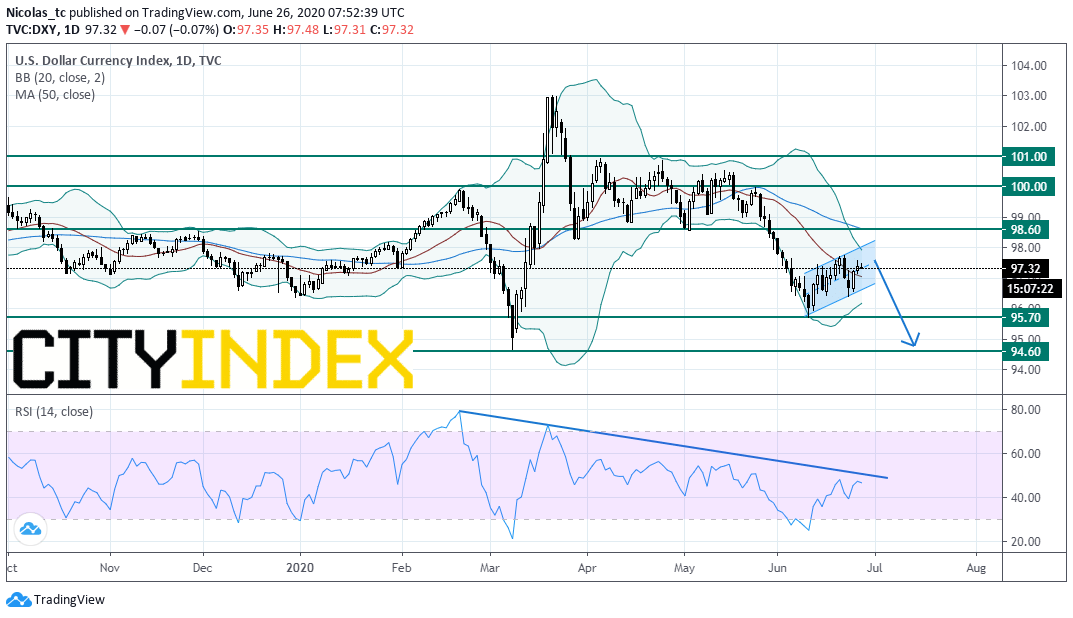

From a technical perspective, the Dollar index remains in a down trend despite the recent pullback. Prices are consolidating within an upward-sloping channel (potential bearish flag pattern pattern). The 20- and 50-simple moving averages are heading downwards. The 50DMA could play a resistance role at 98.6. In addition, the daily Relative Strength Index (RSI, 14) remains capped by a declining trend line. As long as 98.6 is resistance, the bias remains bearish. A break below 95.7 would open a path to see 94.6. Alternatively, a push above 98.6 would call for a reversal up trend with 100 as the first target.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM