With the Fed widely expected to cut rates later today, we take a look at market returns for FX majors, commodities and the S&P500 following such an event.

Using Fed Funds data from 1971, we filtered the Fed cuts and calculated average, forward returns up to +20 after a cut to see if we can isolate potential trends in the future. We stopped at +20 days to avoid an accumulation effect on the averages, where the Fed may have cut at two consecutive meetings in a row which.

Still, these tests are not perfect and there are a few considerations to consider when analysing the data:

- Every Fed meeting is unique

- The further out in time we look in time, the more outside factors come into play which could skew the results

- Forward guidance is mostly missing in the lead up to Fed cuts in these results (where they try to guide market expectations)

Whilst forward returns are not a predictor for future action, they can reveal historical tendencies or patterns of market behaviour, which may reoccur again. So we aim to look for stronger relationships.

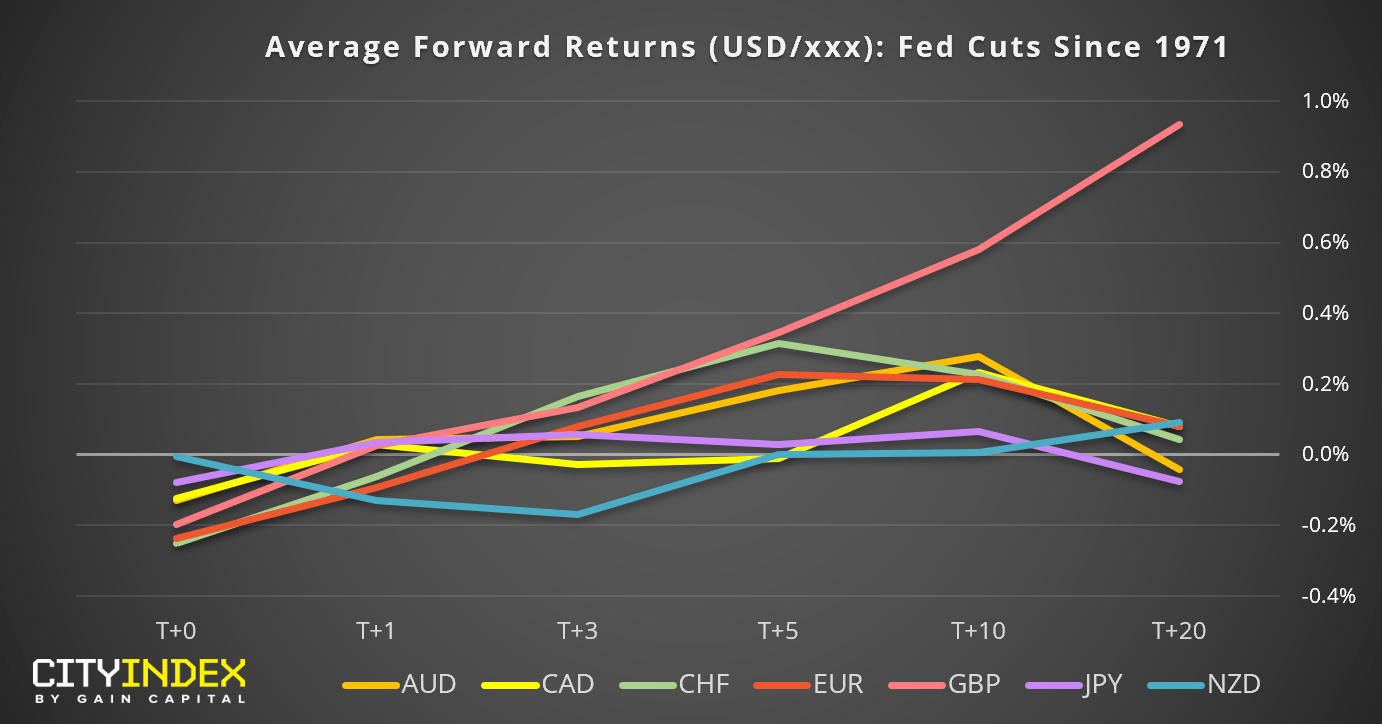

- Markets are expressed in terms of USD strength (ie USD/EUR)

- Long USD/GBP is the standout market, which has shown in increasingly bullish average return between +T3 to +T20

- Interestingly, USD/NZD has been bearish between +T2 to +T3 on average, following a Fed cut

- Converted to spot markets, this shows that short GBP/USD has proven the most favourable among FX majors.

- Short EUR/USD and AUD/USD also appears favourable from +T3 to +T10, although returns have been less on average

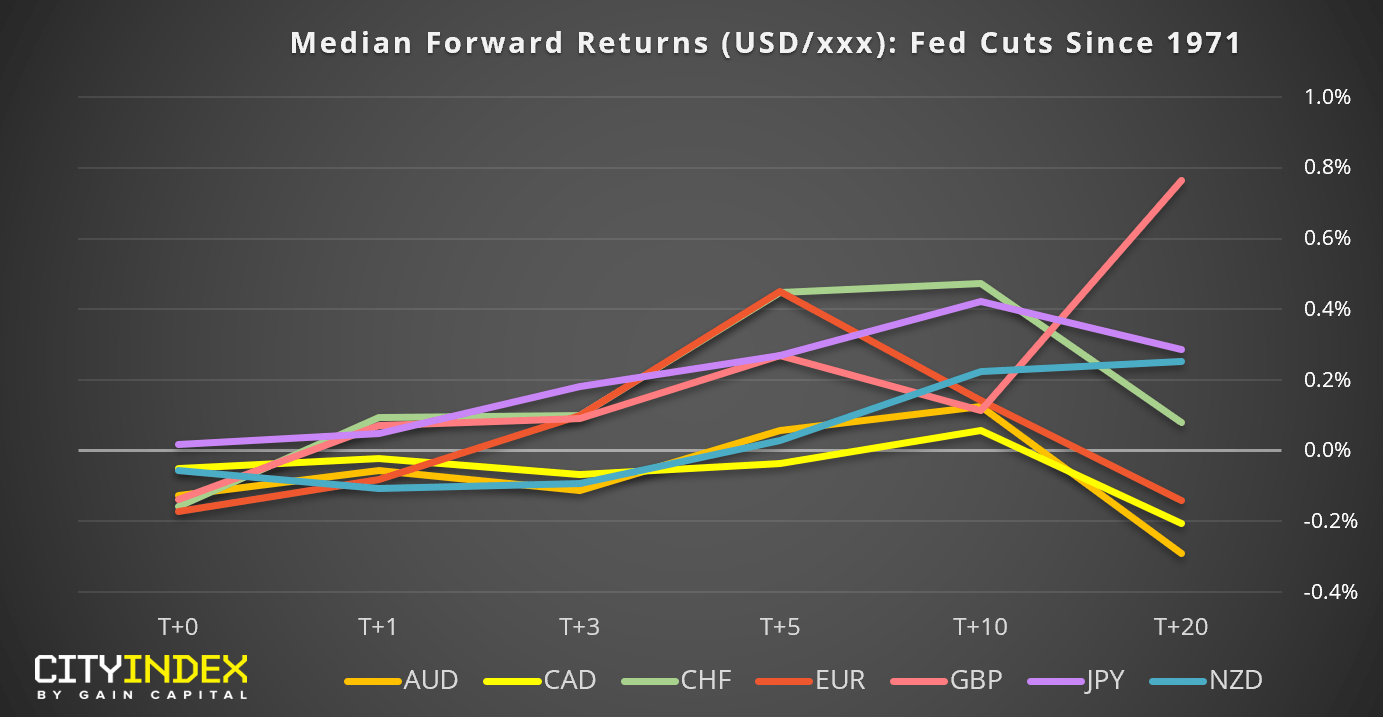

We also look at median returns as an approximation of ‘typical’ returns. This aims to remove outliers which may have favoured the average return.

- Overall, USD tends to strengthen around 1-2 weeks after a Fed cut against EUR, GBP, JPY, AUD and NZD.

- Interestingly, GBP/USD still appears to favour shorts overall, although its relationship is less prominent until it reaches +T20 after a Fed cut.

- Short EUR/USD and long USD/CHF appear favrouable around +T5

- Long USD/CHF and long USD/JPY appear favourable around +T10

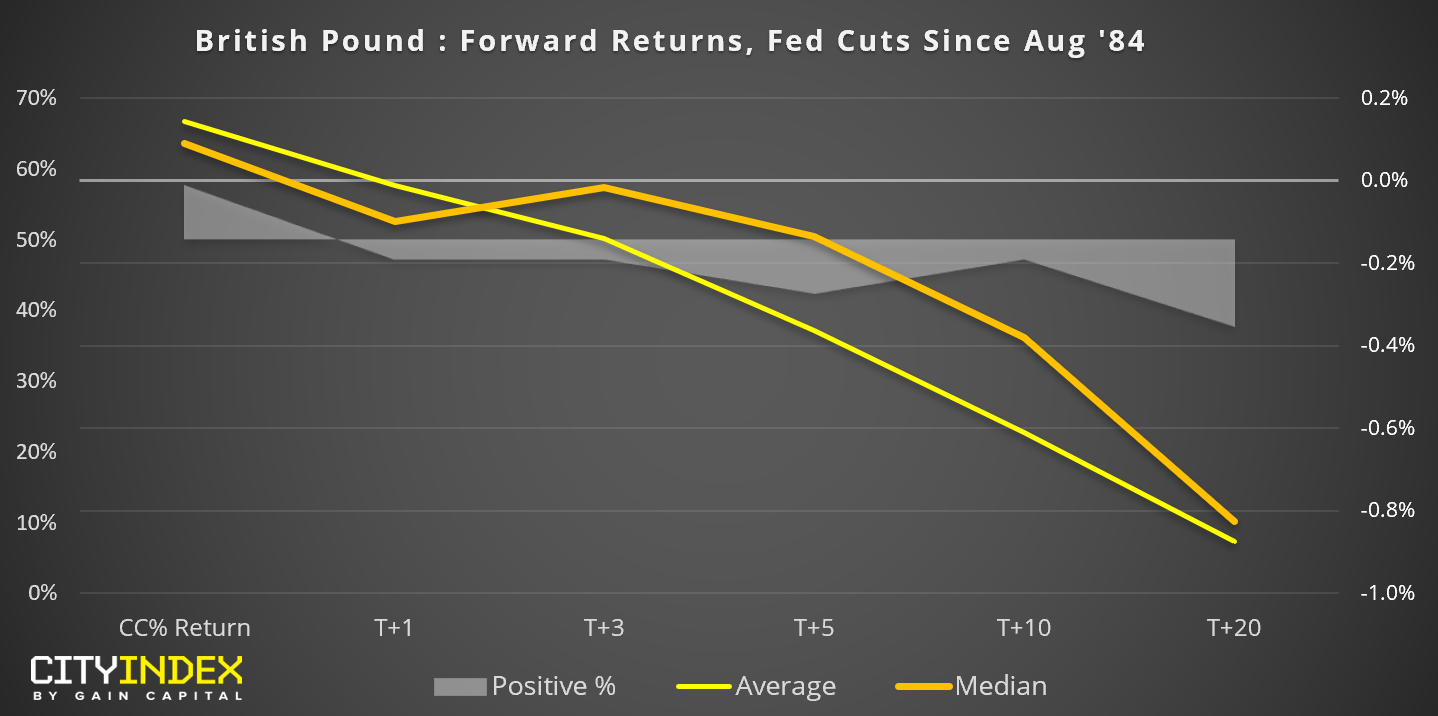

- Drilling down on GBP/USD, we note that returns have been bearish over 50% of the time between +T1 to +T20 as ‘positive’ returns are all below 50%

- Median and average returns track each other quite closely overall, which places more confidence in the reliability of average returns

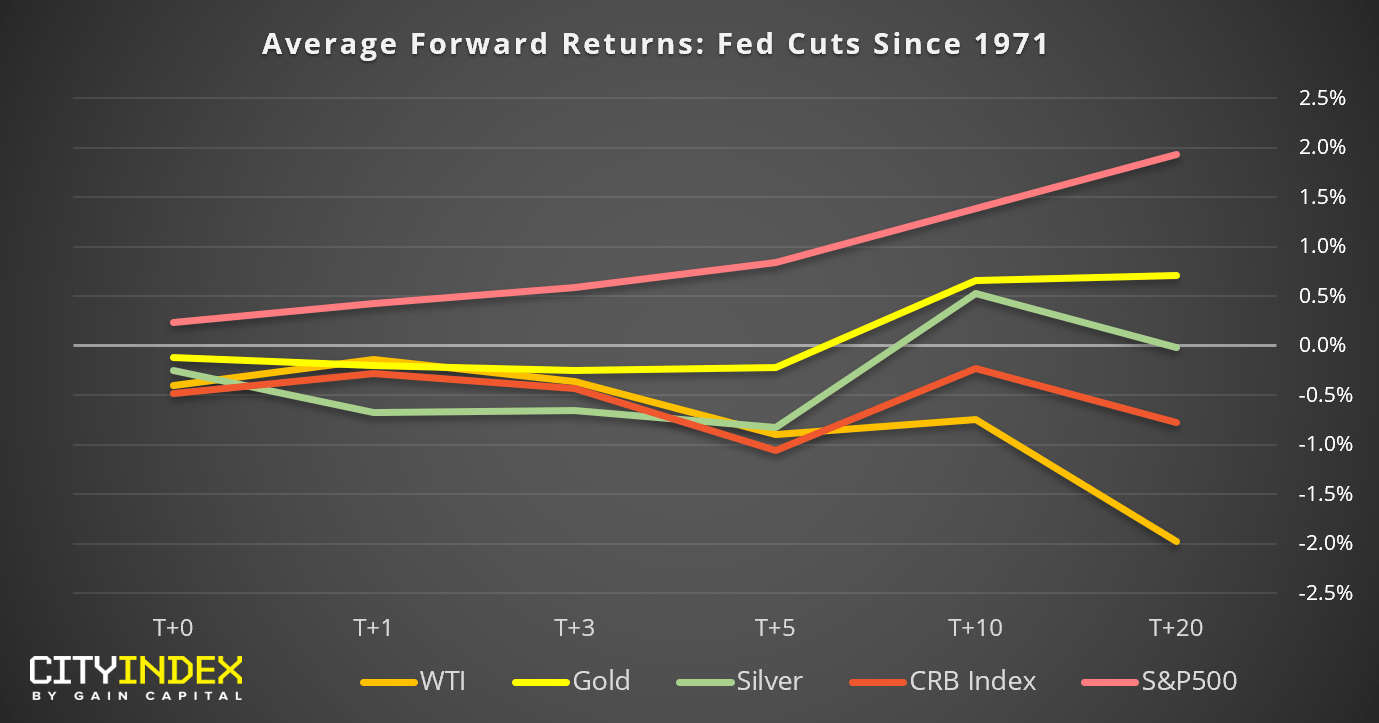

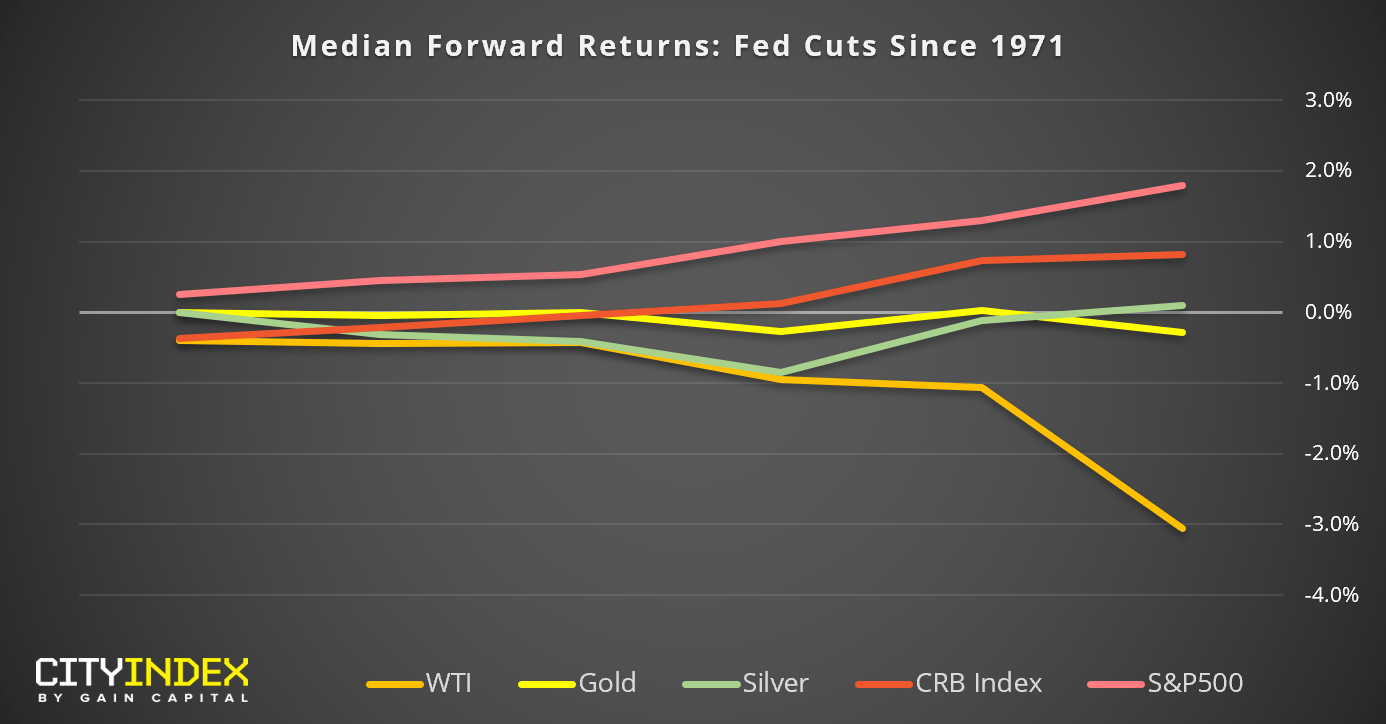

Whilst we now look at average and median returns for the S&P500 and commodity markets, we’ll focus on median returns that back up their average counterpart.

- WTI has been a standout short following a Fed cut. This makes sense in the face of a stronger USD and (presumably) weaker economic data which prompted the Fed to cut

- Long S&P500 has proven favourable between +T0 to +T20 on both average and median returns

- Silver has tended to weaken for up to a week following a Fed cut. This is apparent on both average and median returns

- Whilst gold shows a positive, average return, it appears random on median returns

Related analysis(City Index)

FOMC Preview: One (or Two) and Done?

Equity Brief: Risk off for Asian stocks ahead of Fed