The EUR/USD upside prevails

The EUR/USD upside prevails

The US Dollar was bearish against most of its major pairs on Thursday with the exception of the CAD and JPY. On the economic data front, the Trade Deficit increased to 49.4 billion dollars on month in April (as expected), from a revised 42.3 billion dollars in March. Initial Jobless Claims fell to 1,877K for the week ending May 30th (1,833K expected), from a revised 2,126K in the prior week. Continuing Claims rose to 21,487K for the week ending May 23rd (20,000K expected), from a revised 20,838K in the previous week. On Friday, Change in Nonfarm Payrolls for May is expected to increase to -7,500K on month, from -20,537K in April. Finally, the Unemployment Rate for May is expected to jump to 19.4% on month, from 14.7% in April.

The Euro was bullish against all of its major pairs. In Europe, the ECB kept its main refinancing rate unchanged at 0.000%, as expected. The envelope for the pandemic emergency purchase program (PEPP) will be increased by 600 billion euros to a total of 1,350 billion euros. The horizon for net purchases under the PEPP will be extended to at least the end of June 2021. Research firm Markit has published U.K. Construction PMI for May was released at 28.9 (vs 29.4 expected). The European Commission has posted April retail sales at -11.7% (vs -15.0% on month expected).

The Australian dollar was mixed against all of its major pairs.

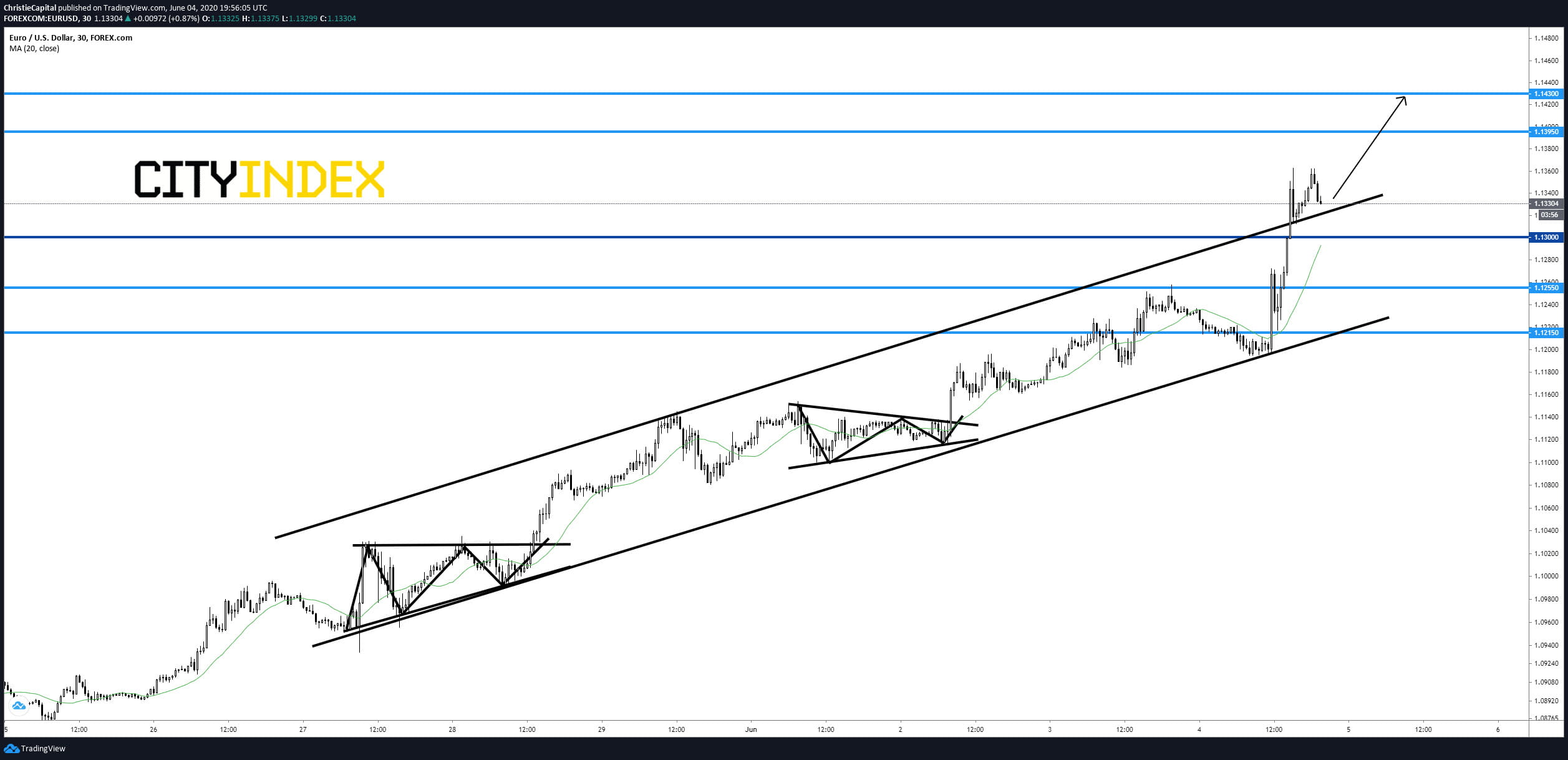

The EUR/USD continues its climb gaining 103 pips in Thursday's trading to 1.1336 the day's range was 1.1195 - 1.1362. Yesterday we drew up a trading scenario on the pair as prices remained inside a bullish trend channel. Today, all resistance targets identified yesterday have been reached. So what now? We continue to ride the uptrend. Traders that are remaining long might want to consider a stop at the 1.13 support level. A break below 1.13 could send the pair back into its longer term bullish trend channel.

Source: GAIN Capital, TradingView

Happy trading.

The US Dollar was bearish against most of its major pairs on Thursday with the exception of the CAD and JPY. On the economic data front, the Trade Deficit increased to 49.4 billion dollars on month in April (as expected), from a revised 42.3 billion dollars in March. Initial Jobless Claims fell to 1,877K for the week ending May 30th (1,833K expected), from a revised 2,126K in the prior week. Continuing Claims rose to 21,487K for the week ending May 23rd (20,000K expected), from a revised 20,838K in the previous week. On Friday, Change in Nonfarm Payrolls for May is expected to increase to -7,500K on month, from -20,537K in April. Finally, the Unemployment Rate for May is expected to jump to 19.4% on month, from 14.7% in April.

The Euro was bullish against all of its major pairs. In Europe, the ECB kept its main refinancing rate unchanged at 0.000%, as expected. The envelope for the pandemic emergency purchase program (PEPP) will be increased by 600 billion euros to a total of 1,350 billion euros. The horizon for net purchases under the PEPP will be extended to at least the end of June 2021. Research firm Markit has published U.K. Construction PMI for May was released at 28.9 (vs 29.4 expected). The European Commission has posted April retail sales at -11.7% (vs -15.0% on month expected).

The Australian dollar was mixed against all of its major pairs.

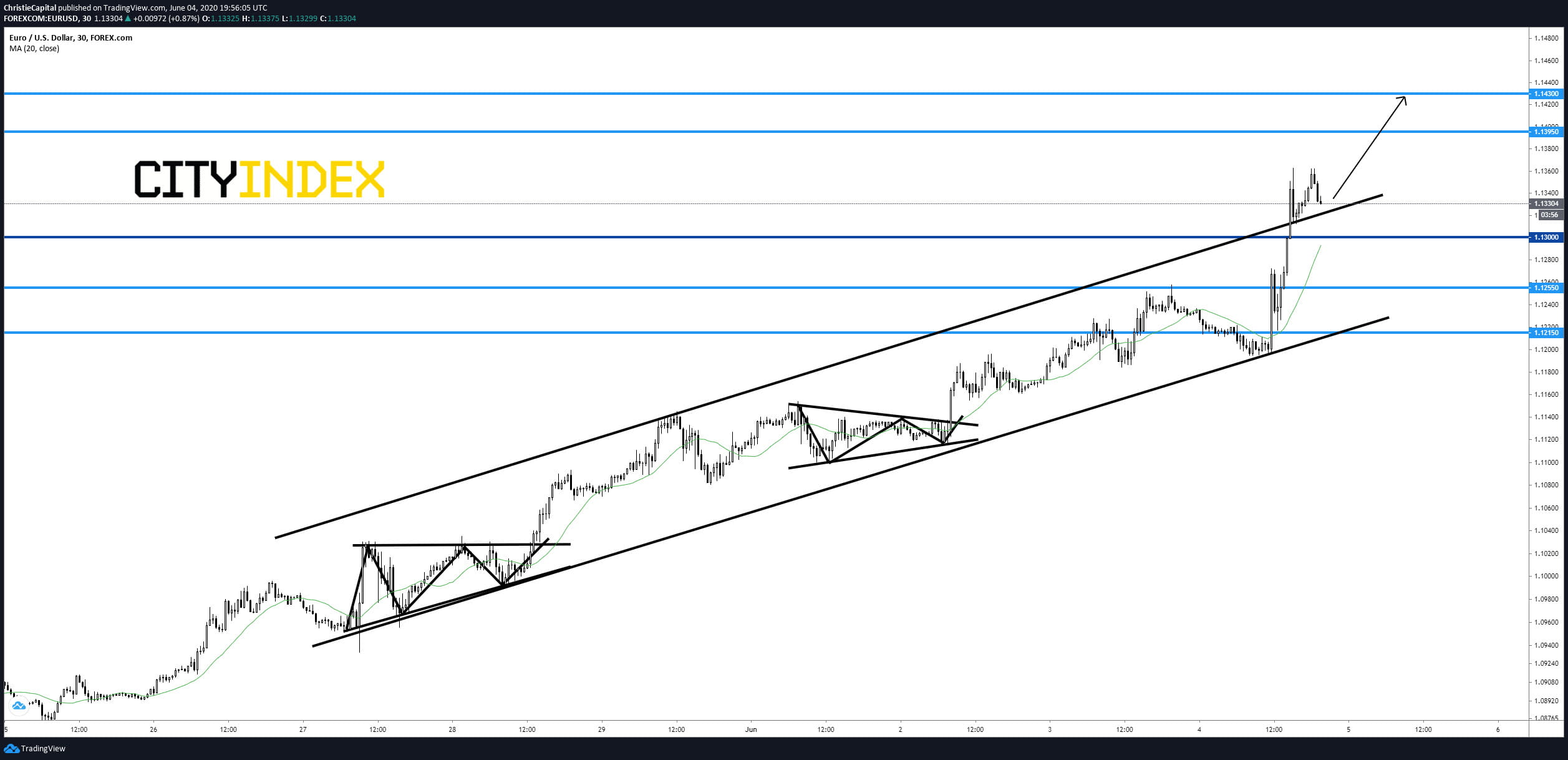

The EUR/USD continues its climb gaining 103 pips in Thursday's trading to 1.1336 the day's range was 1.1195 - 1.1362. Yesterday we drew up a trading scenario on the pair as prices remained inside a bullish trend channel. Today, all resistance targets identified yesterday have been reached. So what now? We continue to ride the uptrend. Traders that are remaining long might want to consider a stop at the 1.13 support level. A break below 1.13 could send the pair back into its longer term bullish trend channel.

Source: GAIN Capital, TradingView

Happy trading.

Latest market news

Today 11:30 AM

Today 08:18 AM

Yesterday 10:40 PM