The EUR USD forecast for 2014

What can we expect from EUR/USD in 2014? The key EUR/USD movements of 2013 EUR/USD (a daily chart of which is shown) […]

What can we expect from EUR/USD in 2014? The key EUR/USD movements of 2013 EUR/USD (a daily chart of which is shown) […]

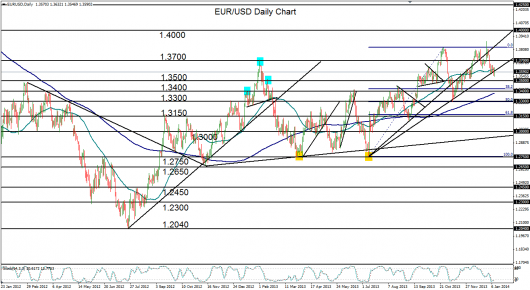

EUR/USD (a daily chart of which is shown) spent the better part of 2013 within a general trading range consolidation between 1.2750 support to the downside and 1.3700 resistance to the upside. For much of the first half of the year, the currency pair wallowed in the lower half of this range.

Only in July did it begin (from its 1.2750 support) a substantial climb that was to lift the cross pair to a two-year high at 1.3830 in late October.

From that high, the pair plunged down to a low around the 1.3300 support level in early November, which also happened to be the key 50% Fibonacci retracement level of the noted bullish run from 1.2750 up to 1.3830. The price then abruptly rebounded from 1.3300 to begin gradually grinding its way higher.

Early December saw a re-break above the 1.3700 level to closely approach the noted 1.3830 high before pulling back once more. Finally, close to the end of 2013, the pair spiked to hit a two-year high of 1.3892.

There remain reasons for optimism surrounding the EUR/USD pair for the year ahead.

Of course, the key fundamental themes affecting trading in this pair will be how well the market reacts to progressive tapering of the Fed’s stimulus, having already seen a somewhat positive reaction to taper from $85bn per month to $75bn per month.

The Fed is expected to progressively keep tapering as the year progresses and so this will have a big bearing on how dollar strength plays out.

Equally, euro buyers need to see continued evidence of strengthening economic recovery and any slowdown in German trade could have a significant bearing.

The beginning of 2014 has seen a defensive pullback that has brought the EUR/USD pair down to a key uptrend support line extending back to the July 1.2750-area double-bottom low.

In the process, the pair has also broken down below the key 1.3700 level, descended slightly below the 50-day moving average, and established a new one-month low.

Moving further into 2014, the outlook remains modestly bullish, despite the current pullback. Still comfortably above its 200-day moving average and within the confines of a bullish trend, EUR/USD could well seek further upside to extend the entrenched uptrend. The key upside targets on a trend resumption reside around the 1.4000 psychological level and then the 1.4250 resistance level.

To the downside, on any further pullback, major support continues to reside around the 1.3300 level.

If you’re interested in other currency pairs, you can click here to read James Chen’s GBP/USD forecast for 2014 as well as his USD/JPY 2014 forecast

You can also visit our forex trading section to learn more about how to trade forex.