The Doctor has Arrived

While gold and stocks had huge selloffs yesterday, one instrument that was able to remain calm under stress was copper. Copper prices have traditionally been a signal to the world as to whether the economy is in good shape or not. If copper prices are going up, that is supposed to signal strength in the economy. If copper prices are moving lower, it signals a weaker economy.

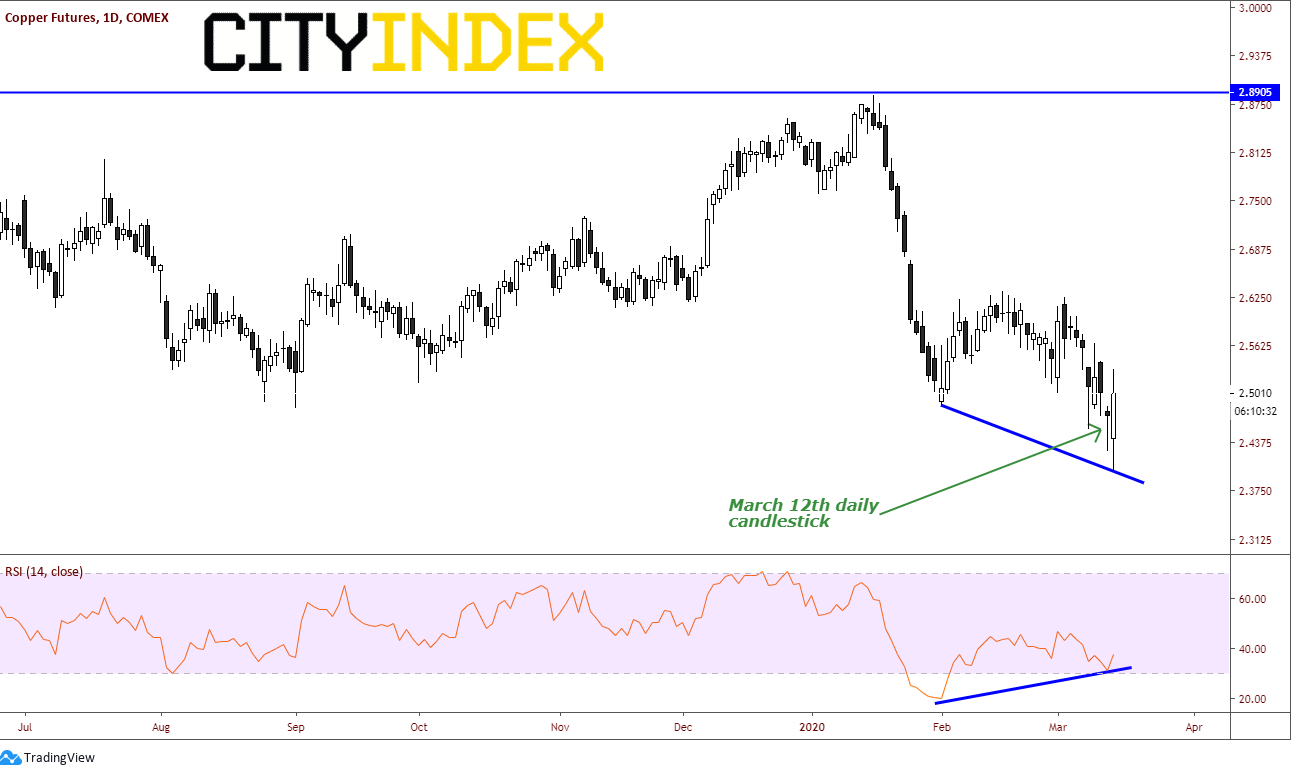

Yesterday, while gold closed down over 3% yesterday and major stock indices were down near 10%, copper was down only 1.2% near 2.428. and closed hear the highs of the session, creating a hammer candlestick formation on the daily chart. Also notice that the RSI has been diverging since the first trading day in February.

Source: Tradingview, COMEX, City Index

Now look at todays candle, a bullish engulfing candle, with price currently up 1.7%. If copper prices closed near current level, this will be a bullish signal for not only copper, but for the economy in general.

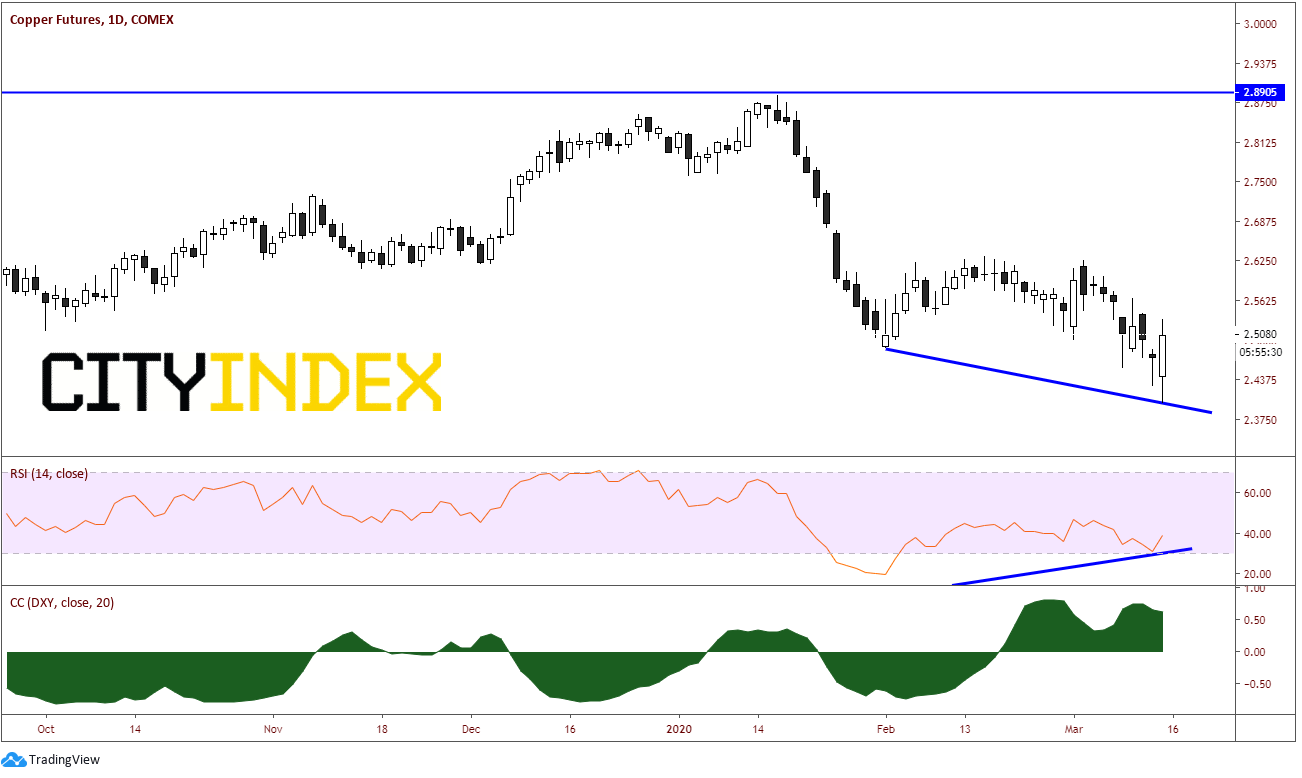

As with gold, copper usually trades inversely with the US Dollar. However, notice as of late that the correlation coefficient has been positive. The DXY and copper have been trading in the same direction. This may be a temporary correlation, but traders should take note of it.

Source: Tradingview, COMEX, City Index

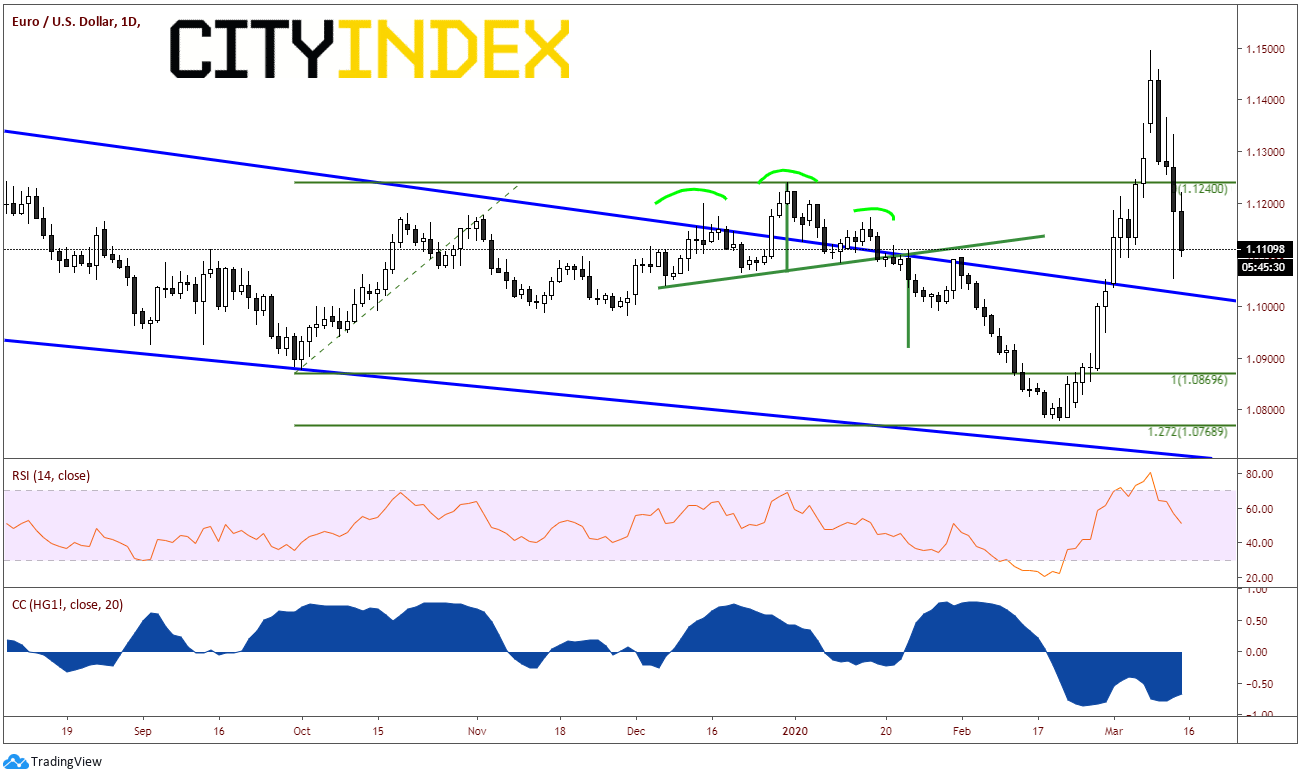

This correlation may give us some insight into other currencies as well, such as EUR/USD, which makes up 57% of the DXY. Notice the EUR/USD and copper are inversely correlated. This should be expected as the DXY is positively correlated. As copper trades lower, so should the EUR/USD.

Source: Tradingview, COMEX, City Index

In the short-term, traders should be watching the correlation between copper and US dollar related currencies. It may provide a clue as to where these currencies are headed next!