The Correction of Hang Seng Index Persists

Hong Kong's Hang Seng Index retreated around 8% from July high at 26780 on weak Hong Kong's economic activity and the rising tension between U.S. and China.

The local economy of Hong Kong is still fragile as Hong Kong is still suffering from the third wave of coronavirus. Hong Kong's July Markit PMI dropped to 44.5, worse than the expectation of 50.4 from 49.6 in June.

The tension between the U.S. and China is escalating as the U.S. banned U.S. residents to do transactions with Tiktok and Wechat, and blocked China Telecom and China Mobile to offer service in America.

This morning, Chan's CPI rose 2.7% on year in July (vs +2.6% expected, +2.5% in June), while PPI dropped 2.4% (vs -2.5% expected, -3.0% in the previous month), according to the government.

The investors should focus on China's July industrial production (+6.2% on year) and retail sale (+1.5% on year) this week as the Chinese stocks weighted more than half in Hang Seng Index.

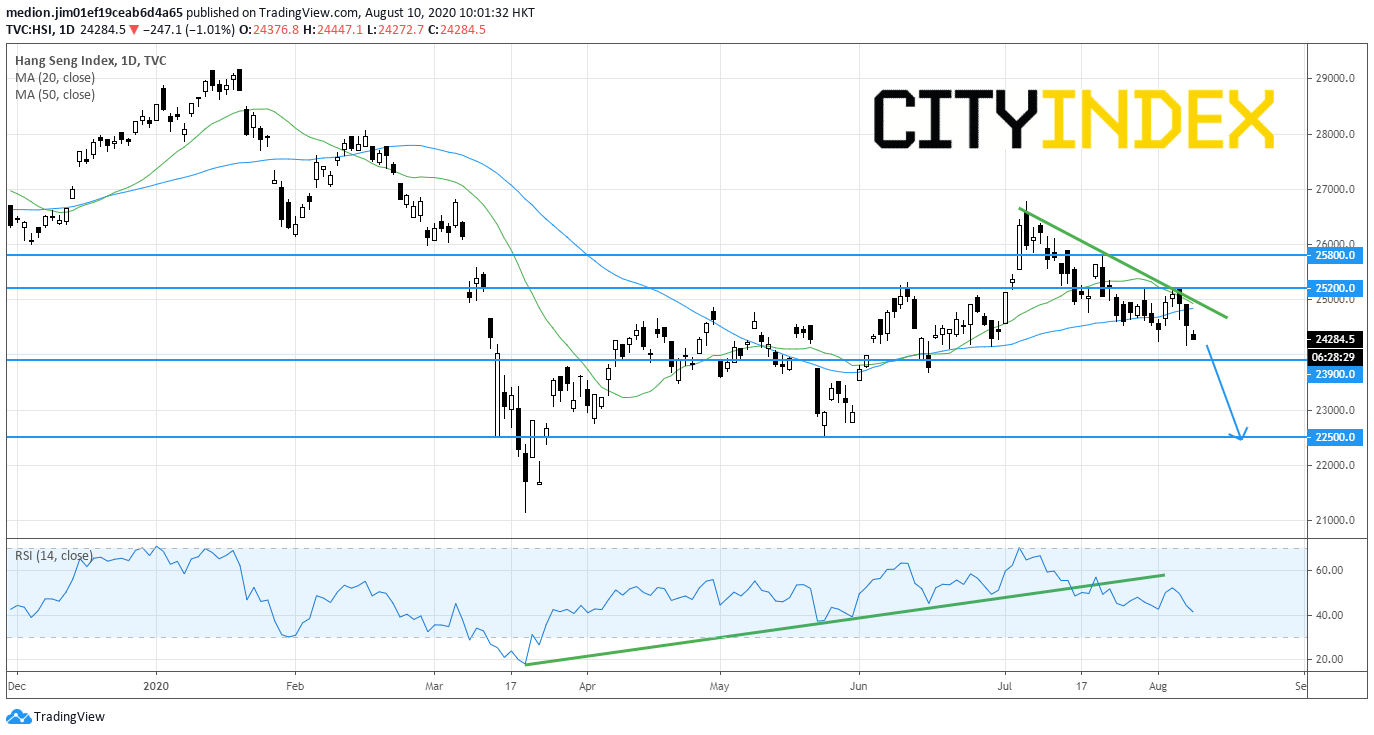

From a technical point of view, the index is capped by a declining trend line on a daily charting, indicating a bearish outlook.

The 20-day moving average is also turning downward and the relative strength index broke below the rising trend line. Both indicators suggest that the downside momentum remains.

Bearish readers could set the resistance level at 25200, while support levels would be located at 23900 and 22500.

Source: GAIN Capital, TradingView

The local economy of Hong Kong is still fragile as Hong Kong is still suffering from the third wave of coronavirus. Hong Kong's July Markit PMI dropped to 44.5, worse than the expectation of 50.4 from 49.6 in June.

The tension between the U.S. and China is escalating as the U.S. banned U.S. residents to do transactions with Tiktok and Wechat, and blocked China Telecom and China Mobile to offer service in America.

This morning, Chan's CPI rose 2.7% on year in July (vs +2.6% expected, +2.5% in June), while PPI dropped 2.4% (vs -2.5% expected, -3.0% in the previous month), according to the government.

The investors should focus on China's July industrial production (+6.2% on year) and retail sale (+1.5% on year) this week as the Chinese stocks weighted more than half in Hang Seng Index.

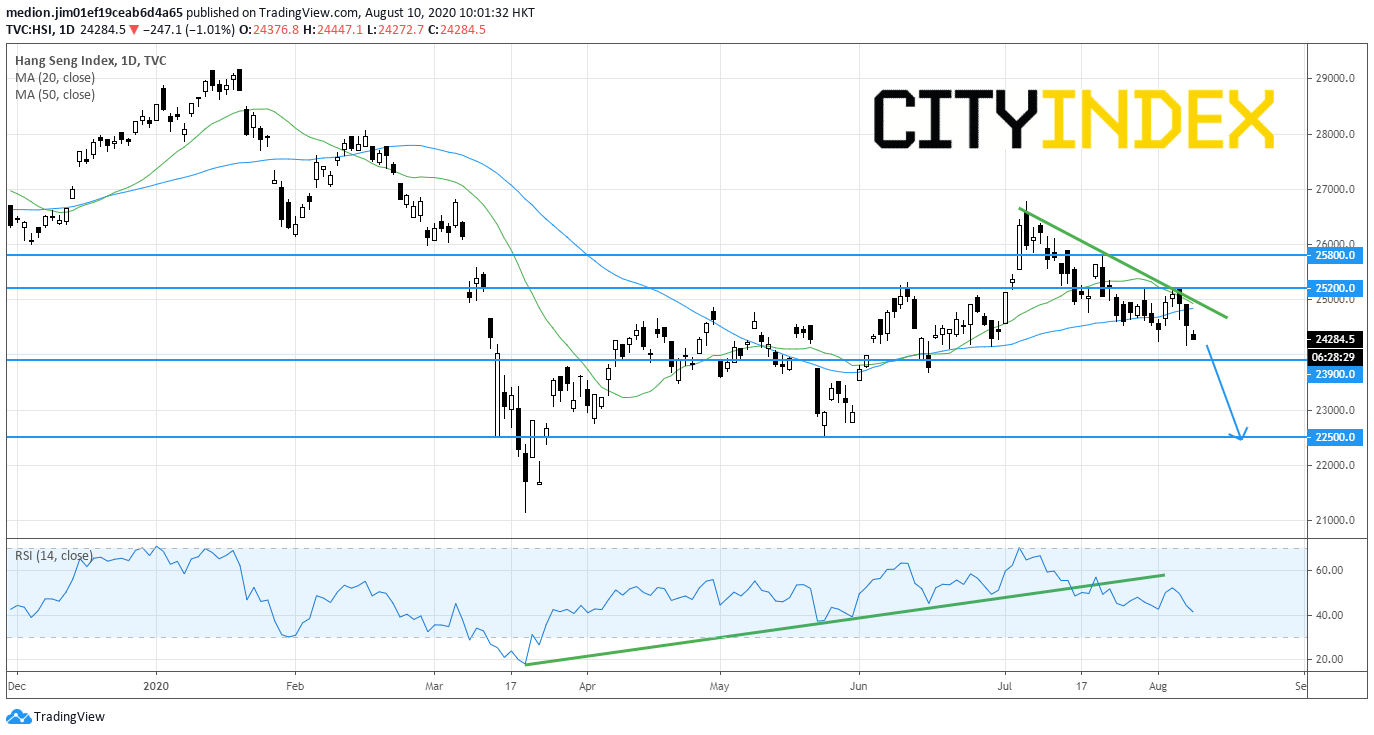

From a technical point of view, the index is capped by a declining trend line on a daily charting, indicating a bearish outlook.

The 20-day moving average is also turning downward and the relative strength index broke below the rising trend line. Both indicators suggest that the downside momentum remains.

Bearish readers could set the resistance level at 25200, while support levels would be located at 23900 and 22500.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM