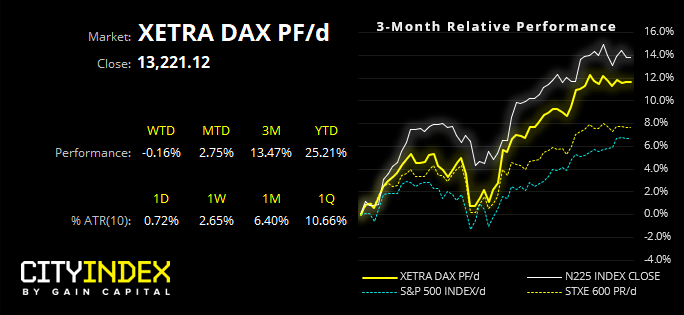

Nobody is denying DAX has been a strong performer of late. Yet with signs of exhaustion at the highs after a relatively strong move, mean reversion could be on the cards before its next leg higher.

Year to date, DAX rallied just over 28% which places it in a technical bull market (with +20% being the threshold). If it can rally another 3% from current levels, it hits a record high. Yet we’ve seen in the past that rallies of around 8-9% relative to its 20-day low has triggered a correction over the coming week/s. So that we now see prices consolidating at their highs after a 10% rally from its 20-day low, it’s a candidate for a correction, with yesterday’s bearish pinbar suggesting bulls are becoming fatigued over the near-term.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM