US election in focus

Today, the economic calendar is relatively quiet in the UK and Eurozone, with events on the other side of the Atlantic expected to drive sentiment as attention switches firmly to election day. Investors are bracing themselves for plenty of market moving headlines later tonight which is expected to bring significant volatility.

Joe Biden has been leading in the national polls by a comfortable 7 points for some time now, although the race is tighter in some key swing states, which will decide the election.

Should Joe Biden manage to win the race, a blue wave, which includes control of the Senate is needed for the markets to really get excited about stimulus. A Republican controlled senate indicates more gridlock to come and the markets will need to drastically scale back stimulus expectations.

Oil prices are sliding lower on Tuesday after a severe bout of volatility at the start of the week. Oil dived to a 5-month low early on Monday, but as the mood in the broader market improved the price of oil picked up, boosted further by Russia. The oil producing major indicated that it was open to the idea maintaining output cuts rather than unwinding them.

Today, the bears are taking back control as concerns over surging covid cases, more lockdown restrictions, political jitters in the US and rising production in Libya are overshadowing optimism that major producers could hold back on planned production increases.

AB Foods announced a 40% fall in full year earnings after the covid hit from closed Primark stores overshadowed stronger performance in its grocery, sugar and ingredients divisions. Primark’s profits plunged to £362 million from £969 million reflecting temporary store closures from the first wave. With a second wave of covid, lockdown 2.0 starting in a matter of days and AB Foods earmarking a £375 million loss from the second round of temporary closures, Primark’s lack of online presence is really being felt.

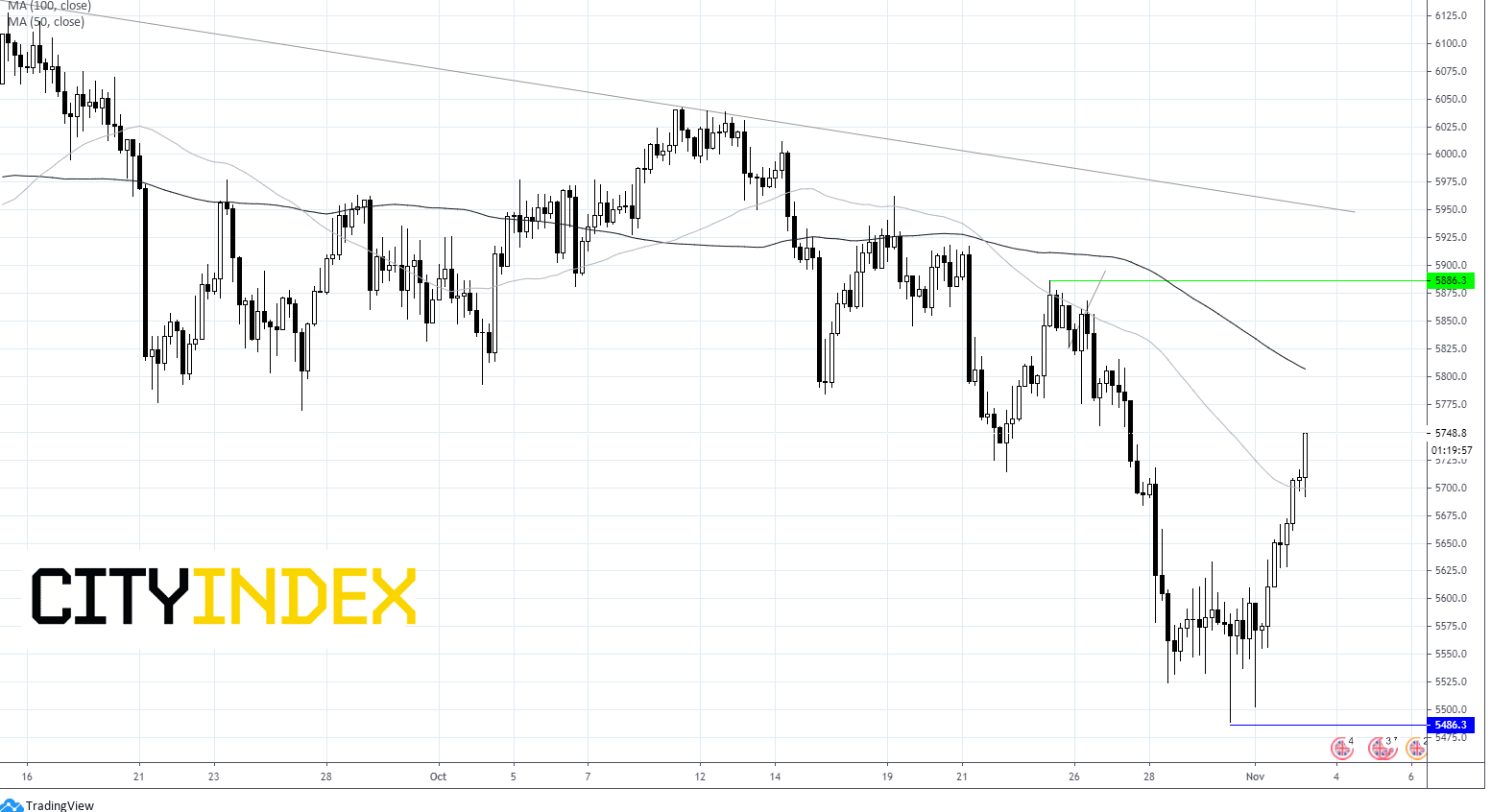

FTSE Chart