The BOC and The Canadian Dollar

The Bank of Canada meets tomorrow and must decide whether they need to cut rates or leave them unchanged at 1.75%. The market is expecting the BOC to leave rates unchanged, as inflation is hovering near 2.0% and GDP has been strong. The more important issue the Committee will have to address is how they will revise (if at all) their growth and inflation outlook. With much in the world in a manufacturing slowdown and in rate cutting mode, the Members must determine if they feel the need to follow suit and revise their forecasts lower. It is also possible the United State-Mexico-Canada Agreement (USMCA) may be ratified, as early as this week. Members will need to determine if this should be factored into the BOC forecasts.

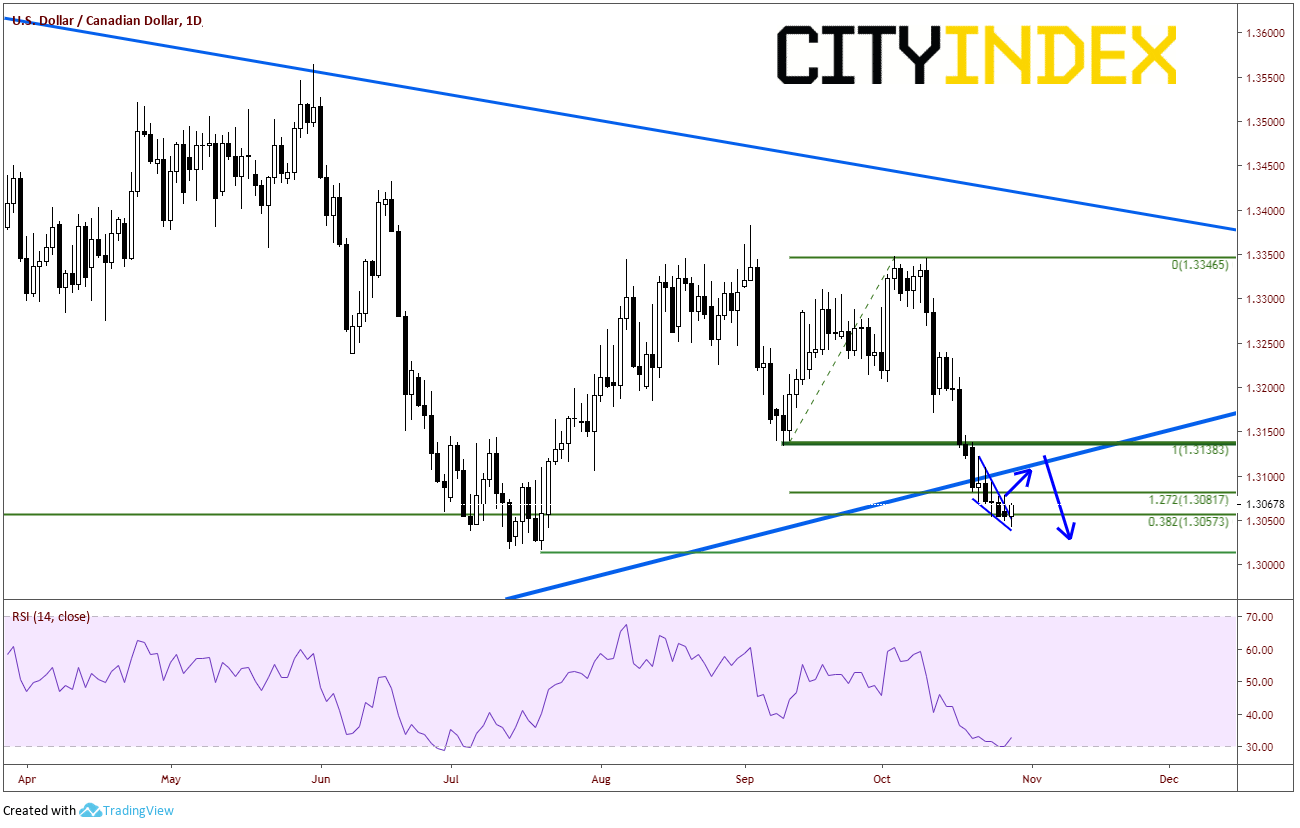

Last week we discussed how USD/CAD is breaking, and now consolidating, below a long-term trendline. This breakdown makes sense from a simple fundamental standpoint as the US is in rate cutting mode while Canada is in a holding pattern. The Canadian Dollar should be stronger than the US Dollar, as the market prices in interest rates differentials.

Source: Tradingview, City Index

However, as USD/CAD now appears to be breaking out of a descending wedge pattern, we need to see if bears can hold the market below 1.3100, which is the upward sloping long term trendline. 1.3183 remain strong horizontal resistance as well. If the pair holds below those levels, the price could be down to 1.3000 in a hurry.

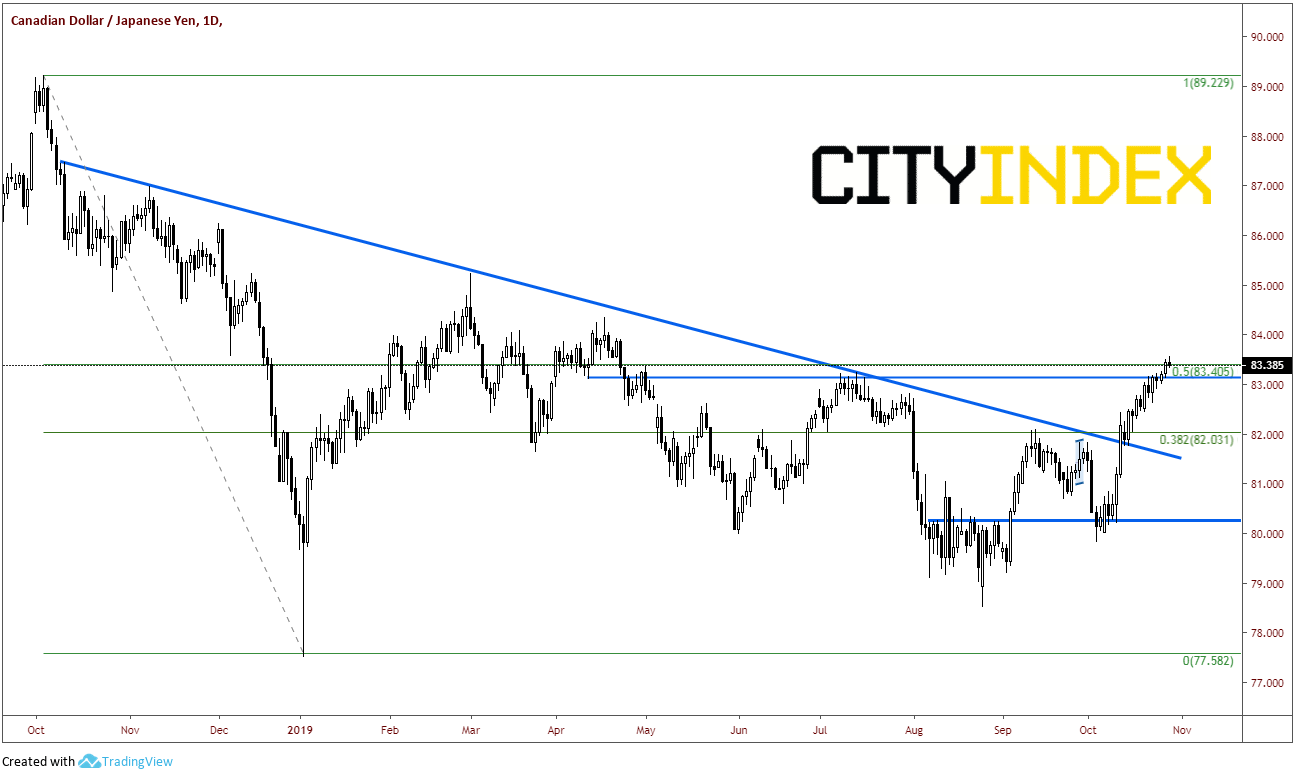

But USD/CAD isn’t the only CAD pair where the Canadian Dollar is strong. CAD/JPY has been on a tear since holding support in early October. The pair then went on to break above the downward sloping trendline from October of last year. CAD/JPY is currently trading near 83.40, which is the 50% retracement from the October 2018 highs to the January 3rd lows.

Source: Tradingview, City Index

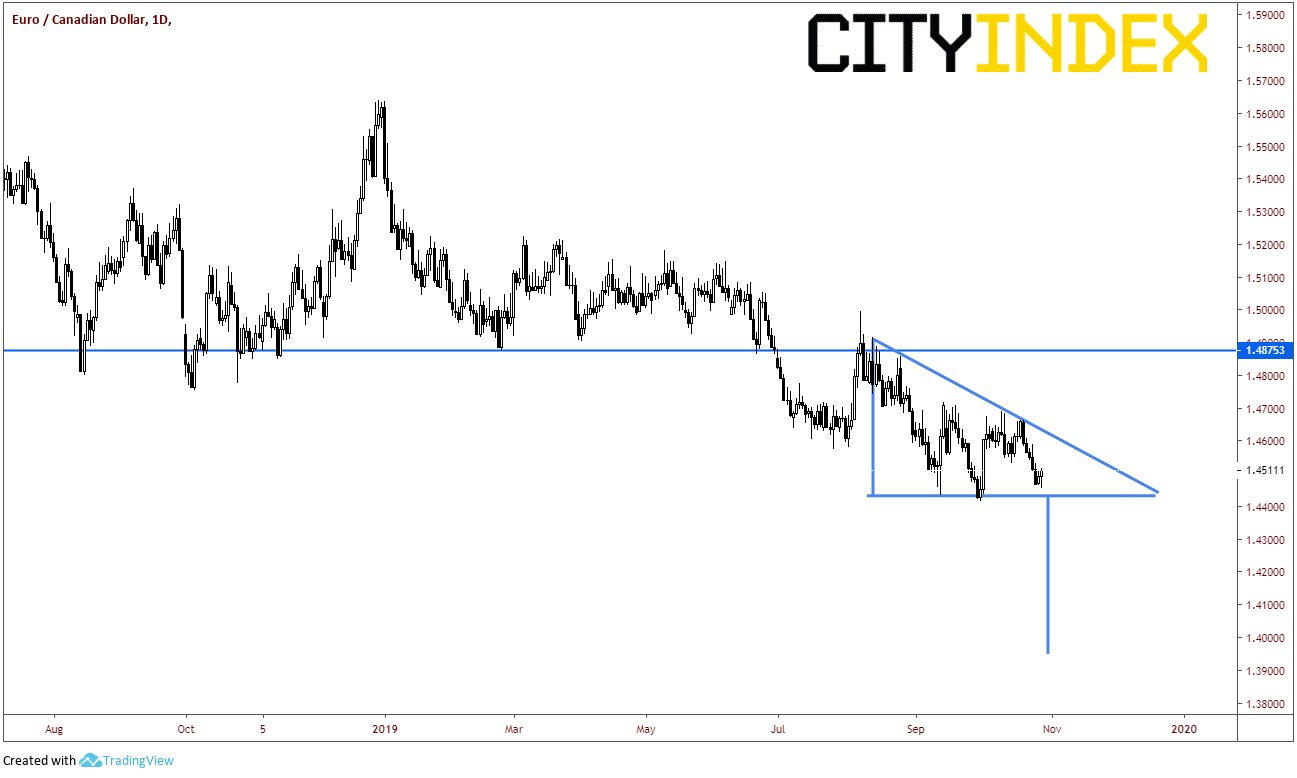

EUR/CAD has been moving lower as well, as the ECB has been in easing mode. The pair is currently in a descending triangle and looks like it could break to the downside. The target for a descending triangle is the height of the triangle added to the breakdown point, which in this case would be below 1.4000!

Source: Tradingview, City Index

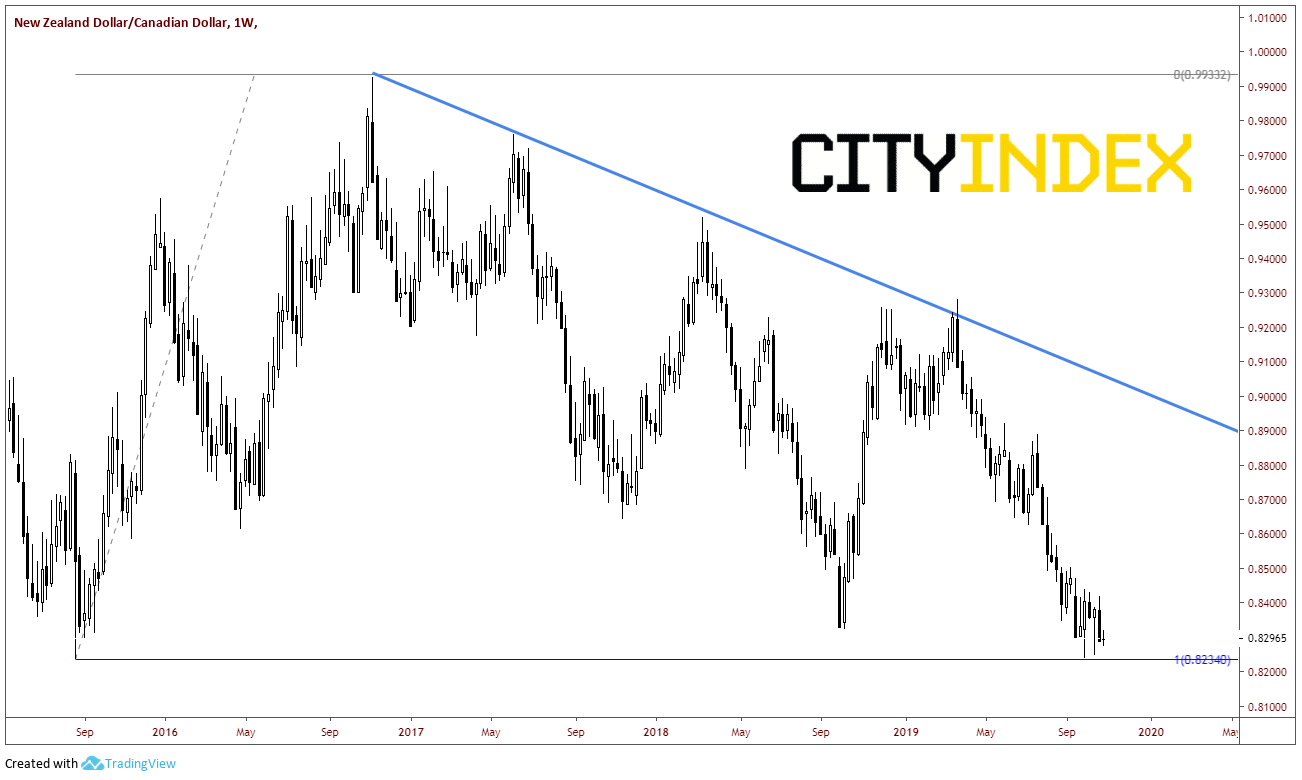

NZD/CAD has retraced the entire move from the lows of August 2015 to the highs of November 2016. That move was from .9932 down to .8234, almost 1700 pips!! AUD/CAD looks similar.

Source: Tradingview, City Index

If the BOC is hawkish or even remains neutral in their forecast or in the press conference to follow, the Canadian Dollar may continue to strengthen vs countries that have an easing monetary policy. If they turn dovish, watch for a possible reversal.