Despite concerns over energy shortages and rising inflation, equity markets have stabilised since the September volatility episode.

Supported by strong U.S. Q3 earnings reports, the VIX index has fallen towards the bottom of its 12-month range. A low volatility environment encourages risk-seeking and provides support for the NZDUSD.

Following the release on Monday of an uncomfortably high Q3 inflation reading in New Zealand as well as a repricing of central bank policy rates, the NZDUSD has received support via a move in short end interest rate differentials.

Furthermore, the Q3 inflation print has prompted revisions higher to future inflation prints and additional hikes priced into the interest rate curve. Economists at ANZ now see the Overnight Cash Rate (OCR) track reaching 2% in August 2022, just nine months away.

Lastly, a three standard deviation fall in USDCNH yesterday from 6.4250 to a low near 6.3685 for as yet unknown reasons helped the NZDUSD cement a significant technical break higher.

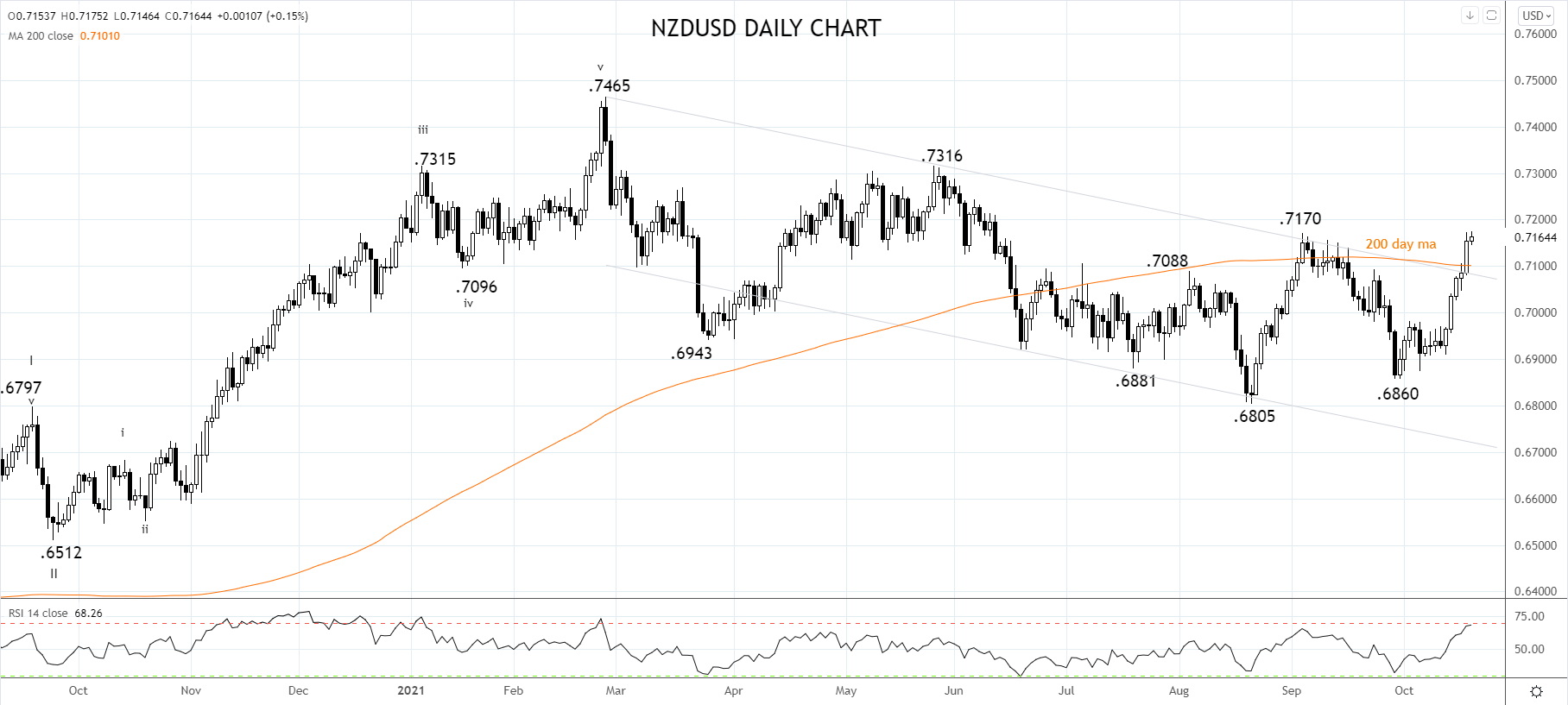

Specifically, yesterday’s break and close above the 200-day ma and trend channel resistance near .7100 is a significant development. It confirms that the multi-month correction from the February .7465 high is complete, and the uptrend has resumed.

Dips back to .7120/00 will likely be well supported and offer a chance to set longs looking for a rally towards the May .7316 high with scope in the medium term to .7500c.

Source Tradingview. The figures stated areas of October 20th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade