The BIG reversal ?

The BIG reversal ?

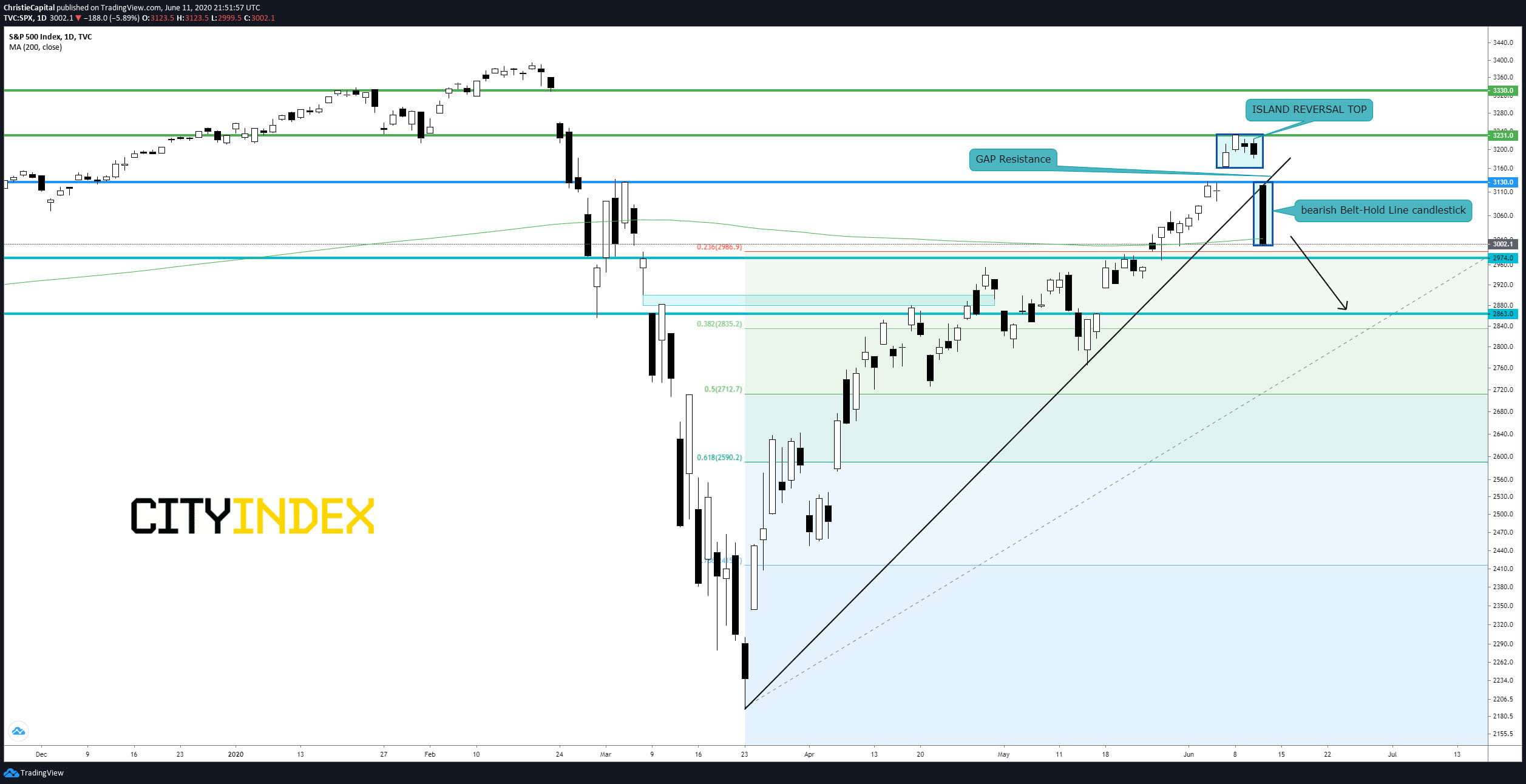

The law of gravity finally hit Wall Street today as the S&P 500 dropped 5.89% and closed back below its 200-day moving average pressured by the Banks (-9.6%), Energy (-9.45%) and Automobiles & Components (-9.26%) sectors. The Dow closed down 1861 points or 6.9%.

Thursday’s trading saw all major U.S. indices confirm an island top reversal pattern after the formation of an exhaustion gap on the 5th of June and a downside breakaway gap that confirmed in today’s trading.

The S&P 500 also confirmed a bearish Belt-Hold Line candlestick. The Japanese name for the belt-hold candle is "Yorikiri" which comes from a sumo wrestling term which means "Pushing your opponent out of the ring while holding onto his belt." Clearly, the S&P 500 got pushed off the top of a cliff in Thursday’s trading.

The S&P 500 has now turned bearish from a technical analysis perspective. A close above the black bearish belt-hold line at 3130 should mean a resumption of the prior uptrend but for now, we look towards bearish price action to close the breakaway gap at the 2863 support level which formed on the 18th of May.

Here is a look at the S&P 500 Index below.

Is it time to short equities? One day of negative price action may be hard to turn bulls into bears but have a look at one of our recent posts that digs a little deeper into some U.S. equities that have had some impressive rebounds. "Short Opportunities Abound as Euphoric US Stocks Take a Tumble"

Source: GAIN Capital, TradingView

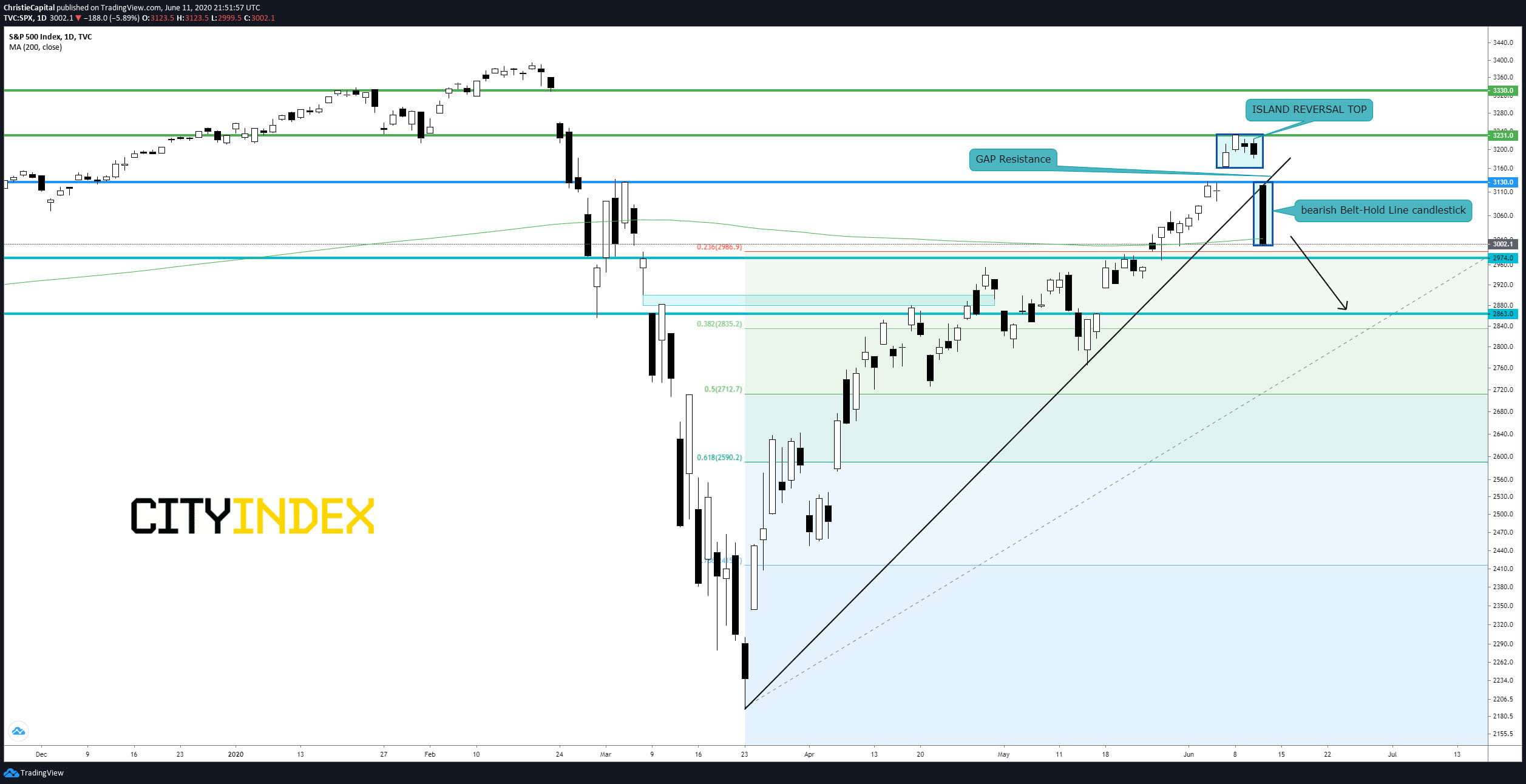

The law of gravity finally hit Wall Street today as the S&P 500 dropped 5.89% and closed back below its 200-day moving average pressured by the Banks (-9.6%), Energy (-9.45%) and Automobiles & Components (-9.26%) sectors. The Dow closed down 1861 points or 6.9%.

Thursday’s trading saw all major U.S. indices confirm an island top reversal pattern after the formation of an exhaustion gap on the 5th of June and a downside breakaway gap that confirmed in today’s trading.

The S&P 500 also confirmed a bearish Belt-Hold Line candlestick. The Japanese name for the belt-hold candle is "Yorikiri" which comes from a sumo wrestling term which means "Pushing your opponent out of the ring while holding onto his belt." Clearly, the S&P 500 got pushed off the top of a cliff in Thursday’s trading.

The S&P 500 has now turned bearish from a technical analysis perspective. A close above the black bearish belt-hold line at 3130 should mean a resumption of the prior uptrend but for now, we look towards bearish price action to close the breakaway gap at the 2863 support level which formed on the 18th of May.

Here is a look at the S&P 500 Index below.

Is it time to short equities? One day of negative price action may be hard to turn bulls into bears but have a look at one of our recent posts that digs a little deeper into some U.S. equities that have had some impressive rebounds. "Short Opportunities Abound as Euphoric US Stocks Take a Tumble"

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM