In April, the U.S. dollar as measured by the DXY index broke above strong resistance to trade to its highest level in 2 years, before curiously stalling. The lack of follow-through prompted the question is the U.S. dollar pausing or failing? https://www.cityindex.co.uk/market-analysis/usd-pausing-or-failing/.

After six weeks of indecisive price action, the U.S. dollar appears on the verge of showing its hand. Contrary to positioning data and popular sentiment, after a nasty two-day fall, the U.S. dollar is left delicately balanced as a culmination of factors have emerged to undermine support.

Principally, the recent escalation in trade tensions has created a significant headwind to sentiment, global trade and growth. Assuming there is no turning back from the current path, the U.S will soon levy a 25% tariff on the remaining U.S. $300 billion of imports from China. China is likely to respond with measures of its own, a combination that will send the global economy into a recession.

The U.S, economy will not be immune from the impact of this, and in response, many analysts are now predicting the Federal Reserve will cut interest rates in 2019. For example, economists at Barclays are expecting 75bp of cuts which will see the effective fund's rate end the year at 1.70%.

Further supporting the idea of Fed rate cuts were comments from the Feds Bullard overnight who said a rate cut “may be warranted soon”. Lower U.S. yields reduce the appeal of the U.S. dollar. According to Morgan Stanley studies from past cycles show the moment the Fed begins to verbally prepare the market for rate cuts to the moment rate cuts are implemented, the U.S. dollar has typically fallen 4-5%.

Also weighing on the U.S. dollar is a 15% fall in crude oil last month. The U.S has overtaken Russia and Saudi Arabia to become the world’s largest oil producer. This means the U.S. economy and the U.S. dollar is vulnerable to sharp drops in the price of oil.

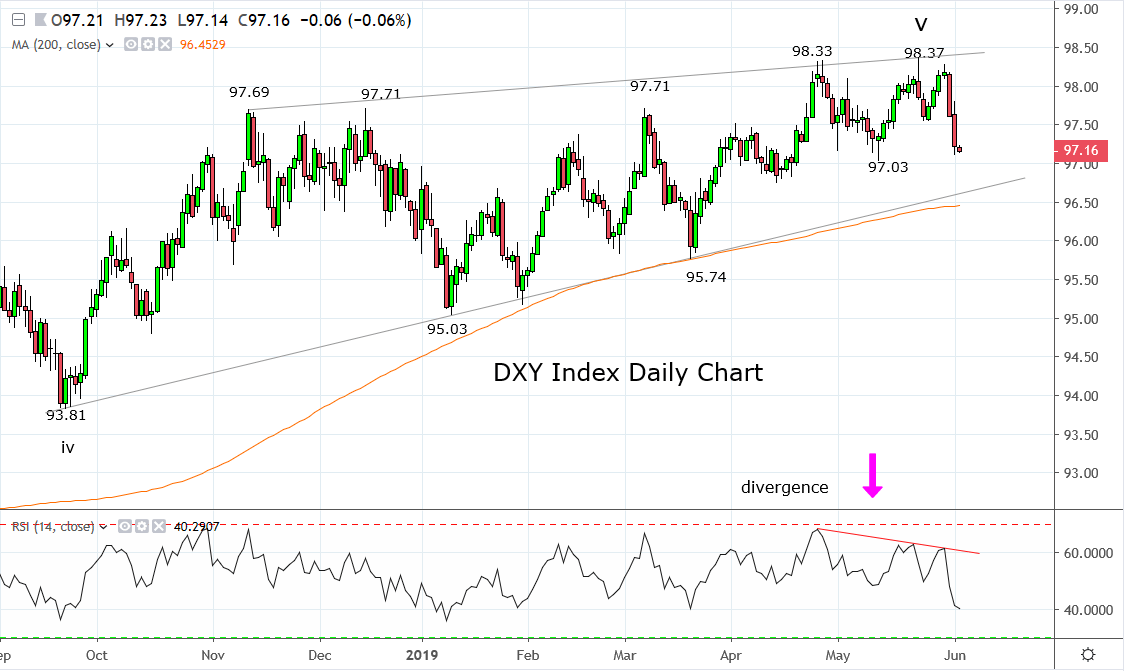

Technically, should the DXY index break/close below the May lows at 97.10/00 it would be initial confirmation of a medium-term top at the recent 98.37 high. Final confirmation would be a break/close below the support at 96.60/50 which includes the uptrend and 200 day moving average and in this instance, a move to 95.00 is likely.

Source Tradingview. The figures stated are as of the 4th of June 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.