The Altcoin Landscape: How Vulnerable is Ethereum’s Position?

The Altcoin Landscape: How Vulnerable is Ethereum’s Position?

This article is a complement to our full 2020 Market Outlook report - please download the full report for more insight into our views for major markets this year, including bold predictions from the research team!

Since its launch in 2014, Ethereum has been the dominant altcoin and smart contract platform, but for the first time in half a decade, its ecosystem may be vulnerable to up-and-coming rivals.

As recent issues around scaling and network capacity have demonstrated, Ethereum is in dire need of extensive upgrades, a project that developers plan to roll out in stages over the next several years. In Ethereum creator Vitalik’s own words, “Ethereum 1.0 is a couple of people’s scrappy attempt to build the world computer; Ethereum 2.0 will actually be the world computer.” While we agree that the updates to improve Ethereum’s capacity and security are essential, every day spent plugging holes in the blockchain’s current iteration gives competitors like EOS, TRON, and Stellar an opportunity to gain ground on the smart contract leader.

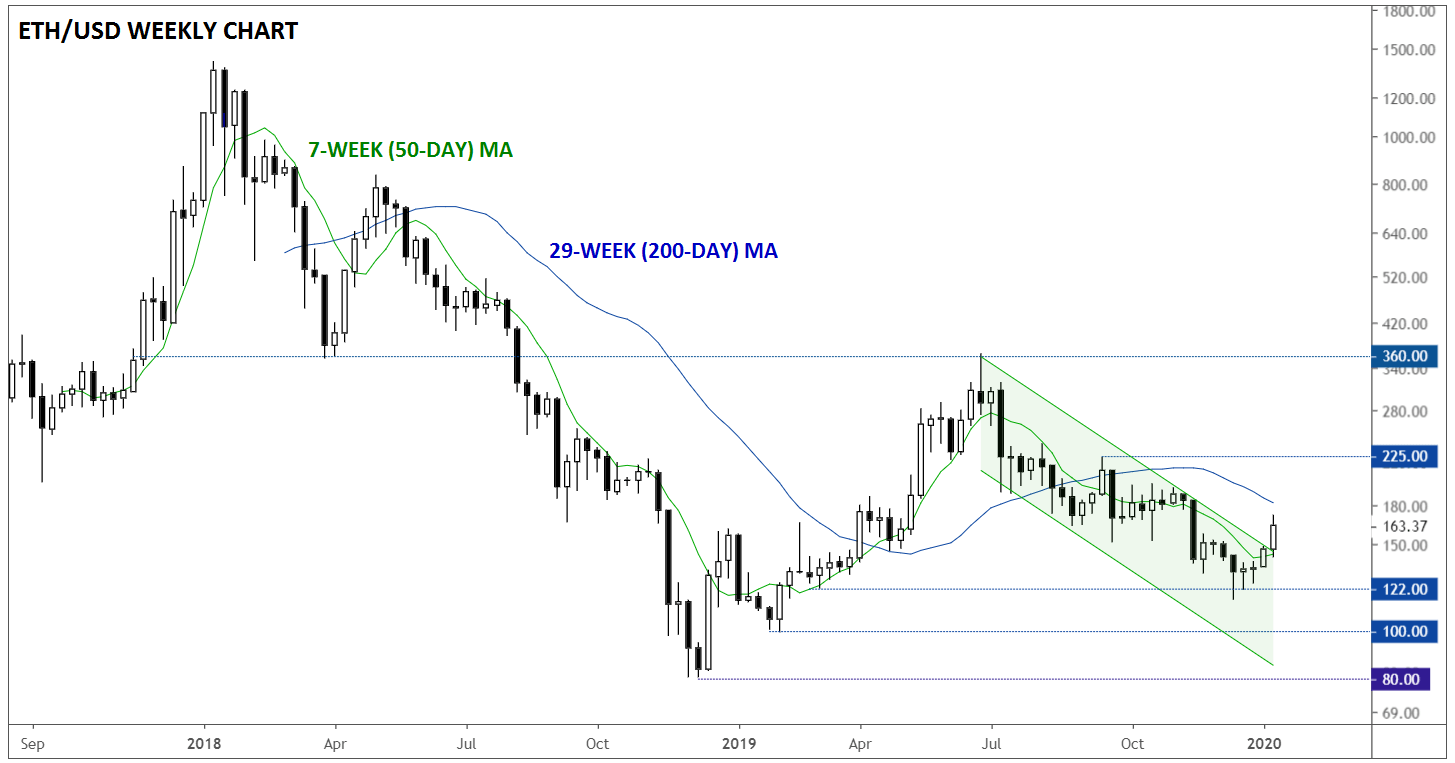

Like Bitcoin, Ethereum has a devoted following and strong “first-mover advantage,” but if the much-needed updates to Ethereum 2.0 are further delayed, developers and investors alike may turn to its competitors. From a technical perspective, Ethereum is trading between 7-week (50-day) and 29-week (200-day) moving averages.

Source: TradingView, GAIN Capital. Note that this chart uses a logarithmic scale.

With the recent breakout above bearish channel resistance, bulls are growing more optimistic, but they’d ideally like to see a move back above $225 to turn the longer-term bias to the topside. Traders should also monitor the ETH/BTC ratio, which remains below its 29-week MA as of writing, suggesting that the longer-term trend continues to favor Bitcoin over Ethereum and other altcoins.