Texas Instruments (TXN)

click to enlarge charts

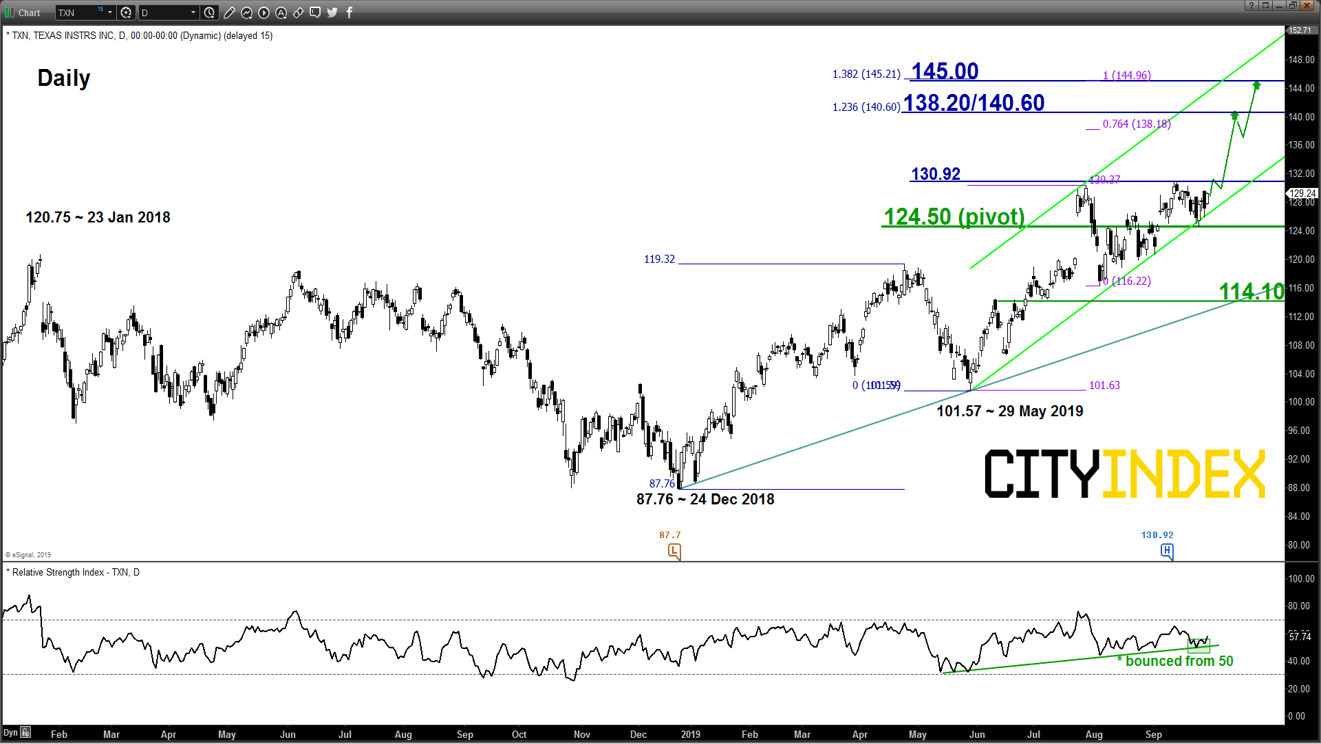

Key Levels (1 to 3 weeks)

Pivot (key support): 124.50

Resistances: 130.92, 138.20/140.60 & 145.00

Next support: 114.10

Directional Bias (1 to 3 weeks)

Texas Instruments, a diversified semiconductor firm that supplies to a broad range of industries from automakers, telecommunications to consumer electronics and it is also the 2nd biggest weightage component stock in the PHLX Semiconductor Sector Index.

Its share price is now exhibiting positive technical elements where it may surge above its current all-time high level of 130.92 printed on 12 Sep 2019. Bullish bias above the 124.50 key medium-term pivotal support for a further potential up move to target the next resistance at 138.20/140.60 and a clearance above 140.60 sees a further rally towards 145.00 next.

On the other hand, a break with a daily close below 124.50 invalidates the impulsive up move scenario for a corrective decline to test a major support at 114.10 (also the ascending trendline from 24 Dec 2018 low).

Key elements

- TXN has continued to evolve within a medium-term ascending channel in place since 29 May 2019 with the lower boundary of the ascending channel acting a support at 124.50.

- The upper boundary of the aforementioned ascending channel stands at 145.00 which is also defined by a Fibonacci expansion cluster.

- The daily RSI oscillator has managed to stage a rebound from a corresponding ascending support in place since 29 May 2019 low and the 50 level. This observation suggests a revival of medium-term upside momentum.

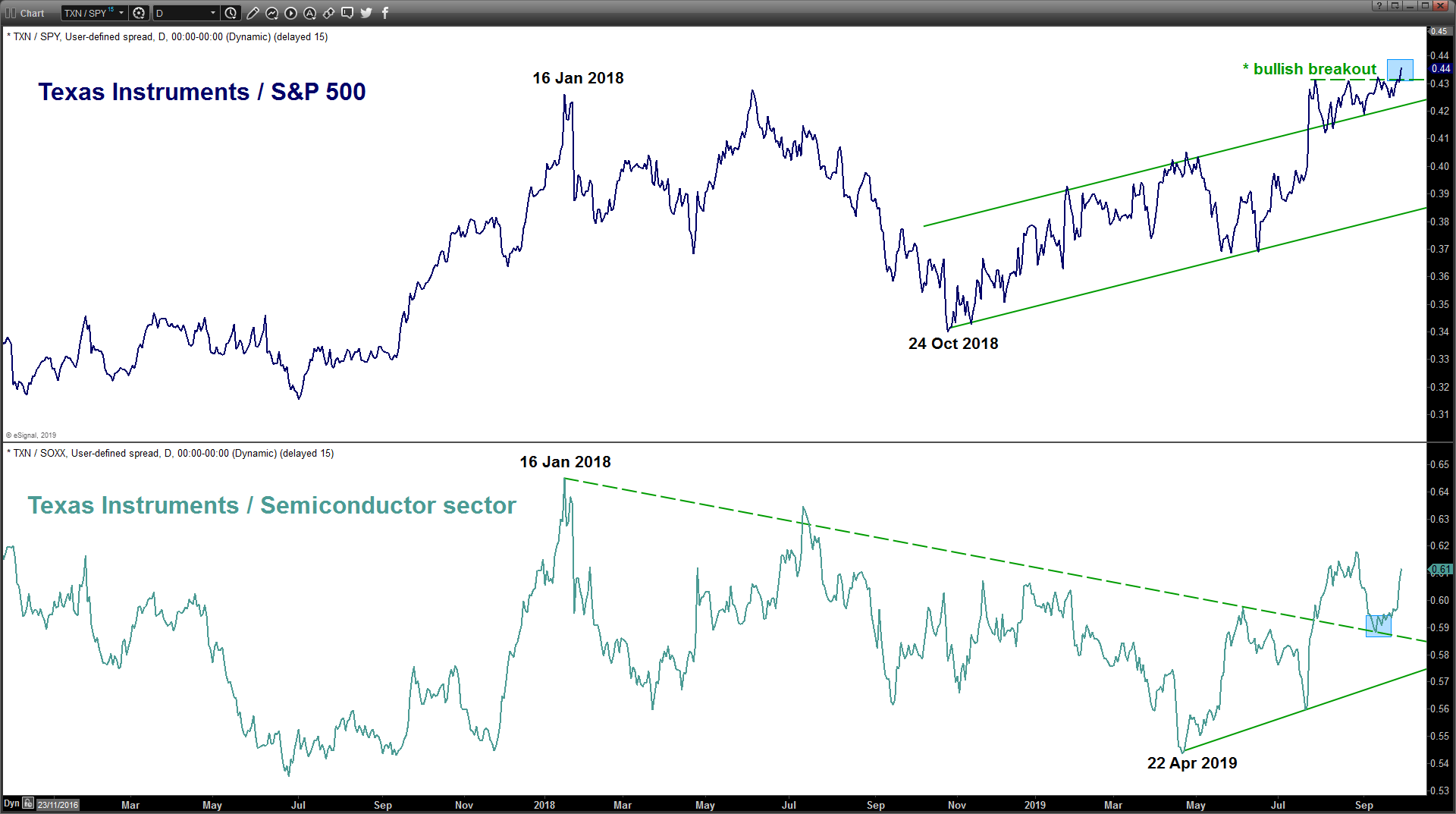

- Relative strength analysis against the market (S&P 500) and its sector (Semiconductor) from the respective ratio charts are suggesting further potential outperformance of TXN.

Charts are from eSignal