Due to the bushfire tragedy, it’s been a summer here unlike any other, with ramifications that will continue to be felt for an extended period. As the county digs in for the long rebuild ahead, there is a lot of debate about what the year ahead holds for the Australian economy and the outlook for the RBA cash rate.

This morning, I read an article here written by Ross Gittins, one of Australia’s most respected economic journalists, who I credit with fostering my original interest and understanding of economic policy.

The key point of the article was that another RBA rate cut would do more harm than good and that the responsibility for stimulating demand should fall on the shoulders of the Federal Government and fiscal policy - a scenario that appears unlikely given the Federal Government’s firm commitment to a budget surplus.

This means there will be an intense focus on the release this Thursday of labour force data for December. Following the strong retail sales report earlier this month the market wound back its expectation of an RBA rate cut in February to approximately 40%. Due partly to a suspicion that Black Friday sales had inflated the retail sales report, the market is again 50% priced for a February rate cut.

Employment is viewed as a lagging indicator, and a gain of 5k or fewer jobs combined with the unemployment rate ticking higher to 5.3% is likely to see the odds of a February rate cut rise significantly and result in downward pressure on the AUDUSD.

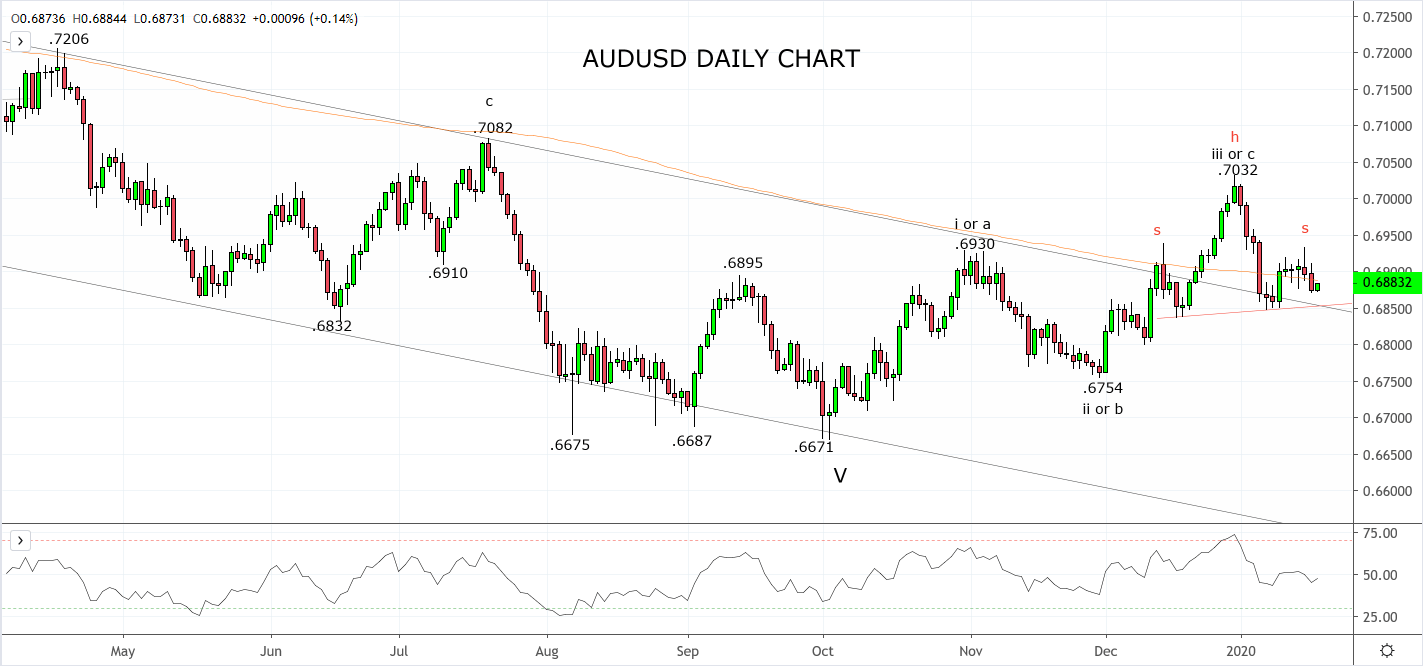

Technically, the bullish signs that emerged in the AUDUSD at the end of 2019 have been erased after the AUDUSD retreated back through the band of medium-term support at .6930/00. More so given the rally from the October .6671 low has unfolded in three waves (countertrend) and there is now evidence of a head and shoulders topping pattern developing with the neckline/support viewed .6850/30 area.

In summary, should the AUDUSD break and close below the .6850/30 support level due to a soft labour market report or any number of other factors, it would be a negative development and likely to see a retest of .6750, before the October .6671 low.

Source Tradingview. The figures stated areas of the 20th of January 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation