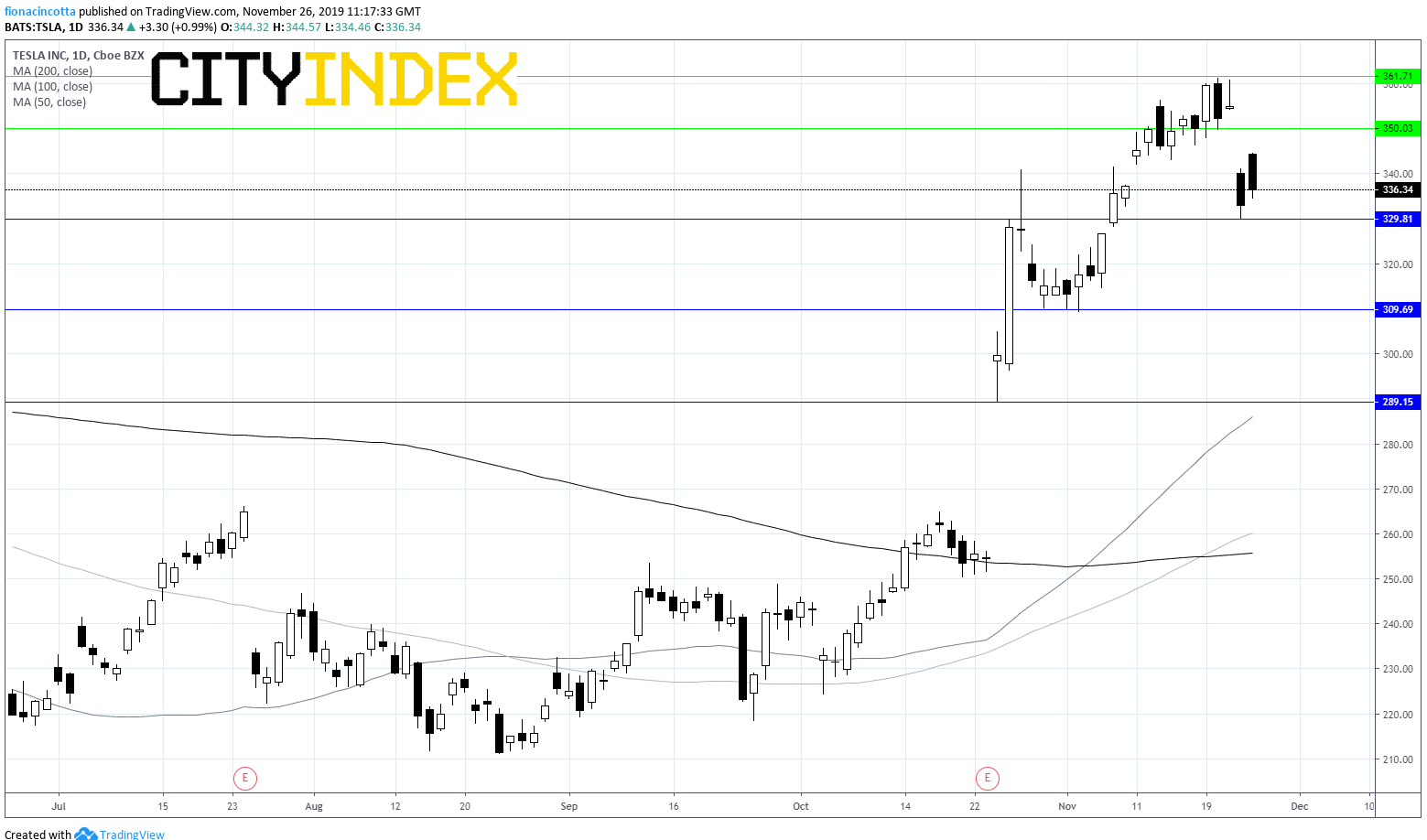

Whilst the Tesla share price hit a low of $330 following the launch, its still up a solid 6.8% on the month and booked gains of 1% in the previous session. The stock is trading higher once again in the pre-market today.

China

Whilst the cybertruck grabbed our attention and achieved orders from hardcore Tesla fans, it is unlikely to win over a wider audience. However, Tesla is also performing a quiet revolution in China. Last Friday the made in China Model 3 was made available in Tesla stores across China. The number of Tesla service centres is being upped from 29 to 63, whilst fast charging stations are being increased from 39 to 362 indicating the ramp up in orders expected.

Tesla shares have been in demand since reporting quarterly profits following $1 billion loss in the first half of the year. The stock is up over 35% so far this quarter.

Ratings?

Wall Street analysts opinions on Tesla remain firmly divided. According to FactSet, of 33 analysts, 13 consider Tesla a buy, 9 a hold and 11 have given it a sell rating. The average target price was $319 representing a 15% downside from its current price.