The demand concerns stem from worse than expected Q1 deliveries. However, Elon categorically denied that there was a demand issue providing some stats to support his claims:

1. He insisted that quarter to date orders are outpacing production, sales are outpacing production and production is good. Bullish talk.2. He implied that Tesla could reach record production and deliveries in Q2. That would mean over 86,555 sales and 90,966 deliveries or year on year growth of at least 123%. Not bad.

3. Elon confirmed that 90% of sales are from new customers rather than reservation holders.

4. Finally, Elon claimed that Model 3 outsold all cars of the same price bracket combined in the U.S. over the last year.

Word of mouth

Importantly Tesla doesn’t advertise, it relies on word of mouth, which takes time to build up. The theory being more cars on the road will lead to more people buying. If point four is correct, it bodes well for future sales of Model 3. This raises the question whether investors have been too bearish on the stock.

Rebounding?

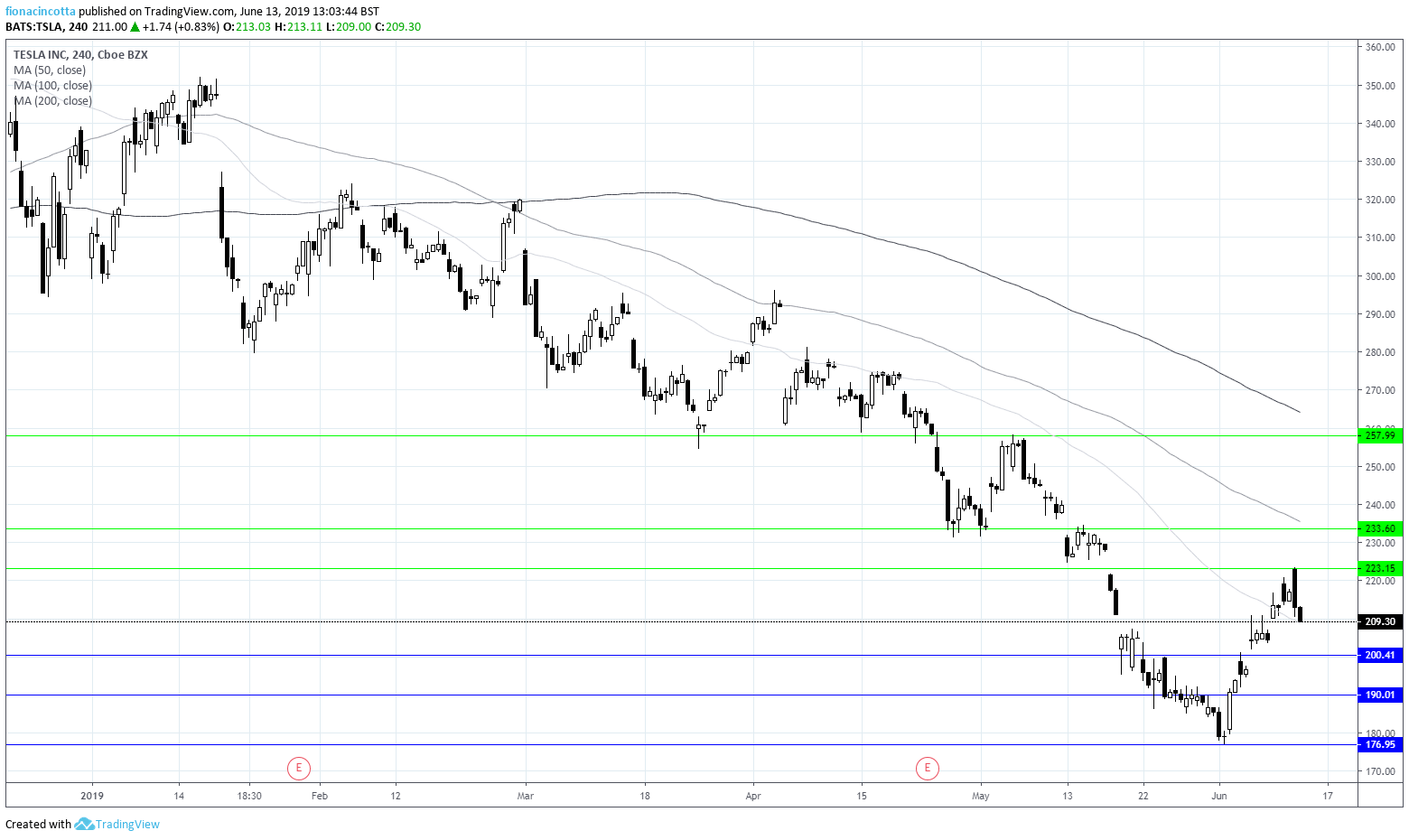

Despite having a rough ride year to date, the share price has bounced off a two and half year low of $177 last week. It is since up over 18% and trading premarket points to a mildly stronger start on Thursday.

Levels to watch:

Tesla is trading below its 100 & 200 sma. It is testing support of the 50 sma at its current level of 209.00. A breakthrough support at this level could see the share price test $200.00 and $190.00 before heading back towards the nadir of $177. Should support hold at $209.00 Tesla could look to test resistance at $223.00 (yesterday’s high), before making a break to $230.00 and then $258.00.

Please note this product may not be available to trade in all regions.