Tesla has surged over 10% on Wednesday, year to date the stock is up 248% and across the past 12 months the share price has jumped over 555%.

The world’s most valuable car makers announced that it will have a 5 – 1 stock split at the end of August.The announcement comes hot on the heels of a similar announcement from Apple of a 4 – 1 stock split.

The number of shares in the company increase and the vale of those shares decrease

In Tesla’s case of a 5 – 1 split 100 shares at the current price of $1500 becomes 500 shares at $300 as the value of each share is reduced by 80%.

Whilst you would still own the same value of shares the number of shares that you own increases. This does not change anything fundamentally at the company.

After Tesla’s share value more than tripled this year the most obvious answer is to make the stock “more accessible to investors and employees”. Stock splits traditionally incentivise smaller retail investors. Individual investors like Tesla, on Robinhood Tesla trades second only to Apple and this move could make Tesla shares even more attractive. However, the fact that it is possible to trade fractions of a share raises doubts over this point.

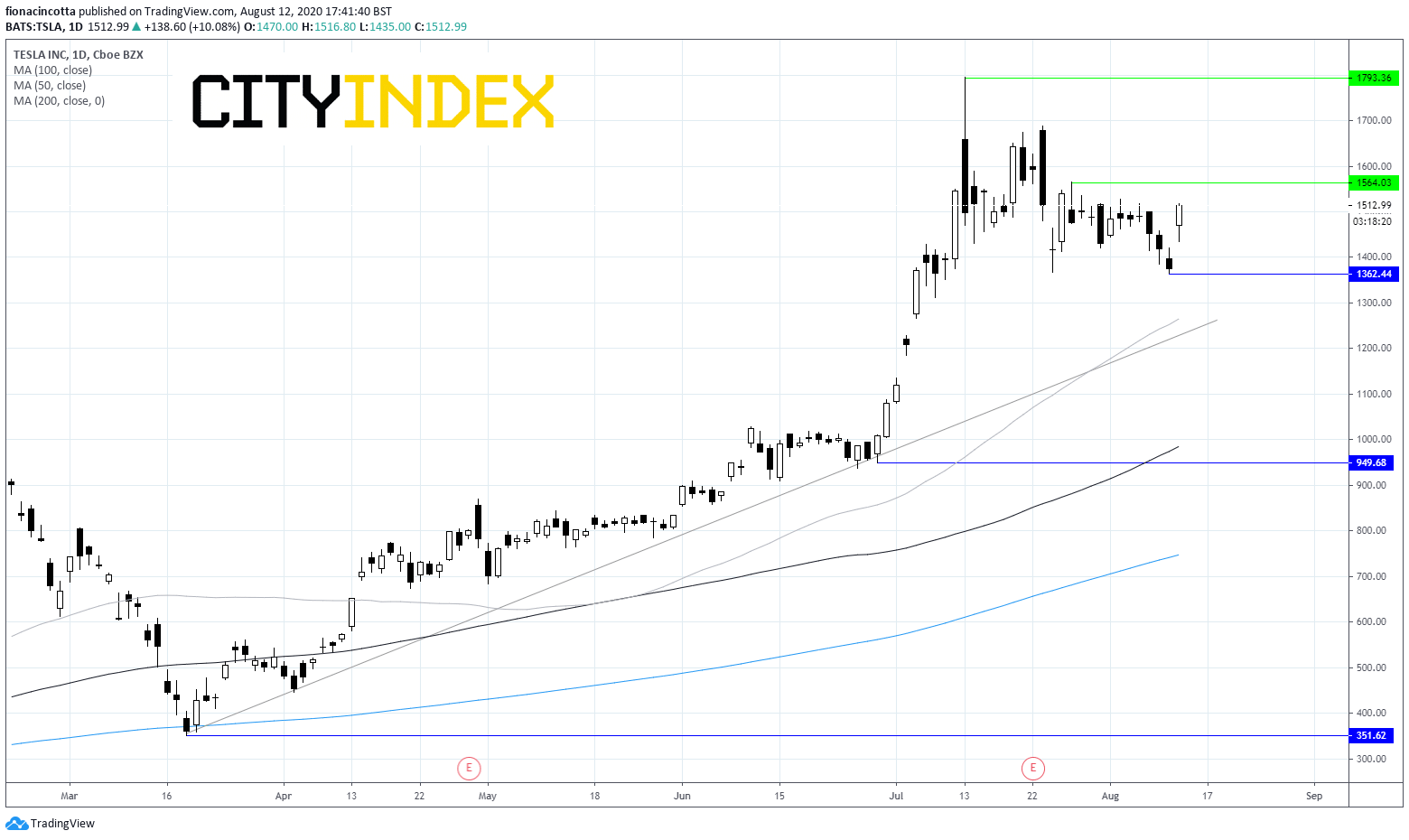

Tesla shares jumped 10% to $1518, although this is still off the recent all time high of $1795 struck three weeks ago,

The rapid rally in the share price has been helped by the broad belief that Tesla has fixed past manufacturing problems and as it moves to widen its appeal to beyond the luxury niche. A solid recent financial performance with two straight quarters of profits now under its belt despite lockdown measures closing down its California factory.

S&P listing here we come

After two straight quarters of profitability Tesla is set to join the S&P. This means that many funds and institutional investors who previous had to avoid the stock will now be allowed to buy in. The decision is awaited.

Chart thoughts

The share price trades firmly its 50,100 & 200 daily moving average and above its ascending trendline, despite selling off since hitting its all time high in early July. The sell off has stalled and a move over resistance at $1564 could see more bulls jump in. Support can be seen at $1362. A break through this level could see the trendline support move into focus.