After the US market close on 29th January.

Expectations:

Revenue $6.45 billion -4% from previous year but +10% from previous quarter

EPS $1.65 -15%

$100 billion company

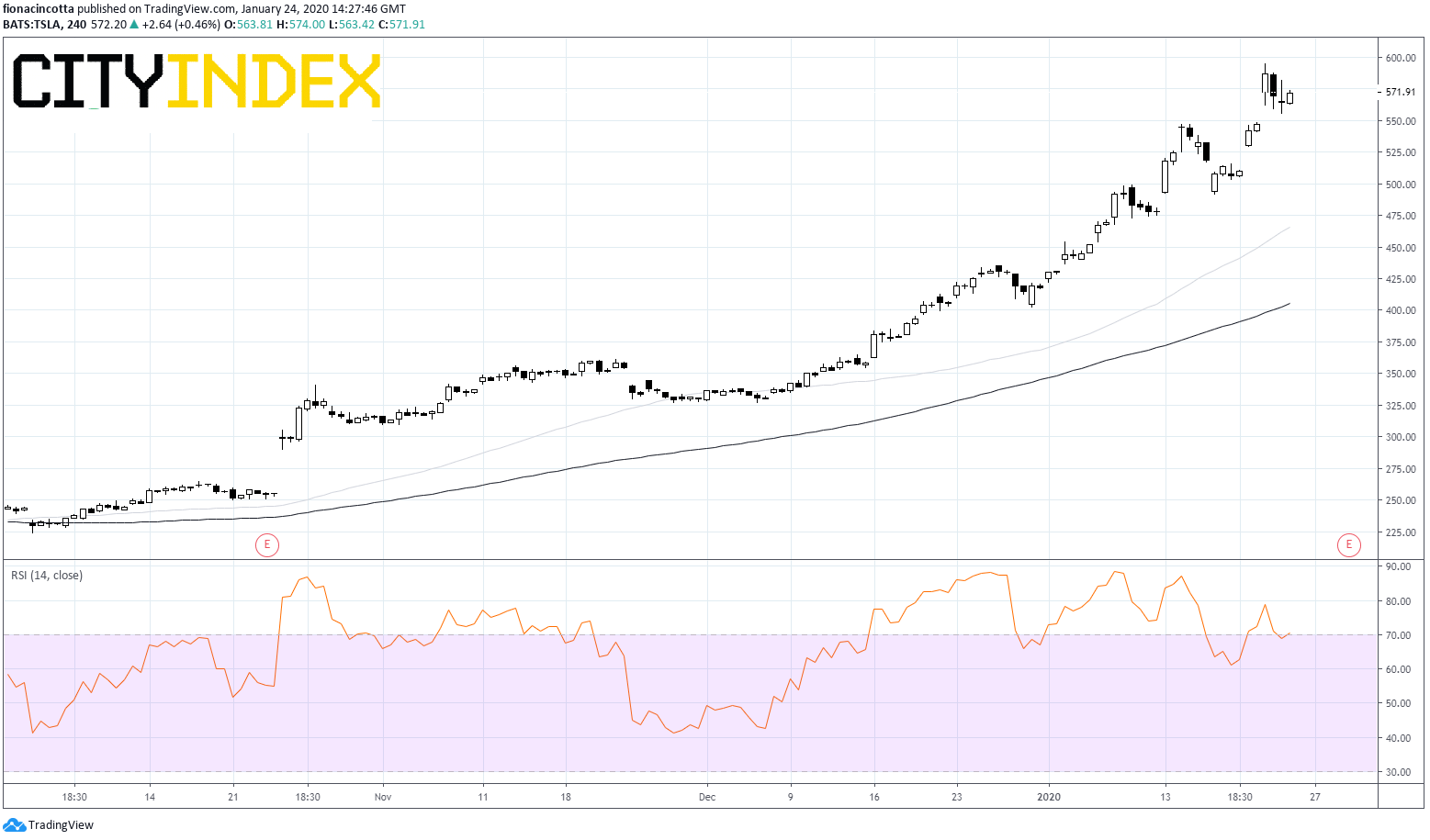

Tesla has surged 12% so far this week and is set to continue advancing in the final trading session of the week. The move higher is part of a 140% rally over the past 4 months, helped by a surprise Q3 profit in October. The electric car maker is now worth over $1 billion, the second most valuable car maker after Toyota Motors.

Why?

This week’s gains come following analyst Daniel Ives of Wedbush, upping the price target for the electric car maker ahead of earnings due to be released next week. Earlier this month Tesla delivered its first China made Model 3 sedans, it also announced that it delivered a record 112,000 vehicles in Q4.

Early indications suggest that production and demand out of Shanghai are very strong. Furthermore, Tesla has the ability to ramp up production significantly to satisfy growing demand in the key China region. The goal of 360,000 vehicles for the year is a sign that Tesla is a serious industry player. This is adding to the bullish outlook on the stock.

Obstacles

However, there are still some major obstacles ahead for Tesla: the elimination of US tax credits for Tesla buyers, the slowing of the car market in China and then of course Elon Musk himself, who not so long ago wanted to take the company private.

Bottom Line

Earnings and are not expected to disappoint given robust demand in China and Europe. In addition to Q4 financial results on 29th January investors will be watching 2020 vehicle delivery guidance.

Analysts’ Recommendations:

Analysts on the street are still divided over the stock: 10 rating buy / 10 hold / 16 sell

Chart thoughts

Telsa trade firmly above its 50, 100 & 200 sma on a clearly bullish chart, trading at its all time high. The stock is just entering into over bought territory according to the RSI.