Tesla (TSLA): Momentum Remains Strong amid Optimism over New Technology

Tesla (TSLA) eased 1.1% on day to $2,213.40 On Friday, but it is still up by more than 50% so far this month, after rallying 32.5% and 29.3% in July and June respectively. Previously on August 11, the company announced a five-for-one stock split, making it more accessible to smaller investors.

On the other hand, Tesla will hold a "Battery Day Event" on September 22, where investors would expect the company to unveil new technology.

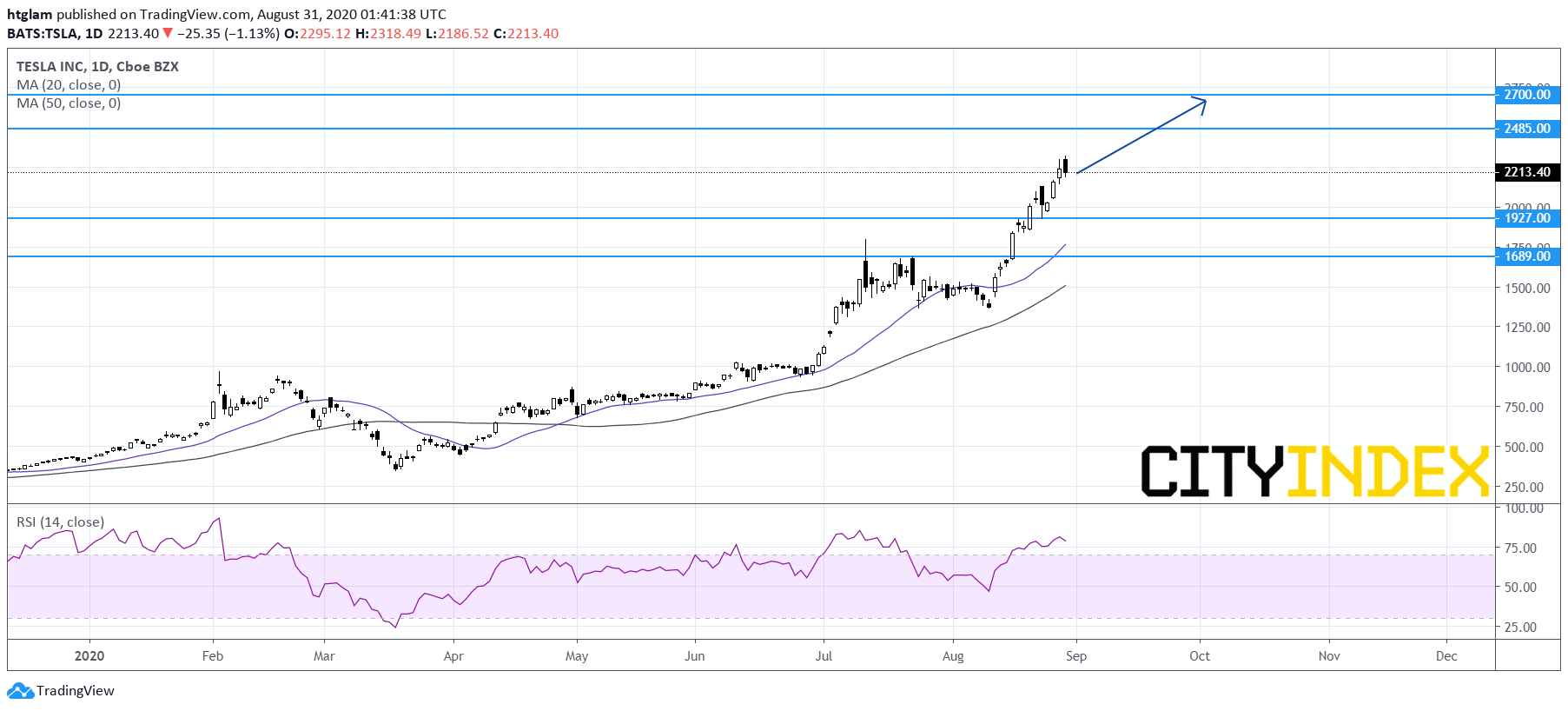

From a technical point of view, Tesla (TSLA) maintains a strong bullish momentum as shown on the daily chart. It briefly traded below the 20-day moving average in early August, then picked up again to break above its previous high. The level at $1,927 ($385.4 after split), which is near the 38.2% Fibonacci retracement of the rally this month, may be considered as the nearest support, while the 1st and 2nd resistance are expected to be located at $2,485 ($497.0 after split) and $2,700 ($540.0 after split). Alternatively, a break below $1,927 ($385.4 after split) might suggest that the next support at $1,689 ($337.8 after split) is exposed.