UK sales slower but Tesco keeps its footing

Tesco shares have been buffeted all over the shop by disappointing underlying sales in the places where they matter most: the UK and Ireland. Combined with news of Amazon’s expanded deal with Morrisons, this dealt a blow to the stock as hard 3%. More even-handed views eventually prevailed to lift the stock more than 1% late in the morning, though shares were back down 0.6% into the afternoon.

Tesco’s UK-only like-for-like sales in the 13 weeks to 25th May grew just 0.4%. That compared badly to the 0.8% some analysts were expecting. The sharp stock impact was possibly aggravated by speculators having ramped up bearish positions ahead of Thursday’s news. Yet, it’s also clear that the group still leads established supermarket rivals on underlying sales growth, whilst the closure of Tesco Direct last July has largely been vindicated by online growth of 7% in Q1.

Breaking out Tesco’s optimised-margin “Exclusively at Tesco” category, turnover was up 10% as the line rolls out at more stores, sales expansion was more sure-footed than headlines suggest.

Elsewhere, the central and eastern European piece remained a drag, though some of that was down to weather, whilst it may be another two quarters before the effect of loss-making store closures fades. Asia was more encouraging. Same-store sales edged back into the black by 0.1% after a 3% drop in Q4.

The quarterly statement pulled few punches about trading conditions. The UK market was “subdued”. Still, evidence of successful investments in range there is piling up. Together with firm demand in Tesco’s top category, and management’s satisfaction with strategic initiatives the case for a Brexit-fuelled slowdown is weak. That has implications for consensus forecasts. Predictably these look quite modest. Post-recovery sales growth will scrape in under 2% when Tesco reports its 2019/20-year next February, according to Bloomberg’s consensus. Operating profit could grow at close to the same rate as 2018/19, around 17%.

In short, most of another long, uncertain retail year remains ahead, with ample time for expectations to be disrupted. But Tesco largely kept its footing in the first quarter.

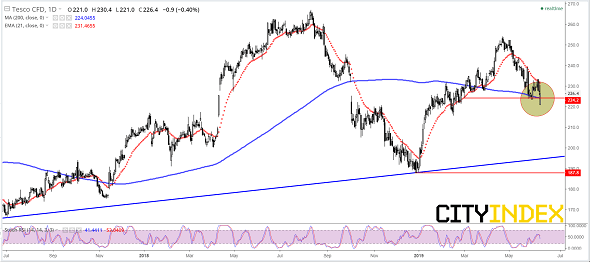

Chart thoughts

As predicted the main chart watch point is whether TSCO’s 200-day moving average can withstand a test. Spirited defence on Thursday, creating a candle that also straddles the closest support of 224p, is objectively promising. The nearer-term drift (21-day exponential average) is still weighted downwards. This suggests significant upside progress is all but impossible for the close horizon. A Thursday close above 224p and 200-DMA though would be crucial for establishing how much longer the down leg since mid-April should continue. A close below raises risks that declines may extend back towards the three-year rising trend or, just as likely, the 188p.

Tesco CFD – daily

Source: City Index