Yesterday Tesco announced that it was selling its Polish business to Danish retail group Sailing for £181 million. The agreed deal will include the sale of 301 Polish stores. Tesco said that the move will now allow it to focus on its central European business in in Czech, Hungary and Slovakia where it has a larger market presence. where it has a larger market presence.

Tesco Polska made sales of £1.4 billion last year and an operating loss of £24 million. This deal will earn Tesco £165 million.

Tesco Polska made sales of £1.4 billion last year and an operating loss of £24 million. This deal will earn Tesco £165 million.

The sake of Tesco Polska is part of a wider move that it is seeing Tesco scale back its international operations. Earlier this year the supermarket retreated from Thailand and Malaysia in a deal worth £8 billion.

Prior to coronavirus, Tesco had been facing increased competition in the UK as shopper had turned towards budget chains such as Lidl and Aldi. However, the covid-19 lockdown has seen habits change. Spending on essential items increased however, shoppers are cutting back on non-essentials. With job losses expected to start piling up in the coming months, consumers will almost certainly rein in their spending further.

With this in mind we view the move as positive. The removal of a profit diluting part of the business is a big plus and will make the supermarket’s foundations that much stronger. Furthermore, the additional cash that the deal brings will plump up Tesco’s balance sheet. A prudent move in these uncertain times., particularly if the economic recovery from covid-19 is more drawn out that initially expected.

For further information on where Tesco stands traders will now look ahead to a trading update by the supermarket giant next Friday 26th June. This should provide fresh impetus and could bring Tesco out of the holding channel that it has been trading in for the past 4 weeks.

Chart thoughts

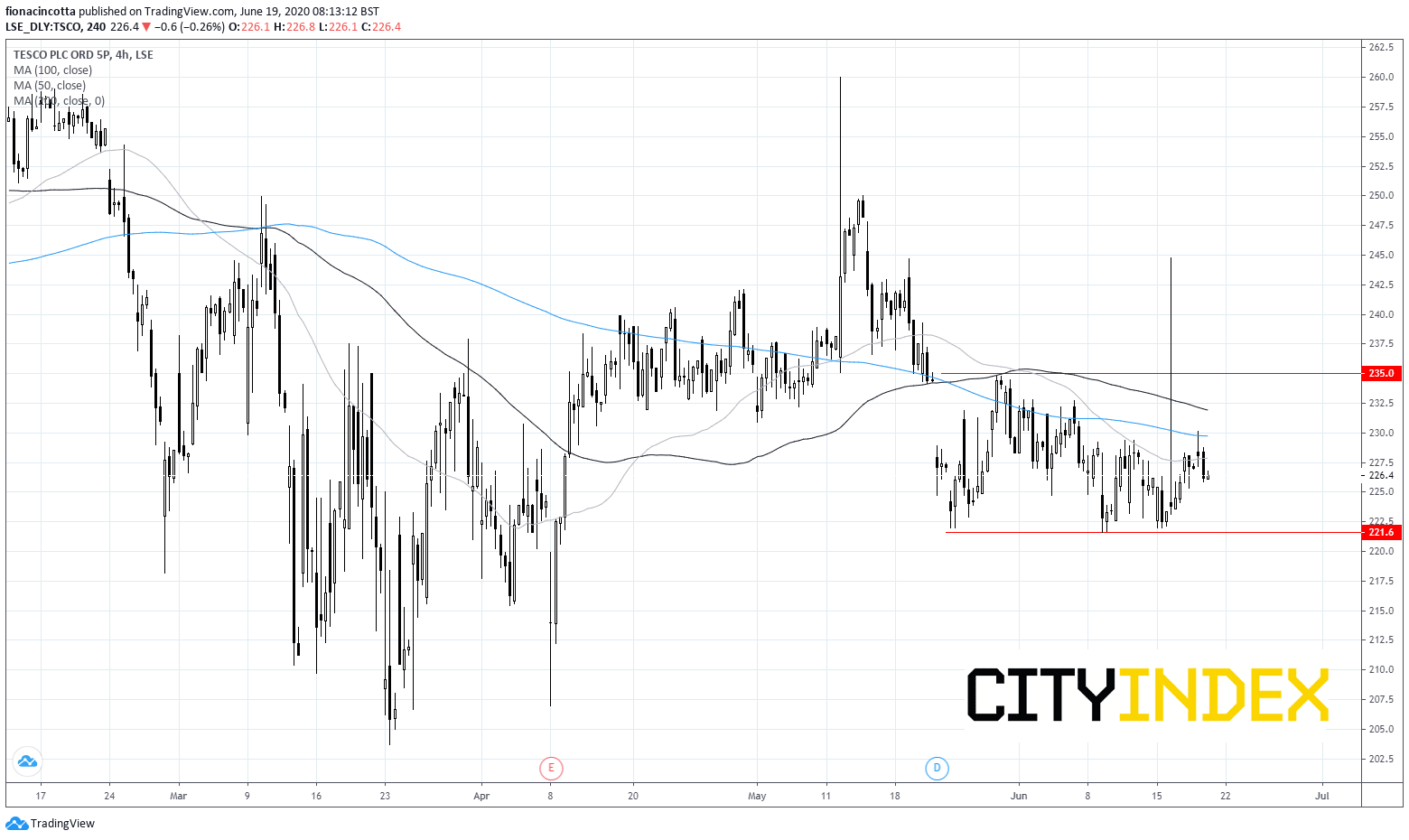

The news initially lifted the share price of Tesco in the previous session, pushing it to a high of 230p before the stock eased back into the close, ending the session at 226p.

The stocks trades below its 50, 100 and 200 sma on the four-hour chart, a bearish chart. However, Tesco also traded in the horizontal channel that it has been trading in since mid-May, between resistance at 235p and support at 221p

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM