Tesco’s first quarter trading statement is set keep a cap on the shares

Traders certainly seem to think so. Volume in Tesco options has surged over the last week or so. Turnover on 5th June alone was over six times the 20-day average, according to Bloomberg data. The jump in contracts bought was entirely in puts. These give their owners the right, though not the obligation, to sell at a specific price. Puts tend to be bearish as they profit when a stock falls.

The trades followed data from research outfits Kantar and Nielsen showing weak retail spending over the last few months, possibly linked to Brexit uncertainty. As Tesco stock had outperformed rivals up till then, it bore the brunt of market disappointment.

Investors were already braced for fresh let-downs. As one of Europe’s largest retailers, Tesco’s exposure to chronic competitive and structural sector pressures is magnified. And with CEO Dave Lewis’s long-standing margin target met (just about) those pressures are more likely to make revenue- rather than profit-growth Tesco’s next priority. The recent Kantar/Nielsen data was just the negative icing on the cake.

The stock, which was still up almost 20% for the year by Wednesday’s close, could see more reflexive selling in reaction to quarterly sales, particularly given the tough comparable quarter in 2018. Even so, Tesco could still show better growth than rivals.

Consensus points to a 0.8% rise in like-for-like sales.

Investors will also focus on:

- Asia store sales which have dragged group performance for several quarters

- Whether closure of 62 loss-making central and eastern European stores in H2 has begun to stem margin declines there

- Net debt: it rose slightly after the Booker acquisition but fell slightly to £12.2bn, including pensions, into end-2018/19

- Cost-cut target: £1.5bn by end-2019/20, including 9,000 job cuts. Costs associated with the headcount reduction pose moderate upside risk to the target

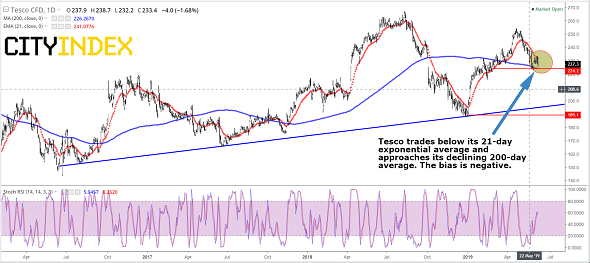

Chart thoughts

- Volatility aside, the stock has retained much of the good progress made since early-2016 multi-year lows

- Only the most bullish buyers will be dissatisfied with the rising trend line across swing lows that has been intact for almost exactly three years

- The nearer term outlook for the stock looks more taxing. It trades below its 21-day exponential moving average (21-DEMA) and approaches its declining 200-day moving average (200-DMA). The bias is clearly negative

- The 200-DMA will be a pivotal test of just how pessimistic sentiment is

- In the event of negative fundamental surprises, any breach of 224p support would seal the deal for deeper losses

- The downside would then target 189p swing-low support

- TSCO needs to pull above April’s 253.5p high to invalidate the falling trend since then

- A sustained swing above the 21-DEMA would be a strong first step

Tesco CFD – daily

Source: City Index