Tesco sales rise 8% - Range bound trading strategy

Whilst any forecast is inherently uncertain, based on an assumption of a continued easing of lockdown restrictions in the UK, our current expectation is that Retail operating profit in the current year is likely to be at a similar level to 2019/20 on a continuing operations basis.

We have increased our provision for potential bad debts at Tesco Bank and we now expect to report a loss for the Bank of between £(175)m and £(200)m for the 2020/21 financial year."

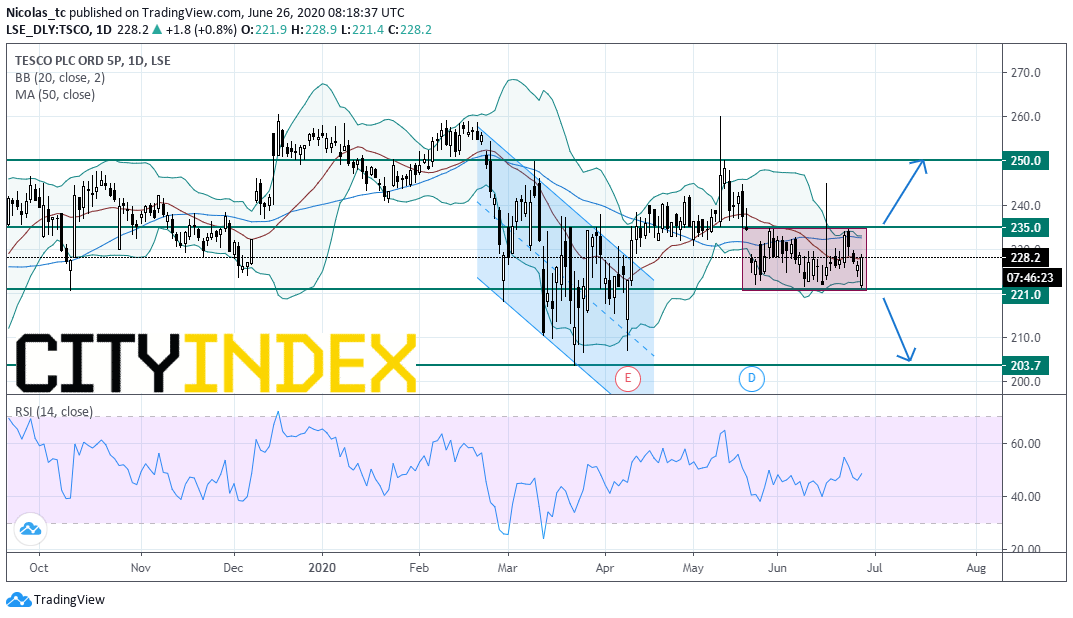

From a technical perspective, the stock price remains stuck in trading range between 221p and 235p. The 20-day simple moving average started to flatten out and the daily Relative Strength index (RSI, 14) is around its neutrality area at 50%. As long as 221p is support, a test of the upper end of the range at 235p can be expected. A break below 221p would deliver a bearish signal and would open a path to see 203.7p. Alternatively, a push above 235p would call for a new up leg towards 250p.

Source: GAIN Capital, TradingView