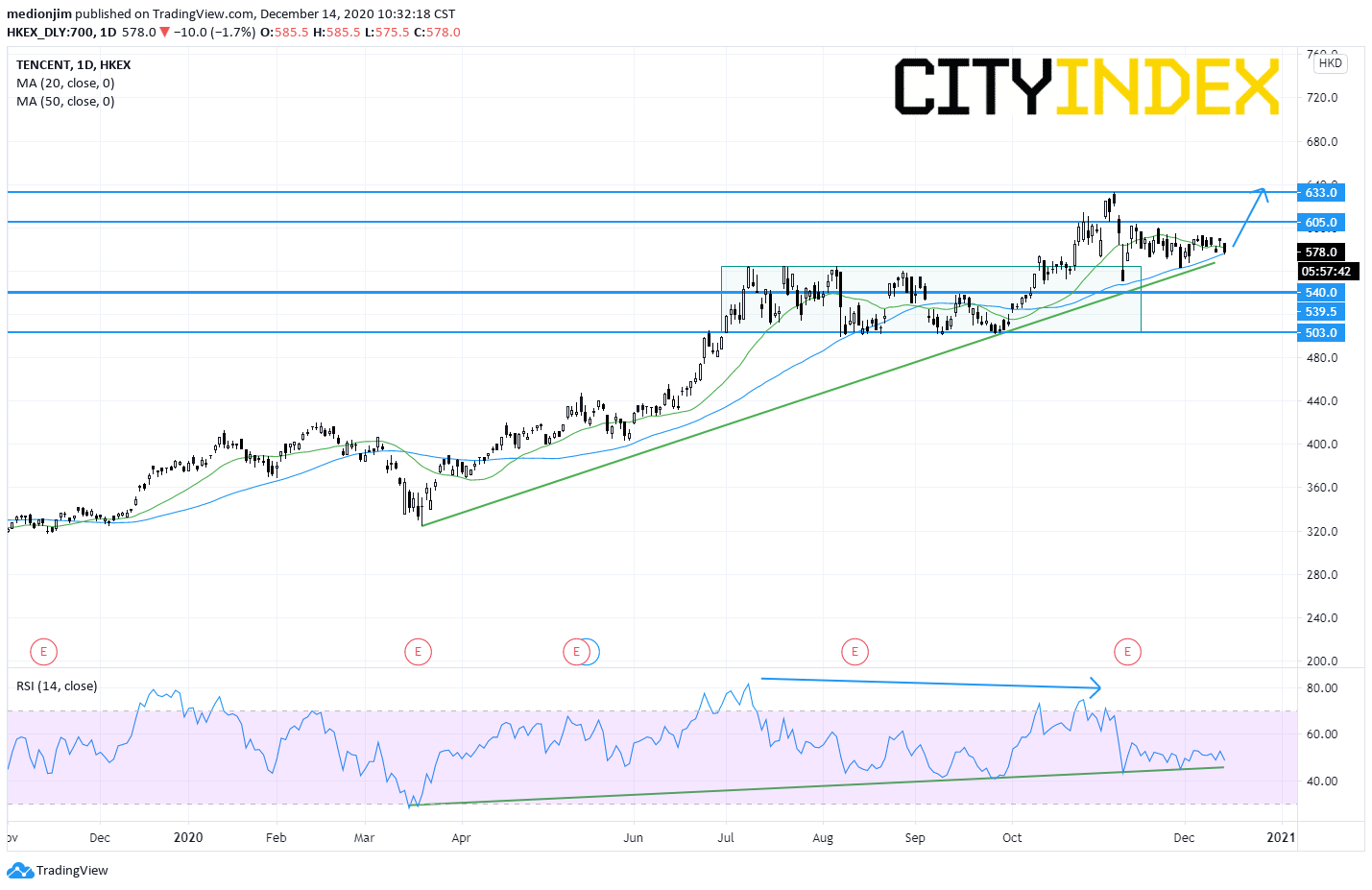

Tencent (700.HK) remains bullish above HK$540

Tencent (700.HK), the tech giant, is in the phase of consolidation after rising to a historical high level at HK$633 in November.

Recently, JP Morgan said Tencent has rich game business growth potential, while the bank estimated Tencent's growth of game revenue could reach 18% in 2021-2022. The Bank kept the company rating on "Buy" with a target price at HK$655.

From a technical point of view, the outlook of the stock remains bullish as the prices are still supported by a rising trend line. However, investors have to be aware that the relative strength index indicated a bearish divergence signal, which suggested the loss of upward momentum. Therefore, investors could expect the continuation of the consolidation phase with bullish bias. The support level is located at HK$540, while resistance levels would be located at HK$605 and HK$633.

Source: GAIN Capital, TradingView

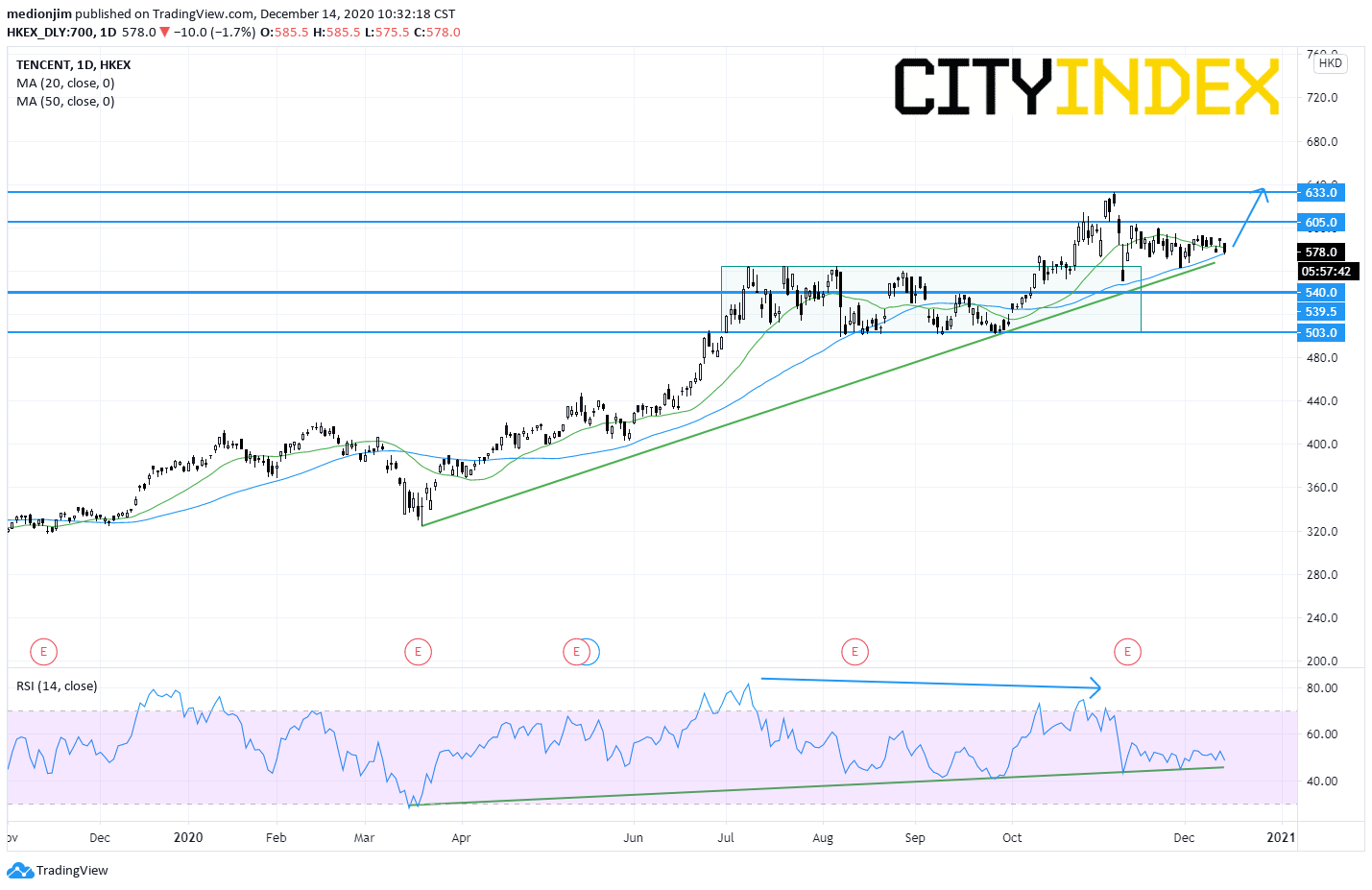

Recently, JP Morgan said Tencent has rich game business growth potential, while the bank estimated Tencent's growth of game revenue could reach 18% in 2021-2022. The Bank kept the company rating on "Buy" with a target price at HK$655.

From a technical point of view, the outlook of the stock remains bullish as the prices are still supported by a rising trend line. However, investors have to be aware that the relative strength index indicated a bearish divergence signal, which suggested the loss of upward momentum. Therefore, investors could expect the continuation of the consolidation phase with bullish bias. The support level is located at HK$540, while resistance levels would be located at HK$605 and HK$633.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM