Tencent Records a New 52 week high After Posting 1Q Result

Tencent (700) opened 3% higher after issuing the 1Q results. After that, the stock pared the gain as the Hang Seng index dropped 1.3%.

Tencent, a Chinese tech giant, announced that 1Q net income rose 6% on year to 28.90 billion yuan, beating the estimation of 24.77 billion yuan, and operating profit grew 1% to 37.26 billion yuan on revenue of 108.07 billion yuan, up 26%. The better-than-expected 1Q results was driven by smartphone games during COVID-10 lockdowns.

After that, Citibank raised the company's target price to HK$530 from HK$495, while Goldman Sachs lifted its target price to HK$520 from HK$494.

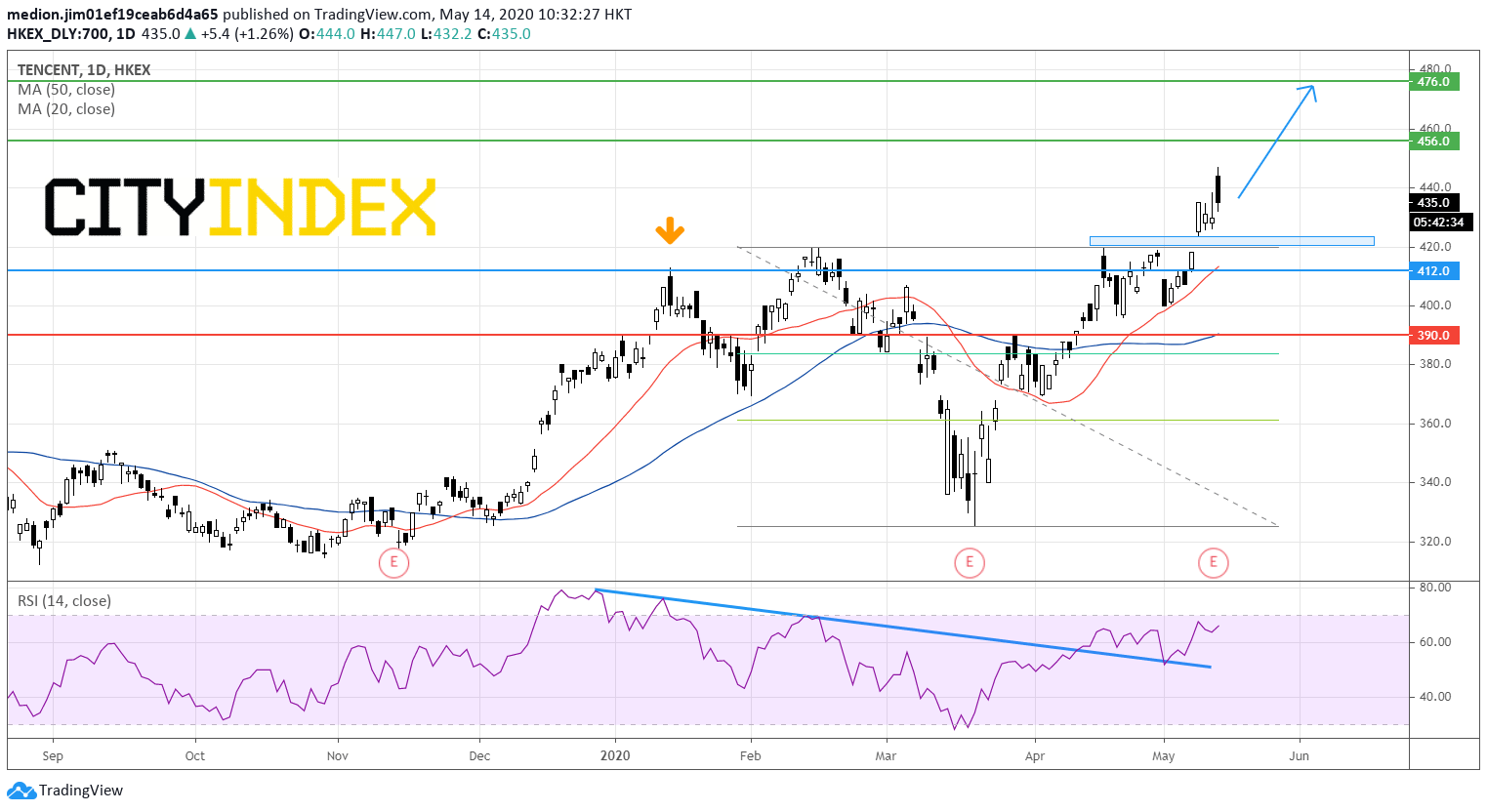

From a technical point of view, the stock is trading around the 52-week high on a daily chart. It suggests that the up trend remains strong. The stock posted a gap to break above the high of February at HK$420, indicating the resumption of upmove since 2018 low. The RSI is heading upward towards the overbought level at 70, suggesting the upward momentum for the prices.

Therefore, the bullish readers could consider to set the support level at HK$412 (around the 20-day moving average and the high of January 14). The nearest resistance levels would be HK$456 (around 138.2% retracement level ) and HK$476 (the record high).

On the other hand, a break below HK$412 could call for a return to the support level at HK$390 (the high of March 27 and the 50-day moving average).

Source: GAIN Capital, TradingView

Tencent, a Chinese tech giant, announced that 1Q net income rose 6% on year to 28.90 billion yuan, beating the estimation of 24.77 billion yuan, and operating profit grew 1% to 37.26 billion yuan on revenue of 108.07 billion yuan, up 26%. The better-than-expected 1Q results was driven by smartphone games during COVID-10 lockdowns.

After that, Citibank raised the company's target price to HK$530 from HK$495, while Goldman Sachs lifted its target price to HK$520 from HK$494.

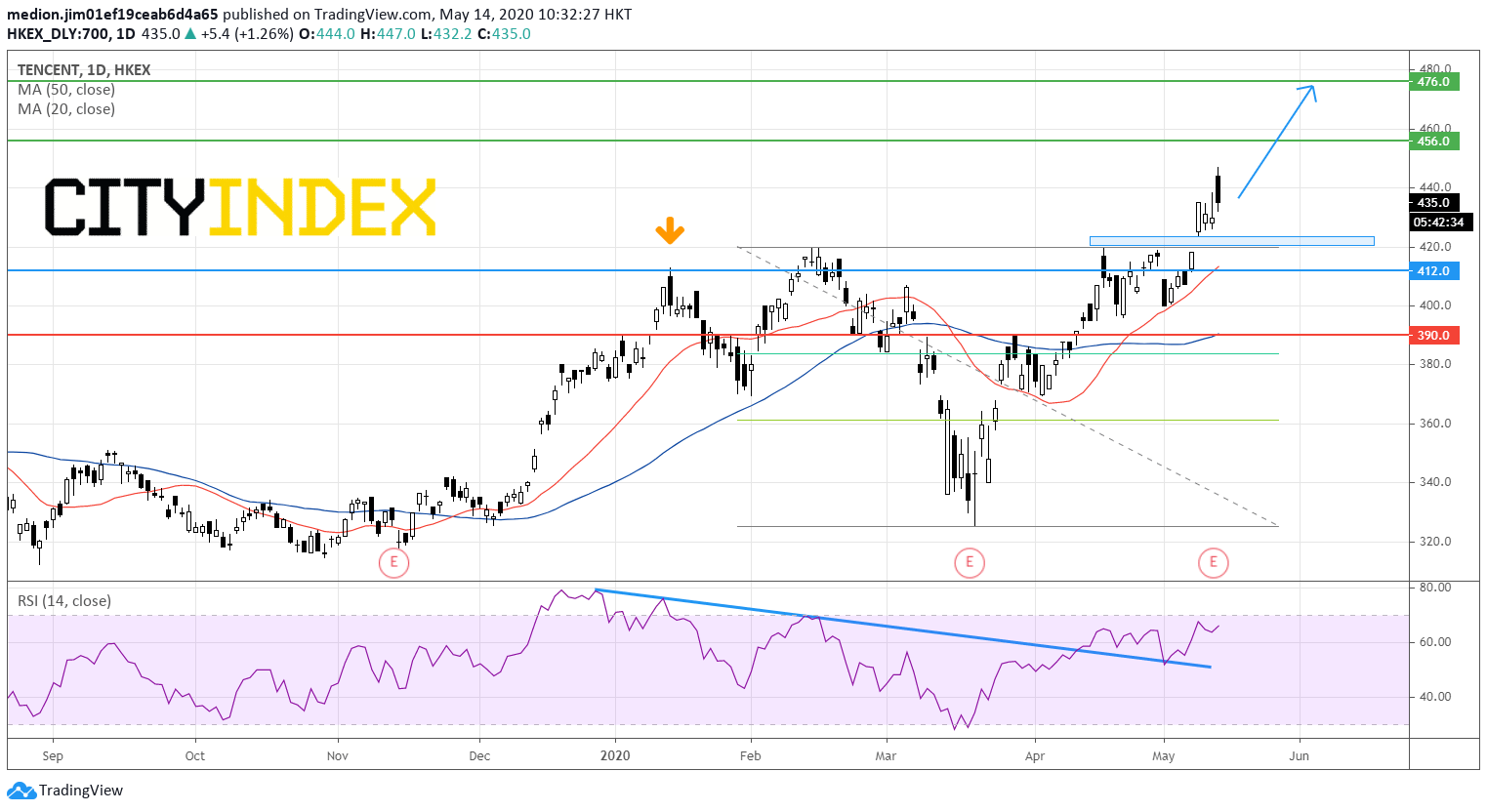

From a technical point of view, the stock is trading around the 52-week high on a daily chart. It suggests that the up trend remains strong. The stock posted a gap to break above the high of February at HK$420, indicating the resumption of upmove since 2018 low. The RSI is heading upward towards the overbought level at 70, suggesting the upward momentum for the prices.

Therefore, the bullish readers could consider to set the support level at HK$412 (around the 20-day moving average and the high of January 14). The nearest resistance levels would be HK$456 (around 138.2% retracement level ) and HK$476 (the record high).

On the other hand, a break below HK$412 could call for a return to the support level at HK$390 (the high of March 27 and the 50-day moving average).

Source: GAIN Capital, TradingView