Tencent (700-hk): Bullish Consolidation Despite Threats from US

Tencent (700-hk), a Chinese tech giant, has been targeted by the U.S. government again as it is considering imposing restrictions on the company's payment system, reported Bloomberg citing people familiar with the matter. Previously, the Trump administration accused Tencent's messaging app WeChat for posing a security risk to Americans.

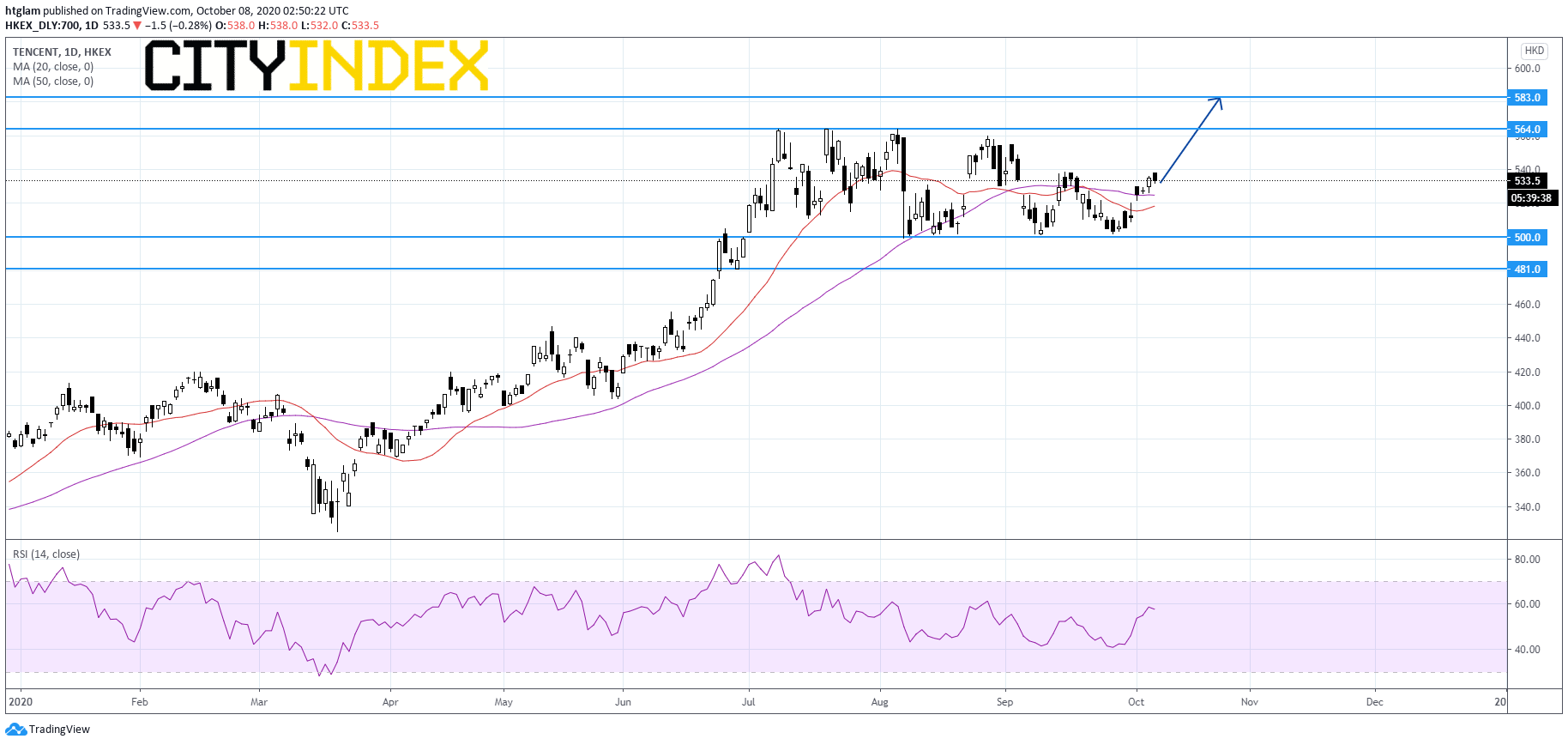

From a technical point of view, despite threats from the US, Tencent remains trading within a bullish consolidation range, after a rally started from March. In the shorter-term, the technical outlook is rather neutral as its share price hovers around both the 20-day and 50-day moving averages. Nevertheless, as long as the level at $500 holds as a support, Tencent is still likely to test the 1st and 2nd resistance at $564 and $583. Alternatively, a break below $500 would be a cautious signal for a downturn and the next support at $481 might be exposed.