Technical view: Gold is glittering again! Can it break 4-month highs near $1875?

There’s no beating around the bush: Gold’s performance through Q4 of last year and Q1 of this year was immensely disappointing for precious metal bulls. Despite political uncertainty, rising bond yields, a falling US dollar, and hints of inflation amidst unprecedented economic stimulus across the globe, gold steadily fell until eventually forming a double bottom beneath $1700 in March.

If you're interested in investing in physical gold and silver, check out our partner CoinInvest!

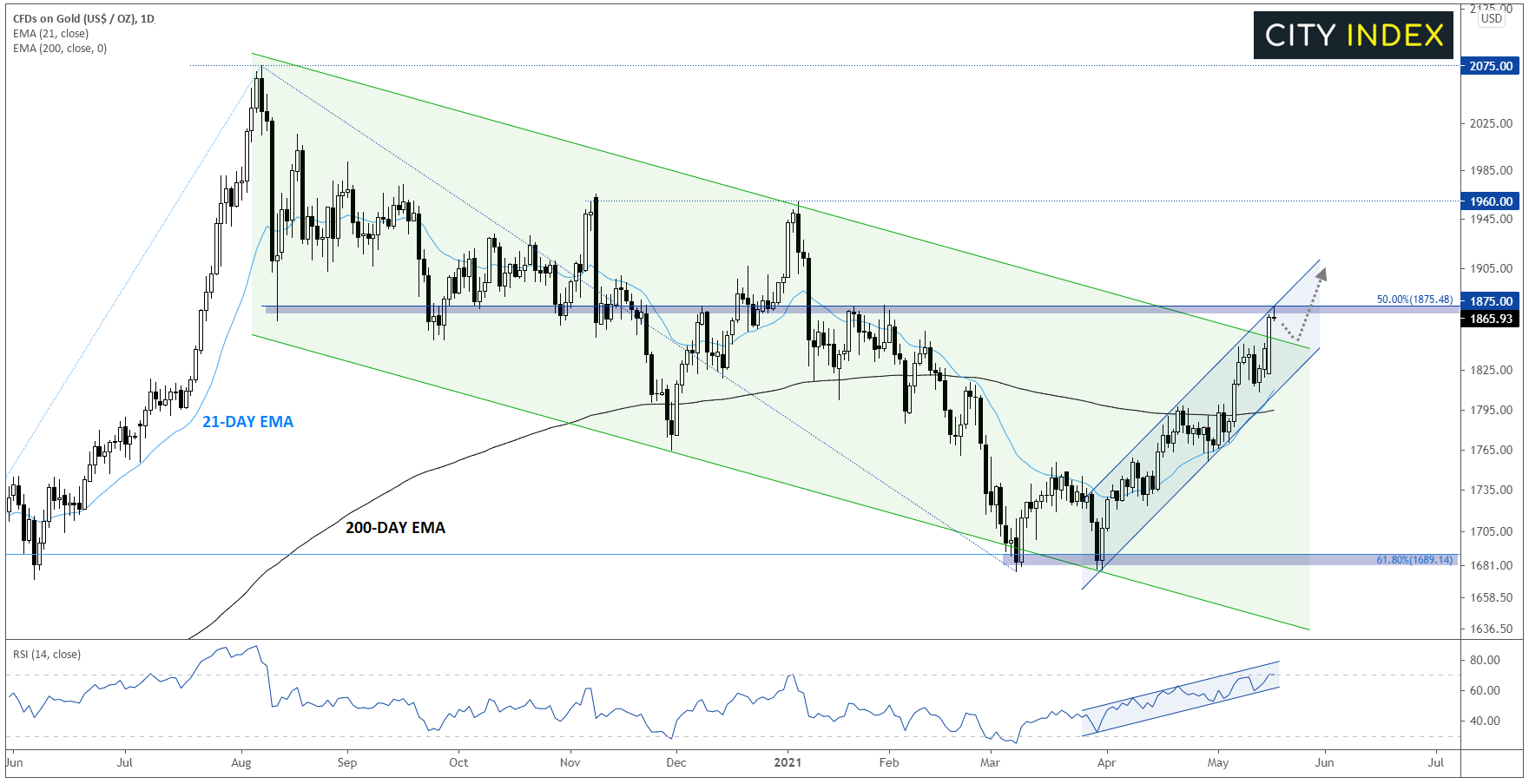

Just when even the most hardcore of gold bugs was losing faith, the yellow metal has quietly formed a bullish channel over the last six weeks. Over that same period, the 14-day RSI indicator has formed a bullish channel of its own, signaling growing buying pressure behind the move and the potential for it to extend further in the weeks to come:

Source: StoneX, TradingView

Looking at the key levels to watch, gold is testing the $1875 area, the 50% Fibonacci retracement of the pullback from last year’s record highs; this area also marks the minor highs from late January, providing a confluence of resistance levels and increasing the odds of a potential pullback in the latter half of this week.

That said, the medium-term momentum has clearly shifted back in favor of the bulls, with the 20-day EMA providing support and the 200-day EMA turning higher for the first time in months. A confirmed break of $1875, if seen, could open the door for a continuation toward the next level of previous resistance at $1960 or key psychological resistance at $2000. Only a break below the bottom of the bullish channel and the 200-day EMA in the $1800 area would erase the near-term bullish bias.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.