European stocks are taking the lead from Wall Street and Asia, pointing to a sharply lower start on the open. Sobering comments from tech giants Apple and Amazon in addition to fears of a new chapter to the US China trade war are weighing on sentiment at the end of the trading week and the start of the new month, pulling equities lower and boosting the safe haven dollar.

Despite the sell off yesterday, global stocks posted their best month since 2011 in April thanks to a slowdown in coronavirus infections, optimism surrounding the gradual reopening of economies and massive stimulus initiatives. However, data and earnings are serving as a reminder that the economic pain is really only just beginning.

Sobering comments

Apple refrained from issuing guidance for the first time in more than a decade amid growing uncertainty and poor visibility. Meanwhile Amazon reported revenue growth but also higher expenses protecting its workers and customers. Amazon warned of losses in the coming quarter. Strong results for Microsoft, Facebook and Tesla limited losses of the tech heavy Nasdaq.

Apple refrained from issuing guidance for the first time in more than a decade amid growing uncertainty and poor visibility. Meanwhile Amazon reported revenue growth but also higher expenses protecting its workers and customers. Amazon warned of losses in the coming quarter. Strong results for Microsoft, Facebook and Tesla limited losses of the tech heavy Nasdaq.

Trade war chapter 2

Trump sharpening his rhetoric against China is unnerving investors, as his team look into retaliatory measures over the coronavirus outbreak. The China trade war seems like an eternity ago after coronavirus has dominated market movements with such intensity over recent weeks. However, threats of more tariffs from Trump have hit a nerve with the markets and is adding to the downbeat sentiment heading into the weekend.

Trump sharpening his rhetoric against China is unnerving investors, as his team look into retaliatory measures over the coronavirus outbreak. The China trade war seems like an eternity ago after coronavirus has dominated market movements with such intensity over recent weeks. However, threats of more tariffs from Trump have hit a nerve with the markets and is adding to the downbeat sentiment heading into the weekend.

UK manufacturing PMI

Following yesterday’s slew of disappointing figures from Europe today’s attention will turn to the UK economy with the final release of manufacturing PMI data, which is expected to come in at 32.8 in April. Whilst the manufacturing sector is holding up better than the service sector, it is still in a plain awful position. And things could get significantly worse with an industry body warning that British factory output was at risk of halving in the second quarter, as 80% of manufacturers reported a collapse in orders owing to the coronavirus outbreak.

Following yesterday’s slew of disappointing figures from Europe today’s attention will turn to the UK economy with the final release of manufacturing PMI data, which is expected to come in at 32.8 in April. Whilst the manufacturing sector is holding up better than the service sector, it is still in a plain awful position. And things could get significantly worse with an industry body warning that British factory output was at risk of halving in the second quarter, as 80% of manufacturers reported a collapse in orders owing to the coronavirus outbreak.

GBP is already trending lower in anticipation of dire data, despite Boris Johnson promising to announce the UK’s exit strategy from lock down next week.

US manufacturing

US ISM manufacturing PMI is expected to drop sharply in April after holding up near the 50 threshold in March. This forward looing survey will provide the first hint of what’s to come in next week’s non-farm payroll report.

US ISM manufacturing PMI is expected to drop sharply in April after holding up near the 50 threshold in March. This forward looing survey will provide the first hint of what’s to come in next week’s non-farm payroll report.

Quick word on oil

WTI is pushing higher for a third straight session, although the rally is running out of steam. After jumping 47% across the previous 2 sessions, WTI is trading just 1.8% higher on Friday, struggling to push through $20. Whilst economies across Europe and US states are gradually reopening and as the production cuts kick in today, the high levels of uncertainty are limiting gains.

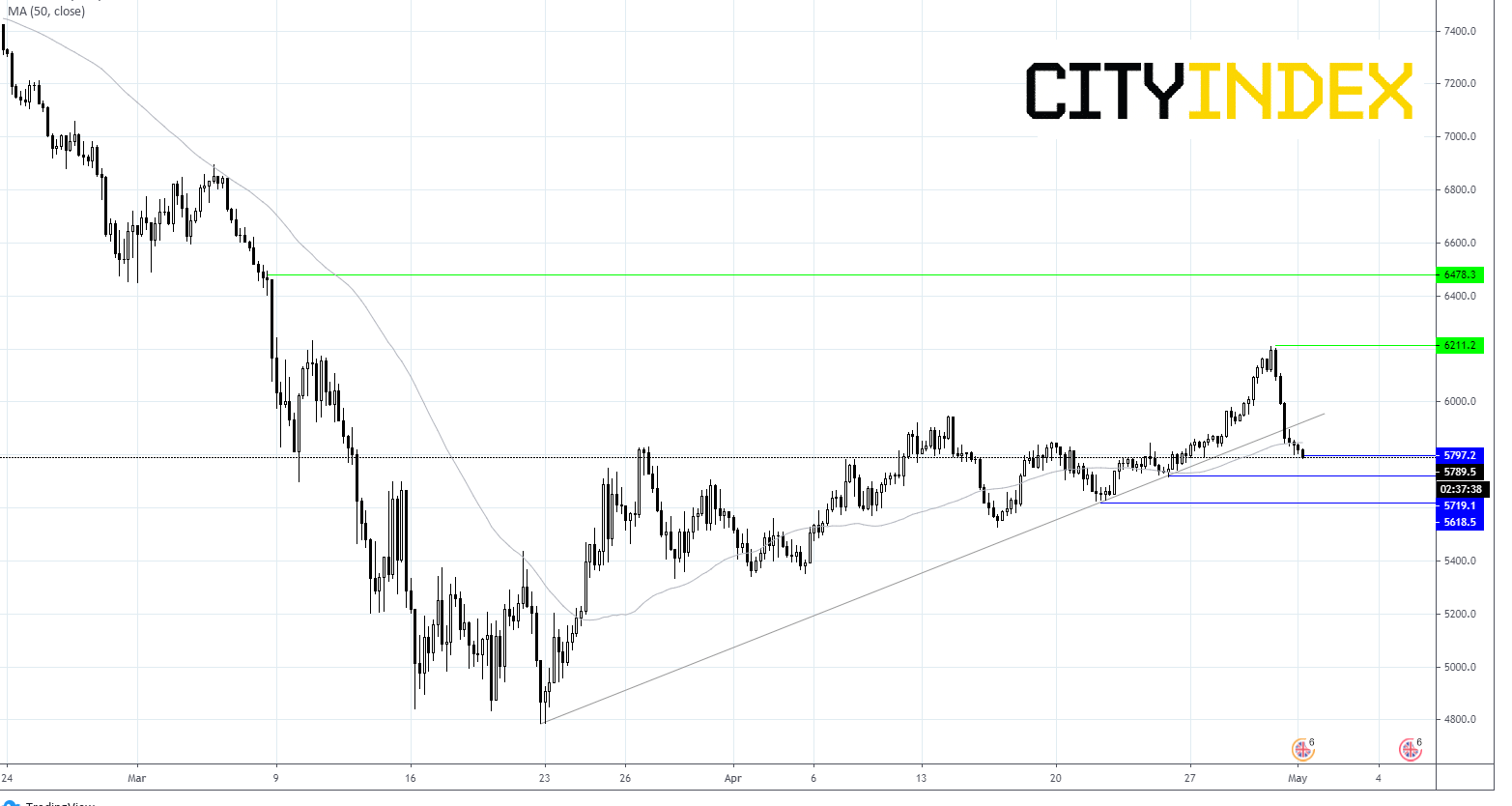

FTSE chart

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM